0000893538false00008935382024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 31, 2024

SM Energy Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-31539 | 41-0518430 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

1700 Lincoln Street, Suite 3200 | | 80203 |

Denver, Colorado | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant's telephone number, including area code: (303) 861-8140

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common stock, $0.01 par value | SM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

In accordance with General Instruction B.2. of Form 8-K, the following information, including Exhibit 99.1, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On October 31, 2024, SM Energy Company (“Company”) issued a press release announcing its financial results for the third quarter of 2024, as well as providing an operational update and announcing its planned participation in upcoming investor conferences and the related details. As indicated in the press release, the Company scheduled a webcast and conference call for November 1, 2024, at 8:00 a.m. Mountain time/10:00 a.m. Eastern time to answer questions. The conference call is publicly accessible via webcast (available live and for replay) and telephone, and the press release includes instructions for accessing the webcast via the Company's website and dial-in information for the call. Availability of the webcast on the Company’s website is at the Company’s discretion and may be discontinued at any time. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | SM ENERGY COMPANY |

| | | |

| Date: | October 31, 2024 | By: | /s/ PATRICK A. LYTLE |

| | | Patrick A. Lytle |

| | | Vice President - Chief Accounting Officer and Controller |

| | | (Principal Accounting Officer) |

EXHIBIT 99.1

SM ENERGY REPORTS THIRD QUARTER 2024 RESULTS

HIGHLIGHTING EXCELLENT OPERATIONAL EXECUTION THAT DELIVERED

INCREASED OIL PRODUCTION ON LOWER CAPITAL

DENVER, CO October 31, 2024 - SM Energy Company (the “Company”) (NYSE: SM) today reported operating and financial results for the third quarter 2024 and provided certain full year and fourth quarter 2024 guidance.

Excellent operational execution drove strong third quarter results including:

•Net production was 15.6 MMBoe, or 170.0 MBoe/d, at 46% oil or 77.4 MBbls/d, which exceeded guidance. Higher than expected oil production and total production were driven largely by better than expected performance in both the Midland Basin and South Texas, as well as the timing of completions in South Texas. Continued strong quarterly performance in the Midland Basin and South Texas is expected to support full year production volumes at the high end of expectations for these areas.

•Net income was $240.5 million, or $2.09 per diluted common share, Adjusted net income(1) was $1.62 per diluted common share, net cash provided by operating activities was $452.3 million and Adjusted EBITDAX(1) was $481.5 million, all of which benefited from strong oil production and lower than expected operating costs.

•Net cash provided by operating activities of $452.3 million before net change in working capital of $(32.0) million totaled $420.2 million(1) and capital expenditures of $302.1 million adjusted for a change in capital expenditure accruals of $(11.7) million were $290.4 million.(1)

•Adjusted free cash flow(1) was $129.8 million, up 32% from the second quarter 2024.

Portfolio expansion sets up for an exciting 2025 with significantly increased scale:

•Utah adds a third core area to the Company’s top-tier portfolio. On October 1, 2024, the Company completed the previously announced $2.1 billion acquisition of an undivided 80 percent interest in the Uinta Basin assets of XCL Resources (and affiliated entities) and Altamont Energy (the “Uinta Basin Acquisitions”), adding high oil content production, approximately 63,300 net acres and multiple years of incremental quality drilling inventory. This acquisition of low breakeven assets is expected to be accretive to all financial metrics.

•Three recent wells in Utah reached peak 30-day initial production rates testing the Douglas Creek in the Upper Cube. The test wells averaged 870 Boe/d per well at 94% oil.

•Increased scale supports an increased borrowing base and lender commitments under the Company’s senior secured revolving credit facility. The borrowing base was increased to $3.0 billion and lender commitments to $2.0 billion (see Financial Position and Liquidity below for further discussion).

•Activity in the Klondike area of the Midland Basin includes the completion of eight wells that confirm oil saturated sandstone and the conventional nature of the play, in-line with the Company’s geologic modeling. Two Klondike wells with average lateral lengths of approximately 11,500 feet have reached peak 30-day initial production rates, which averaged 918 Boe/d per well at 93% oil.

•Initial wells targeting the Woodford-Barnett in the Sweetie Peck area continue to perform well with cumulative oil production exceeding the peer average in the area to date by more than 50%.

•In South Texas, the Company has successfully fulfilled its obligation under its drill-to-earn arrangement to add 8,663 net acres in the northern, high oil/liquids content Austin Chalk.

President and Chief Executive Officer Herb Vogel comments: “2024 is proving to be a highly successful year for SM Energy. Exceptional operational performance, magnified by increased top-tier portfolio scale and substantial oil production growth, supports a strong balance sheet and upside value creation opportunity.

“Looking ahead, we are keenly focused on our Utah operations. Along with the investment community, we are invigorated by the opportunity to unlock value in an overlooked basin, and we expect to deliver results attributable to the crude profile, high margins and substantial scale that the Uinta Basin Acquisitions provide. In the fourth quarter, we expect to sequentially grow our oil and total production volumes by around 40% and 25%, respectively, and execute a smooth integration of the Utah operations. We will diligently work to develop a 2025-2027 operating plan that will optimize capital efficiency and demonstrate the value of our expanded portfolio.

