Trending: Barclays Shares Tumble as Lender Flags Hit to Profitability

24 Outubro 2023 - 7:33AM

Dow Jones News

1002 GMT - Barclays is among the most mentioned companies across

news items over the past six hours in the United Kingdom, according

to Factiva data. The British bank's shares fell as much as 8.7% in

morning trade after it said it is eyeing cost-reduction measures

that could lead to extra charges in the fourth-quarter. "Fixing

that comes at a cost to buyback potential but to the benefit of

future competitiveness, ROTE and capital generation," UBS analysts

say in a note. Management is set to give out more details and share

revised financial targets at its full-year results in February.

Investors were also disappointed by another guidance cut for its

2023 U.K. net interest margin, though Shore Capital notes that this

part of the business accounts for one quarter of total group

income--while it usually accounts for around three quarters for

domestic peers--so the impact should be relatively small on overall

revenues. The lender posted an on-year fall in third-quarter net

profit but the figure was ahead of analysts' expectations on

lighter-than-expected provisions for bad loans. The stock is the

worst performer of London's blue chip index, dragging shares of

U.K. peers NatWest and Lloyds Banking lower. Dow Jones & Co.

owns Factiva. (elena.vardon@wsj.com)

(END) Dow Jones Newswires

October 24, 2023 06:18 ET (10:18 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

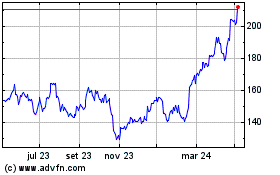

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024