Crypto regulation shifts as Bitcoin eyes $105K amid liquidity boost

13 Março 2025 - 3:30PM

Cointelegraph

Bitcoin (BTC) price has risen 8% from its March

11 low of $76,703, driven in part by large investors aggressively

buying the dip with leverage.

Margin longs on Bitfinex surged to their highest level since

November 2024, adding 13,787 BTC over 17 days. Currently standing

at $5.7 billion, this bullish leveraged positioning signals

confidence in Bitcoin’s upside potential despite recent price

weakness.

Bitcoin/USD (orange, left) vs. Bitfinex BTC margin longs

(right). Source: TradingView / Cointelegraph

Some analysts argue that Bitcoin’s price is closely linked to

the global monetary base, meaning it tends to rise as central banks

inject liquidity.

With recession

risks mounting, the likelihood of expansionary monetary

policies increasing the money supply grows. If this correlation

holds, Bitfinex whales could be well-positioned to capitalize on a

rally above $105,000 in the next two months.

Source: pakpakchicken

For instance, X user Pakpakchicken claims to have identified an

82% correlation between the global money supply (M2) and Bitcoin’s

price.

When central banks drain liquidity by raising interest rates or

reducing bond holdings, traders become more risk-averse, leading to

weaker demand for Bitcoin. Conversely, periods of monetary easing

tend to fuel greater investor interest in the asset, increasing its

price potential.

Bitfinex whales go long BTC as M2 bottoms

In early September 2024, Bitfinex margin traders added 7,840 BTC

in long positions, coinciding with a period of bearish momentum as

Bitcoin struggled to reclaim the $50,000 level for over three

months.

Despite the downturn, Bitfinex whales held their positions, and

Bitcoin’s price surged past $75,000 less than two months later.

Notably, the global M2 money supply bottomed out around the same

time these traders increased their Bitcoin exposure, further

reinforcing the correlation.

It may be impossible to establish a direct cause-and-effect

relationship between money supply and investors’ willingness to

accumulate Bitcoin, especially given the influence of major events

during these periods.

For example, Donald Trump’s election as US president in November

2024 significantly fueled Bitcoin’s rally due to the new

administration’s pro-crypto stance, regardless of global M2 trends

and liquidity conditions.

Spot Bitcoin ETF net flows, USD. Source: CoinGlass

Similarly, Michael Saylor’s latest plan to

raise up to $21

billion in fresh capital for Strategy to acquire more Bitcoin

could shift market dynamics, even accounting for the $4.1 billion

in net outflows from Bitcoin spot exchange-traded funds (ETFs)

since Feb. 24.

Strategy remains the largest corporate Bitcoin holder, with

499,096 BTC acquired at a total cost of $33.1 billion, reinforcing

its long-term bullish strategy.

Clearer crypto regulation, Strategy capital

increase

In essence, the expansion of the global money supply may have

influenced the increase in Bitfinex margin longs, but Bitcoin’s

push toward $105,000 could be primarily driven by industry-specific

news and events.

A Wall Street Journal report on March 13 revealed that

representatives of Donald Trump have held discussions about

potentially acquiring a

stake in Binance.

Related: US

Bitcoin ETFs break outflow streak with $13.3M

inflow

So far, the market impact of a more crypto-friendly US

government has yet to yield concrete benefits.

For example, the Office of the Comptroller of the Currency (OCC)

has not yet clarified whether banks can custody digital

assets and manage stablecoins without prior approval.

Similarly, Acting SEC Chairman Mark Uyeda announced plans to

remove crypto-specific

provisions from a proposed rule that would expand exchange

definitions.

The US Securities and Exchange Commission is currently reviewing

requests from spot Bitcoin ETF issuers to permit in-kind creations

and redemptions, allowing shares to be exchanged directly for

Bitcoin instead of using the traditional cash-based method.

Meanwhile, global

macroeconomic conditions have deteriorated, putting pressure on

Bitcoin’s price. However, these same factors gradually push

governments toward economic stimulus measures and expand the M2

money supply.

If this trend continues, it should ultimately create conditions

for Bitcoin's price to meet Pakpakchicken’s $105,000 prediction by

May 2025 and possibly go even higher.

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading Crypto regulation shifts as Bitcoin

eyes $105K amid liquidity boost

The post

Crypto regulation shifts as Bitcoin eyes $105K amid

liquidity boost appeared first on

CoinTelegraph.

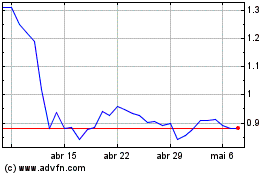

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025