“We are very excited to be among the core operators in Utah. We welcome our new employees and look forward to becoming actively involved in our new communities.”

THIRD QUARTER 2024 RESULTS

| | | | | | | | | | | |

| NET PRODUCTION BY OPERATING AREA | |

| Third Quarter 2024 |

| Midland Basin | South Texas | Total |

Oil (MBbl / MBbl/d) | 5,099 / 55.4 | 2,019 / 21.9 | 7,118 / 77.4 |

Natural Gas (MMcf / MMcf/d) | 16,067 / 174.6 | 18,472 / 200.8 | 34,540 / 375.4 |

NGLs (MBbl / MBbl/d) | 7 / - | 2,758 / 30.0 | 2,765 / 30.1 |

Total (MBoe / MBoe/d) | 7,784 / 84.6 | 7,855 / 85.4 | 15,639 / 170.0 |

| Note: Totals may not calculate due to rounding. | | |

•Third quarter net production volumes were 15.6 MMBoe (170.0 MBoe/d) and were 46% oil (77.4 MBbl/d). Volumes were 50% from the Midland Basin and 50% from South Texas.

•Third quarter net production exceeded expectations due to strong base production performance from both Midland Basin and South Texas wells, as well as the early turn-in-line of eight wells in South Texas.

| | | | | | | | | | | |

| REALIZED PRICES BY OPERATING AREA | | |

| Third Quarter 2024 |

| Midland Basin | South Texas | Total (Pre/Post-hedge)(1) |

Oil ($/Bbl) | $75.88 | $71.79 | $74.72 / $74.65 |

Natural Gas ($/Mcf) | $1.20 | $1.69 | $1.46 / $1.95 |

NGLs ($/Bbl) | nm | $21.69 | $21.70 / $21.79 |

| Per Boe | $52.20 | $30.05 | $41.08 / $42.13 |

| Note: Totals may not calculate due to rounding. | | |

•Third quarter average realized price before the effect of hedges was $41.08 per Boe, and average realized price after the effect of hedges was $42.13 per Boe.(1)

•Third quarter benchmark pricing included NYMEX WTI at $75.10/Bbl, NYMEX Henry Hub natural gas at $2.16/MMBtu and OPIS Composite NGLs at $26.68/Bbl.

•The effect of commodity net derivative settlements for the third quarter was a gain of $1.05 per Boe, or $16.5 million.

For additional operating metrics and regional detail, please see the Financial Highlights section below and the accompanying slide deck.

NET INCOME, NET INCOME PER SHARE AND NET CASH PROVIDED BY OPERATING ACTIVITIES

Third quarter 2024 net income was $240.5 million, or $2.09 per diluted common share, compared with net income of $222.3 million, or $1.88 per diluted common share, for the same period in 2023. The primary drivers of increased net income were higher production volumes and lower operating and DD&A expenses per unit, partially offset by lower realized prices per unit and higher interest expense net of interest income. For the first nine months of 2024, net income was $582.0 million, or $5.03 per diluted common share, compared with net income of $570.8 million, or $4.75 per diluted common share, for the same period in 2023. On a per share basis, the Company’s stock repurchase program contributed to a 4.5 million share decrease in the weighted-average diluted share count during the nine months ended September 30, 2023, compared with the nine months ended September 30, 2024, further boosting EPS.

Third quarter 2024 net cash provided by operating activities of $452.3 million before net change in working capital of $(32.0) million totaled $420.2 million,(1) compared with net cash provided by operating activities of $383.0 million before net change in working capital of $52.9 million that totaled $435.9 million(1) for the same period in 2023. The $(15.7) million, or 4%, decrease in the current year period is primarily due to lower realized prices and increased interest expense net of interest income, partially offset by higher production and lower costs. For the first nine months of 2024, net cash provided by operating activities of $1,204.6 million before net change in working capital of $15.4 million totaled $1,220.1 million,(1) compared with net cash provided by operating activities of $1,097.9 million before net change in working capital of $57.3 million that totaled $1,155.2 million(1) for the same period in 2023.

ADJUSTED EBITDAX,(1) ADJUSTED NET INCOME,(1) AND NET DEBT-TO-ADJUSTED EBITDAX(1)

Third quarter 2024 Adjusted EBITDAX(1) was $481.5 million, up $6.0 million, or 1%, from $475.6 million for the same period in 2023. For the first nine months of 2024, Adjusted EBITDAX(1) was $1,376.5 million, up $109.3 million, or 9%, from $1,267.2 million for the same period in 2023.

Third quarter 2024 Adjusted net income(1) was $186.4 million, or $1.62 per diluted common share, compared with an Adjusted net income(1) of $205.0 million, or $1.73 per diluted common share, for the same period in 2023. For the first nine months of 2024, Adjusted net income(1) was $564.9 million, or $4.88 per diluted common share, compared with Adjusted net income(1) of $521.0 million, or $4.34 per diluted common share, for the same period in 2023.

At September 30, 2024, Net debt-to-Adjusted EBITDAX(1) was 0.5 times.

CAPITAL EXPENDITURES(1)

Third quarter 2024 capital expenditures of $302.1 million adjusted for a change in capital expenditure accruals of $(11.7) million totaled $290.4 million.(1) Capital activity during the quarter included drilling 37 net wells, of which 16 were in South Texas and 21 were in the Midland Basin, and adding 35 net flowing completions, of which 20 were in South Texas and 15 were in the Midland Basin.

