Hong Kong fintech sector sees 250% blockchain growth since 2022

14 Março 2025 - 9:55AM

Cointelegraph

Hong Kong anticipates the continued growth of its fintech

ecosystem, with blockchain, digital assets, distributed ledger

technology (DLT) and artificial intelligence playing a central role

in shaping its future.

Hong Kong is home to over 1,100 fintech companies, which include

175 blockchain application or software firms and 111 digital asset

and cryptocurrency companies, marking a 250% and 30% increase,

respectively, since 2022, according to

the Hong Kong Fintech Ecosystem report by InvestHK, a government

department overseeing Foreign Direct Investments.

Participants of the Hong Kong Fintech Ecosystem. Source:

InvestHK

Exploring deeper fintech revenue streams

The expansive growth of Hong Kong’s Web3 industry is attributed

to proactive government policies and an active licensing regime for

crypto exchanges or virtual asset trading platforms.

“The revenue for the Hong Kong fintech market is projected to

reach US$606 billion by 2032, with an anticipated annual growth

rate of 28.5% from 2024 to 2032,” the report stated.

InvestHK, along with other Hong Kong authorities, surveyed 130

fintech companies operating in Hong Kong and identified talent

shortage as the top concern in the region, cited by 58.8% of

respondents, followed by access to capital (43.9%).

Related: Coinbase to add 1,000 more US jobs in 2025,

thanks to Trump — Brian Armstrong

Addressing these hurdles will be critical to sustaining Hong

Kong’s momentum to become the top financial hub.

Over 73% of the surveyed fintech companies operate in the AI

subsector, far exceeding the 41.5% focused on digital assets and

cryptocurrency.

China’s “one country, two systems” policy at play

The InvestHK report highlighted Hong Kong’s advantage in

adopting China’s “one country, two systems” policy, allowing it to

maintain a free-market economy, unrestricted capital flow, and

strong global trade relations while benefiting from its proximity

to mainland China.

As a result, the Hong Kong government was able to roll out

several Web3 innovations, including a licensing regime, spot

Bitcoin (BTC) and Ether

(ETH) exchange-traded funds, the Hong

Kong Monetary Authority’s stablecoin sandbox and tokenized finance

and AI integration.

Hong Kong Monetary Authority’s five-step “Fintech 2025”

strategy. Source: HKMA

In 2021, the HKMA unveiled a strategy

to establish itself as a financial hub by 2025.

The strategy included encouraging fintech adoption among banks,

increasing Hong Kong’s readiness in issuing central bank digital

currencies at both wholesale and retail levels, enhancing the

city’s existing data infrastructure and building new ones,

increasing the supply of fintech talent and formulating supportive

policies for the Hong Kong fintech ecosystem.

Magazine: Vitalik on AI apocalypse, LA Times both-sides

KKK, LLM grooming: AI Eye

...

Continue reading Hong Kong fintech sector sees 250%

blockchain growth since 2022

The post

Hong Kong fintech sector sees 250% blockchain growth

since 2022 appeared first on

CoinTelegraph.

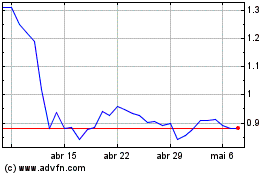

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025