Why is Bitcoin price stuck?

14 Março 2025 - 8:21AM

Cointelegraph

Bitcoin (BTC) price has been consolidating

within a roughly $5,500 range since March 9 as the $84,000 level

represents stiff overhead resistance.

Data from Cointelegraph

Markets Pro and Bitstamp shows BTC price oscillating between

$78,599 and $84,000, as shown in the chart below.

BTC/USD daily chart. Source:

Cointelegraph/TradingView

Key reasons why Bitcoin price remains flat today include:

-

Trump’s trade war tensions causing uncertainty in the

market.

-

Weakening demand for Bitcoin and neutral funding rates.

-

BTC price remains pinned below the 200-day SMA.

Broader economic uncertainty, weakening

demand

Bitcoin’s price stagnation is partially due to the broader

economic and geopolitical factors that are currently at

play.

What to know:

-

Trump’s new

policies, such as his proposed trade

tariffs on Mexico and Canada, have unnerved the market.

-

Investors, wary of inflation concerns and a potential tariff

war, are avoiding risk assets like Bitcoin.

-

As Cointelegraph recently

reported, Bitcoin’s rally post-Trump’s November election has

lost steam amid a weakening global economy.

-

This has resulted in weaker demand for Bitcoin,

according

to Glassnode.

For instance, the cost basis of 1w–1m short-term holders

flattened out above that of the longer-term holders (1m–3m) in Q1,

“marking an early sign of weakening demand in the immediate

term.”

Related:

Bitcoin price drops 2% as falling inflation boosts US

trade war fears

Bitcoin’s drop below the $95,000 level saw the 1w–1m cost basis

slide below the 1m–3m cost basis, “confirming a transition into net

capital outflows.”

Glassnode noted:

“This reversal indicates that macro uncertainty has

spooked demand, reducing new inflows… and suggests that new buyers

are now hesitant to absorb sell-side pressure, reinforcing the

shift from post-ATH euphoria into a more cautious market

environment.”

Bitcoin STH capital flow. Source: Glassnode

Until the current trend changes due to macroeconomic tailwinds,

such as Fed rate cuts, Bitcoin could struggle to break out of the

current range, leaving it vulnerable to pullbacks toward

$70,000.

Another clear signal of Bitcoin’s stagnation is in the perpetual

futures funding rates. BTC funding rates, which reflect the cost of

holding long or short positions in crypto futures, are hovering

close to 0%, indicating increasing indecisiveness among

traders.

Bitcoin perpetual futures funding rates across all

exchanges. Source: Glassnode

Without speculative fuel, Bitcoin is struggling to move in

either direction, leaving its price stuck in a tight range as

traders wait for the next catalyst.

Bitcoin price faces stiff resistance on the

upside

Bitcoin also trades below key resistance areas, as shown in the

chart below:

-

On March 9, BTC fell below the 200-day simple moving average

(SMA) at $83,736.

-

This trendline has stifled the latest efforts for a sustained

recovery.

BTC/USD daily chart. Source:

Cointelegraph/TradingView

Popular crypto analyst Daan Crypto Trades says that the 200-day

SMA at around $83,700 and the 200-day EMA at $86,000 are key levels

as they are “solid indicators of the mid/long term trend and

overall strength of the market.”

In other words, failure to produce a decisive close above the

200-day SMA and flipping it into a new support level could lead to

a longer consolidation period for Bitcoin price.

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Why is Bitcoin price stuck?

The post

Why is Bitcoin price stuck? appeared first on

CoinTelegraph.

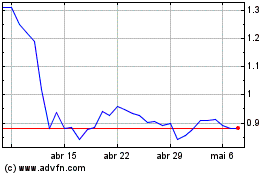

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025