For the first nine months of 2024, capital expenditures of $957.2 million adjusted for a change in capital accruals of $(33.2) million totaled $924.0 million.(1) Capital activity during the first nine months included drilling 97 net wells, of which 38 were in South Texas and 59 were in the Midland Basin, and adding 98 net flowing completions, of which 46 were in South Texas and 52 were in the Midland Basin.

ADJUSTED FREE CASH FLOW(1)

Third quarter 2024 cash flow from operations before net change in working capital totaled $420.2 million,(1) and capital expenditures before changes in accruals totaled $290.4 million,(1) delivering Adjusted free cash flow of $129.8 million.(1)

RETURN OF CAPITAL TO STOCKHOLDERS

Return of capital to stockholders during the quarter totaled $20.6 million through the payment of the Company’s $0.18 per share quarterly dividend on August 5, 2024. Since announcing the return of capital program in September 2022, the Company has repurchased approximately 10.1 million shares, or 8% of shares then outstanding, and returned $521.3 million to stockholders, inclusive of dividends and common stock repurchases.

In June 2024, the Board approved an 11% increase in the Company’s fixed quarterly dividend policy, from $0.18 to $0.20 per share, to commence in the fourth quarter 2024, and re-authorized the Company’s existing stock repurchase program in the amount of $500 million through December 31, 2027. There was $500 million available under the repurchase program as of the end of the third quarter.

FINANCIAL POSITION AND LIQUIDITY

On September 30, 2024, the outstanding principal amount of the Company’s long-term debt was $2.74 billion, with zero drawn on the Company’s senior secured revolving credit facility, and cash and cash equivalents of $1.74 billion. Net debt(1) was $1.00 billion. The cash balance at September 30, 2024 did not include restricted cash of $102.0 million that was held in escrow as a performance deposit in connection with the Uinta Basin Acquisitions.

During the third quarter of 2024, the Company issued and sold $750.0 million aggregate principal amount of 6.750% senior notes due 2029, and $750.0 million aggregate principal amount of 7.000% senior notes due 2032. The notes were issued at par. The Company used the net proceeds from the notes offerings, together with cash on hand and borrowings under its Credit Agreement, to fund the Uinta Basin Acquisitions, redeem all of its outstanding 5.625% Notes due in 2025, and pay related fees and expenses. On October 1, 2024, post-closing of the Uinta Basin Acquisitions, long-term debt was $2.93 billion including $2.74 billion principal amount of senior unsecured notes and $190 million drawn on the Company’s senior secured revolving credit facility. Cash and cash equivalents were $21 million.

COMMODITY DERIVATIVES

As of October 24, 2024, commodity derivative positions for the fourth quarter of 2024 include:

SWAPS AND COLLARS:

•Oil: Approximately 3,820 MBbls, or approximately 40% of expected 4Q 2024 net oil production, is hedged to benchmark prices at an average price of $72.08/Bbl (weighted-average of collar floors and swaps) to $78.27/Bbl (weighted-average of collar ceilings and swaps), excluding basis swaps.

•Natural gas: Approximately 8,900 BBtu, or approximately 20% of expected 4Q 2024 net natural gas production, is hedged to benchmark prices at an average price of $3.32/MMBtu (weighted-average of collar floors and swaps, excluding basis swaps).

BASIS SWAPS:

•Oil, Midland Basin differential: 1,230 MBbls of expected 4Q 2024 net Midland Basin oil production are hedged to the local price point at a positive weighted-average price of $1.21/Bbl.

•Gas, WAHA differential: 5,240 BBtu of expected 4Q 2024 net Midland Basin natural gas production are hedged to WAHA at a weighted-average price of ($0.73)/MMBtu.

•Gas, HSC differential: 5,750 BBtu of expected 4Q 2024 net South Texas natural gas production are hedged to HSC at a weighted-average price of ($0.38)/MMBtu.

A detailed schedule of these and additional derivative positions are provided in the 3Q24 accompanying slide deck.

2024 OPERATING PLAN AND GUIDANCE

The Company is unable to provide a reconciliation of forward-looking non-GAAP capital expenditures because components of the calculation are inherently unpredictable, such as changes to, and timing of, capital accruals. The inability to project certain components of the calculation would significantly affect the accuracy of a reconciliation.

UPDATED GUIDANCE FULL YEAR 2024:

The following includes Uinta Basin operations for the fourth quarter:

•Net production of 62.2-63.5 MMBoe, or 170-174 MBoe/d.

•Oil production, as a percent of total production, is expected to approximate 47% inclusive of the high oil content production from the Uinta Basin in the fourth quarter.

•Full year guidance for capital expenditures (net of the change in capital accruals),(1) excluding acquisitions, is expected to range between $1.24-$1.26 billion. The projected number of net wells drilled and completed in 2024 is expected to be approximately 137 and 134, respectively.

GUIDANCE FOURTH QUARTER 2024:

The following includes Uinta Basin operations for the full quarter.

•Net production of 18.9-20.2 MMBoe, or 205-220 MBoe/d, at 51% oil.

•Capital expenditures (net of the change in capital accruals),(1) excluding acquisitions is expected to range between $320-$340 million. The Company expects to drill approximately 40 net wells, of which 13 are planned for South Texas, 14 are planned for the Midland Basin and 13 are planned for the Uinta Basin. The Company expects to turn-in-line 36 net wells, of which 8 are planned for South Texas, 20 are planned for the Midland Basin and 8 are planned for the Uinta Basin.

•LOE is expected to range between $4.90-$5.10 per Boe.

•Transportation expense is expected to range between $4.30-$4.60 per Boe.

•Ad valorem and production taxes are expected to range between $2.40-$2.50 per Boe.

•G & A, including non-cash compensation expense, is expect to range between $35 million-$38 million.

UPCOMING EVENTS

EARNINGS Q&A WEBCAST AND CONFERENCE CALL

November 1, 2024 – Please join SM Energy management at 8:00 a.m. Mountain time/10:00 a.m. Eastern time for the third quarter 2024 financial and operating results Q&A session. This discussion will be accessible via:

•Webcast (available live and for replay) - on the Company’s website at sm-energy.com/investors (replay accessible approximately 1 hour after the live call); or

•Telephone - join the live conference call by registering at https://event.choruscall.com/mediaframe/webcast.html?webcastid=kAQMBh9B. Dial-in for domestic toll free/International is 877-407-6050 / +1 201-689-8022.

CONFERENCE PARTICIPATION

November 21, 2024 – Stephens Annual Investment Conference. Executive Vice President and Chief Financial Officer Wade Pursell will host a fireside chat at 9:00 a.m. Central time/10:00 a.m. Eastern time and will also meet with investors in one-on-one settings. The event will be webcast, accessible from the Company’s website, and available for replay for a limited period.

December 3, 2024 – Bank of America Leveraged Finance Conference. Executive Vice President and Chief Financial Officer Wade Pursell will host a fireside chat at 8:10 a.m. Mountain time/10:10 a.m. Eastern time and will also meet with investors in one-on-one settings. The event will be webcast, accessible from the Company’s website, and available for replay for a limited period.

When applicable, updated event presentations are posted to the Company’s website the morning of the event.

DISCLOSURES

FORWARD LOOKING STATEMENTS

This release contains forward-looking statements within the meaning of securities laws. The words “anticipate,” “deliver,” “demonstrate,” “establish,” “estimate,” “expects,” “goal,” “generate,” “indicate,” “maintain,” “objectives,” “optimize,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this release include, among other things: certain matters related to the Uinta Basin Acquisitions, including integration plans and expectations, operational plans and expectations, accretion to certain financial metrics, future drilling inventory, and projections for production; projections for the full year and fourth quarter 2024, including guidance for capital expenditures, production, the number of wells expected to be drilled and completed in total and in each of our operating areas, certain operating and G&A costs, and the percent of future production to be hedged. These statements involve known and unknown risks, which may cause SM Energy's actual results to differ materially from results expressed or implied by the forward-looking statements. Future results may be impacted by the risks discussed in the Risk Factors section of SM Energy's most recent Annual Report on Form 10-K and Exhibit 99.2 to our Current Reports on Form 8-K filed on July 18, 2024, and such risk factors may be updated from time to time in the Company's other periodic reports filed with the Securities and Exchange Commission. The forward-looking statements contained herein speak as of the date of this release. Although SM Energy may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so, except as required by securities laws.

FOOTNOTE 1

Indicates a non-GAAP measure or metric. Please refer below to the section “Definitions of non-GAAP Measures and Metrics as Calculated by the Company” in Financials Highlights for additional information.

ABOUT THE COMPANY

SM Energy Company is an independent energy company engaged in the acquisition, exploration, development, and production of oil, gas, and NGLs in the states of Texas and Utah. SM Energy routinely posts important information about the Company on its website. For more information about SM Energy, please visit its website at www.sm-energy.com.

SM ENERGY INVESTOR CONTACTS

Jennifer Martin Samuels, jsamuels@sm-energy.com, 303-864-2507

Lindsay Miller, lmiller@sm-energy.com, 303-830-5860

| | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

|

| Condensed Consolidated Balance Sheets | | | |

| (in thousands, except share data) | September 30, | | December 31, |

| ASSETS | 2024 | | 2023 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,735,313 | | | $ | 616,164 | |

| Accounts receivable | 226,604 | | | 231,165 | |

| Derivative assets | 72,287 | | | 56,442 | |

| Prepaid expenses and other | 10,224 | | | 12,668 | |

| Total current assets | 2,044,428 | | | 916,439 | |

| Property and equipment (successful efforts method): | | | |

| Proved oil and gas properties | 12,501,494 | | | 11,477,358 | |

| Accumulated depletion, depreciation, and amortization | (7,370,881) | | | (6,830,253) | |

Unproved oil and gas properties, net of valuation allowance of $33,095 and $35,362, respectively | 287,311 | | | 335,620 | |

| Wells in progress | 291,197 | | | 358,080 | |

| | | |

Other property and equipment, net of accumulated depreciation of $62,435 and $59,669, respectively | 45,149 | | | 35,615 | |

| Total property and equipment, net | 5,754,270 | | | 5,376,420 | |

| Noncurrent assets: | | | |

| Acquisition deposit held in escrow | 102,000 | | | — | |

| Derivative assets | 11,584 | | | 8,672 | |

| Other noncurrent assets | 115,490 | | | 78,454 | |

| Total noncurrent assets | 229,074 | | | 87,126 | |

| Total assets | $ | 8,027,772 | | | $ | 6,379,985 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 560,839 | | | $ | 611,598 | |

| | | |

| Derivative liabilities | 2,401 | | | 6,789 | |

| Other current liabilities | 17,859 | | | 15,425 | |

| Total current liabilities | 581,099 | | | 633,812 | |

| Noncurrent liabilities: | | | |

| Revolving credit facility | — | | | — | |

| Senior Notes, net | 2,706,700 | | | 1,575,334 | |

| Asset retirement obligations | 125,327 | | | 118,774 | |

| | | |

| Net deferred tax liabilities | 467,459 | | | 369,903 | |

| Derivative liabilities | 448 | | | 1,273 | |

| Other noncurrent liabilities | 85,193 | | | 65,039 | |

| Total noncurrent liabilities | 3,385,127 | | | 2,130,323 | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value - authorized: 200,000,000 shares; issued and outstanding: 114,418,413 and 115,745,393 shares, respectively | 1,144 | | | 1,157 | |

| Additional paid-in capital | 1,492,778 | | | 1,565,021 | |

| Retained earnings | 2,570,108 | | | 2,052,279 | |

| Accumulated other comprehensive loss | (2,484) | | | (2,607) | |

| Total stockholders’ equity | 4,061,546 | | | 3,615,850 | |

| Total liabilities and stockholders’ equity | $ | 8,027,772 | | | $ | 6,379,985 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

|

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share data) | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating revenues and other income: | | | | | | | |

| Oil, gas, and NGL production revenue | $ | 642,380 | | | $ | 639,699 | | | $ | 1,835,427 | | | $ | 1,757,032 | |

| | | | | | | |

| Other operating income, net | 1,233 | | | 1,202 | | | 2,611 | | | 8,128 | |

| Total operating revenues and other income | 643,613 | | | 640,901 | | | 1,838,038 | | | 1,765,160 | |

| Operating expenses: | | | | | | | |

| Oil, gas, and NGL production expense | 148,380 | | | 138,264 | | | 422,377 | | | 426,200 | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 202,942 | | | 189,353 | | | 548,781 | | | 501,374 | |

Exploration (1) | 12,097 | | | 10,245 | | | 47,772 | | | 43,633 | |

| | | | | | | |

| | | | | | | |

General and administrative (1) | 35,141 | | | 29,255 | | | 96,431 | | | 84,424 | |

Net derivative (gain) loss (2) | (86,283) | | | 75,355 | | | (70,256) | | | 12,352 | |

| Other operating expense, net | 384 | | | 2,832 | | | 4,206 | | | 20,182 | |

| Total operating expenses | 312,661 | | | 445,304 | | | 1,049,311 | | | 1,088,165 | |

| Income from operations | 330,952 | | | 195,597 | | | 788,727 | | | 676,995 | |

| Interest expense | (50,682) | | | (23,106) | | | (94,362) | | | (67,713) | |

| Interest income | 18,017 | | | 4,106 | | | 31,120 | | | 13,802 | |

| | | | | | | |

| Other non-operating expense | (637) | | | (233) | | | (684) | | | (696) | |

| Income before income taxes | 297,650 | | | 176,364 | | | 724,801 | | | 622,388 | |

| Income tax (expense) benefit | (57,127) | | | 45,979 | | | (142,786) | | | (51,619) | |

| Net income | $ | 240,523 | | | $ | 222,343 | | | $ | 582,015 | | | $ | 570,769 | |

| | | | | | | |

| Basic weighted-average common shares outstanding | 114,405 | | | 117,823 | | | 114,870 | | | 119,589 | |

| Diluted weighted-average common shares outstanding | 114,993 | | | 118,328 | | | 115,701 | | | 120,165 | |

| Basic net income per common share | $ | 2.10 | | | $ | 1.89 | | | $ | 5.07 | | | $ | 4.77 | |

| Diluted net income per common share | $ | 2.09 | | | $ | 1.88 | | | $ | 5.03 | | | $ | 4.75 | |

| Net dividends declared per common share | $ | 0.20 | | | $ | 0.15 | | | $ | 0.56 | | | $ | 0.45 | |

| | | | | | | |

(1) Non-cash stock-based compensation included in: | | | | | | | |

| Exploration expense | $ | 1,338 | | | $ | 1,174 | | | $ | 3,651 | | | $ | 3,021 | |

| General and administrative expense | 5,249 | | | 4,864 | | | 13,742 | | | 11,498 | |

| Total non-cash stock-based compensation | $ | 6,587 | | | $ | 6,038 | | | $ | 17,393 | | | $ | 14,519 | |

| | | | | | | |

(2) The net derivative (gain) loss line item consists of the following: | | | | | | | |

| Net derivative settlement (gain) loss | $ | (16,491) | | | $ | 314 | | | $ | (46,288) | | | $ | (20,398) | |

| Net (gain) loss on fair value changes | (69,792) | | | 75,041 | | | (23,968) | | | 32,750 | |

| Total net derivative (gain) loss | $ | (86,283) | | | $ | 75,355 | | | $ | (70,256) | | | $ | 12,352 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

| | | | | | | | | | | |

| Condensed Consolidated Statements of Stockholders' Equity |

| (in thousands, except share data and dividends per share) |

|

| | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders’ Equity |

| Common Stock | | | | |

| Shares | | Amount | | | | |

| Balances, December 31, 2023 | 115,745,393 | | | $ | 1,157 | | | $ | 1,565,021 | | | $ | 2,052,279 | | | $ | (2,607) | | | $ | 3,615,850 | |

| Net income | — | | | — | | | — | | | 131,199 | | | — | | | 131,199 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 8 | | | 8 | |

Net cash dividends declared, $0.18 per share | — | | | — | | | — | | | (20,707) | | | — | | | (20,707) | |

| | | | | | | | | | | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 1,147 | | | — | | | (22) | | | — | | | — | | | (22) | |

| Stock-based compensation expense | 1,839 | | | — | | | 5,018 | | | — | | | — | | | 5,018 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (712,235) | | | (7) | | | (33,088) | | | — | | | — | | | (33,095) | |

| Balances, March 31, 2024 | 115,036,144 | | | $ | 1,150 | | | $ | 1,536,929 | | | $ | 2,162,771 | | | $ | (2,599) | | | $ | 3,698,251 | |

| Net income | — | | | — | | | — | | | 210,293 | | | — | | | 210,293 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 7 | | | 7 | |

Net cash dividends declared, $0.18 per share | — | | | — | | | — | | | (20,532) | | | — | | | (20,532) | |

| Issuance of common stock under Employee Stock Purchase Plan | 56,006 | | | 1 | | | 1,843 | | | — | | | — | | | 1,844 | |

| | | | | | | | | | | |

| Stock-based compensation expense | 35,691 | | | 1 | | | 5,787 | | | — | | | — | | | 5,788 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (1,058,956) | | | (11) | | | (51,700) | | | — | | | — | | | (51,711) | |

| | | | | | | | | | | |

| Balances, June 30, 2024 | 114,068,885 | | | $ | 1,141 | | | $ | 1,492,859 | | | $ | 2,352,532 | | | $ | (2,592) | | | $ | 3,843,940 | |

| Net income | — | | | — | | | — | | | 240,523 | | | — | | | 240,523 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 108 | | | 108 | |

Net cash dividends declared, $0.20 per share | — | | | — | | | — | | | (22,947) | | | — | | | (22,947) | |

| | | | | | | | | | | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 349,528 | | | 3 | | | (6,819) | | | — | | | — | | | (6,816) | |

| Stock-based compensation expense | — | | | — | | | 6,587 | | | — | | | — | | | 6,587 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | — | | | — | | | 151 | | | — | | | — | | | 151 | |

| Balances, September 30, 2024 | 114,418,413 | | | $ | 1,144 | | | $ | 1,492,778 | | | $ | 2,570,108 | | | $ | (2,484) | | | $ | 4,061,546 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

| | | | | | | | | | | |

| Condensed Consolidated Statements of Stockholders' Equity (Continued) |

| (in thousands, except share data and dividends per share) |

| | | | | | | | | | | |

| | | Additional Paid-in Capital | | | | Accumulated Other Comprehensive Loss | | Total Stockholders’ Equity |

| Common Stock | | | Retained Earnings | | |

| Shares | | Amount | | | | |

| Balances, December 31, 2022 | 121,931,676 | | | $ | 1,219 | | | $ | 1,779,703 | | | $ | 1,308,558 | | | $ | (4,022) | | | $ | 3,085,458 | |

| Net income | — | | | — | | | — | | | 198,552 | | | — | | | 198,552 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 13 | | | 13 | |

Net cash dividends declared, $0.15 per share | — | | | — | | | — | | | (18,078) | | | — | | | (18,078) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 4,318 | | | — | | | — | | | 4,318 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (1,413,758) | | | (14) | | | (40,454) | | | — | | | — | | | (40,468) | |

| Balances, March 31, 2023 | 120,517,918 | | | $ | 1,205 | | | $ | 1,743,567 | | | $ | 1,489,032 | | | $ | (4,009) | | | $ | 3,229,795 | |

| Net income | — | | | — | | | — | | | 149,874 | | | — | | | 149,874 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 13 | | | 13 | |

Net cash dividends declared, $0.15 per share | — | | | — | | | — | | | (17,704) | | | — | | | (17,704) | |

| Issuance of common stock under Employee Stock Purchase Plan | 68,210 | | | 1 | | | 1,815 | | | — | | | — | | | 1,816 | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 774 | | | — | | | (7) | | | — | | | — | | | (7) | |

| Stock-based compensation expense | 56,872 | | | 1 | | | 4,162 | | | — | | | — | | | 4,163 | |

| Purchase of shares under Stock Repurchase Program | (2,550,706) | | | (26) | | | (69,457) | | | — | | | — | | | (69,483) | |

| Other | 19,037 | | | — | | | — | | | — | | | — | | | — | |

| Balances, June 30, 2023 | 118,112,105 | | | $ | 1,181 | | | $ | 1,680,080 | | | $ | 1,621,202 | | | $ | (3,996) | | | $ | 3,298,467 | |

| Net income | — | | | — | | | — | | | 222,343 | | | — | | | 222,343 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 14 | | | 14 | |

Net cash dividends declared, $0.15 per share | — | | | — | | | — | | | (17,543) | | | — | | | (17,543) | |

| Issuance of common stock under Employee Stock Purchase Plan | (18) | | | — | | | — | | | — | | | — | | | — | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 553,442 | | | 6 | | | (7,881) | | | — | | | — | | | (7,875) | |

| Stock-based compensation expense | — | | | — | | | 6,038 | | | — | | | — | | | 6,038 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (2,351,642) | | | (24) | | | (97,127) | | | — | | | — | | | (97,151) | |

| Balances, September 30, 2023 | 116,313,887 | | | $ | 1,163 | | | $ | 1,581,110 | | | $ | 1,826,002 | | | $ | (3,982) | | | $ | 3,404,293 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

|

| Condensed Consolidated Statements of Cash Flows | | | | | | |

| (in thousands) | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 240,523 | | | $ | 222,343 | | | $ | 582,015 | | | $ | 570,769 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 202,942 | | | 189,353 | | | 548,781 | | | 501,374 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense | 6,587 | | | 6,038 | | | 17,393 | | | 14,519 | |

| Net derivative (gain) loss | (86,283) | | | 75,355 | | | (70,256) | | | 12,352 | |

| Net derivative settlement gain (loss) | 16,491 | | | (314) | | | 46,288 | | | 20,398 | |

| Amortization of deferred financing costs | 2,182 | | | 1,371 | | | 4,925 | | | 4,114 | |

| | | | | | | |

| Deferred income taxes | 45,615 | | | (51,075) | | | 116,522 | | | 43,171 | |

| Other, net | (7,834) | | | (7,184) | | | (25,590) | | | (11,489) | |

| Net change in working capital | 32,040 | | | (52,893) | | | (15,433) | | | (57,329) | |

| Net cash provided by operating activities | 452,263 | | | 382,994 | | | 1,204,645 | | | 1,097,879 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Capital expenditures | (302,107) | | | (216,710) | | | (957,156) | | | (766,756) | |

| Acquisition of proved and unproved oil and gas properties | (838) | | | (20,484) | | | (836) | | | (109,318) | |

| Other, net | — | | | — | | | 80 | | | 657 | |

| Net cash used in investing activities | (302,945) | | | (237,194) | | | (957,912) | | | (875,417) | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Debt issuance costs related to credit facility | (2,378) | | | — | | | (2,378) | | | — | |

| Net proceeds from Senior Notes | 1,477,032 | | | — | | | 1,477,032 | | | — | |

| Cash paid to repurchase Senior Notes | (349,118) | | | — | | | (349,118) | | | — | |

| Repurchase of common stock | — | | | (96,383) | | | (83,991) | | | (205,246) | |

| Dividends paid | (20,595) | | | (17,800) | | | (62,136) | | | (54,167) | |

| Net proceeds from sale of common stock | — | | | — | | | 1,844 | | | 1,815 | |

| Net share settlement from issuance of stock awards | (6,815) | | | (7,875) | | | (6,837) | | | (7,882) | |

| | | | | | | |

| Net cash provided by (used in) financing activities | 1,098,126 | | | (122,058) | | | 974,416 | | | (265,480) | |

| | | | | | | |

| Net change in cash, cash equivalents, and restricted cash | 1,247,444 | | | 23,742 | | | 1,221,149 | | | (43,018) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 589,869 | | | 378,238 | | | 616,164 | | | 444,998 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,837,313 | | | $ | 401,980 | | | $ | 1,837,313 | | | $ | 401,980 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

|

| Condensed Consolidated Statements of Cash Flows (Continued) | | | | | | |

| (in thousands) | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Supplemental schedule of additional cash flow information and non-cash activities: | | | | | | | |

| Operating activities: | | | | | | | |

Cash paid for interest, net of capitalized interest (1) | $ | (41,571) | | | $ | (34,834) | | | $ | (83,130) | | | $ | (77,514) | |

| Net cash paid for income taxes | $ | (194) | | | $ | (39) | | | $ | (7,623) | | | $ | (6,176) | |

| Investing activities: | | | | | | | |

| Changes in capital expenditure accruals | $ | (11,696) | | | $ | 11,463 | | | $ | (33,187) | | | $ | 35,683 | |

Non-cash financing activities (2) | | | | | | | |

| | | | | | | |

| Reconciliation of cash, cash equivalents, and restricted cash: | | | | | | | |

| Cash and cash equivalents | $ | 1,735,313 | | | $ | 401,980 | | | $ | 1,735,313 | | | $ | 401,980 | |

Restricted cash (3) | 102,000 | | | — | | | 102,000 | | | — | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,837,313 | | | $ | 401,980 | | | $ | 1,837,313 | | | $ | 401,980 | |

| | | | | | | |

(1) Cash paid for interest, net of capitalized interest during the nine months ended September 30, 2024, does not include $9.0 million in fees paid to secure firm commitments for senior unsecured bridge term loans, in connection with the Uinta Basin Acquisitions. Please reference Note 11 - Acquisitions in Part I, Item 1 in the Company’s Form 10-Q as of September 30, 2024, for additional discussion. |

(2) Please reference Note 5 - Long Term Debt in Part I, Item 1 in the Company’s Form 10-Q as of September 30, 2024, for discussion of the debt transactions executed during the nine months ended September 30, 2024. |

(3) Represents a deposit held in a third-party escrow account related to the Uinta Basin Acquisitions and is included in the acquisition deposit held in escrow line item on the unaudited condensed consolidated balance sheets as of September 30, 2024. Please reference Note 11 - Acquisitions in Part I, Item 1 in the Company’s Form 10-Q as of September 30, 2024, for additional discussion regarding the Uinta Basin Acquisitions. |

DEFINITIONS OF NON-GAAP MEASURES AND METRICS AS CALCULATED BY THE COMPANY

To supplement the presentation of its financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company provides certain non-GAAP measures and metrics, which are used by management and the investment community to assess the Company’s financial condition, results of operations, and cash flows, as well as compare performance from period to period and across the Company’s peer group. The Company believes these measures and metrics are widely used by the investment community, including investors, research analysts and others, to evaluate and compare recurring financial results among upstream oil and gas companies in making investment decisions or recommendations. These measures and metrics, as presented, may have differing calculations among companies and investment professionals and may not be directly comparable to the same measures and metrics provided by others. A non-GAAP measure should not be considered in isolation or as a substitute for the most directly comparable GAAP measure or any other measure of a company’s financial or operating performance presented in accordance with GAAP. Reconciliations of the Company’s non-GAAP measures to the most directly comparable GAAP measure is presented below. These measures may not be comparable to similarly titled measures of other companies.

Adjusted EBITDAX: Adjusted EBITDAX is calculated as net income before interest expense, interest income, income taxes, depletion, depreciation, amortization and asset retirement obligation liability accretion expense, exploration expense, property abandonment and impairment expense, non-cash stock-based compensation expense, derivative gains and losses net of settlements, gains and losses on divestitures, gains and losses on extinguishment of debt, and certain other items. Adjusted EBITDAX excludes certain items that the Company believes affect the comparability of operating results and can exclude items that are generally non-recurring in nature or whose timing and/or amount cannot be reasonably estimated. Adjusted EBITDAX is a non-GAAP measure that the Company believes provides useful additional information to investors and analysts, as a performance measure, for analysis of the Company’s ability to internally generate funds for exploration, development, acquisitions, and to service debt. The Company is also subject to financial covenants under the Company’s Credit Agreement, a material source of liquidity for the Company, based on Adjusted EBITDAX ratios. Please reference the Company’s third quarter 2024 Form 10-Q and the most recent Annual Report on Form 10-K for discussion of the Credit Agreement and its covenants.

Adjusted free cash flow: Adjusted free cash flow is calculated as net cash provided by operating activities before net change in working capital less capital expenditures before changes in accruals. The Company uses this measure as representative of the cash from operations, in excess of capital expenditures that provides liquidity to fund discretionary obligations such as debt reduction, returning cash to stockholders or expanding the business.

Adjusted net income and Adjusted net income per diluted common share: Adjusted net income and Adjusted net income per diluted common share excludes certain items that the Company believes affect the comparability of operating results, including items that are generally non-recurring in nature or whose timing and/or amount cannot be reasonably estimated. These items include non-cash and other adjustments, such as derivative gains and losses net of settlements, impairments, net (gain) loss on divestiture activity, gains and losses on extinguishment of debt, and accruals for non-recurring matters. The Company uses these measures to evaluate the comparability of the Company's ongoing operational results and trends and believes these measures provide useful information to investors for analysis of the Company's fundamental business on a recurring basis.

Net debt: Net debt is calculated as the total principal amount of outstanding senior notes plus amounts drawn on the revolving credit facility less cash and cash equivalents (also referred to as total funded debt). The Company uses net debt as a measure of financial position and believes this measure provides useful additional information to investors to evaluate the Company's capital structure and financial leverage.

Net debt-to-Adjusted EBITDAX: Net debt-to-Adjusted EBITDAX is calculated as Net Debt (defined above) divided by Adjusted EBITDAX (defined above) for the trailing twelve-month period (also referred to as “leverage ratio” or “Adjusted EBITDAX multiple”). A variation of this calculation is a financial covenant under the Company’s Credit Agreement. The Company and the investment community may use this metric in understanding the Company’s ability to service its debt and identify trends in its leverage position. The Company reconciles the two non-GAAP measure components of this calculation.

Post-hedge: Post-hedge is calculated as the average realized price after the effects of commodity net derivative settlements. The Company believes this metric is useful to management and the investment community to understand the effects of commodity net derivative settlements on average realized price.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

| | | | | | | | | | | | | | | | | | | |

| Production Data | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | Percent Change

Between | | For the Nine Months Ended | | Percent Change Between Periods |

| September 30, | | June 30, | | September 30, | | 3Q24 & 2Q24 | | | | | | 3Q24 & 3Q23 | | September 30, | | September 30, | |

| 2024 | | 2024 | | 2023 | | | | | | | | 2024 | | 2023 | |

| Realized sales price (before the effect of net derivative settlements): |

| Oil (per Bbl) | $ | 74.72 | | | $ | 80.48 | | | $ | 80.95 | | | (7) | % | | | | | | (8) | % | | $ | 77.08 | | | $ | 75.90 | | | 2 | % |

| Gas (per Mcf) | $ | 1.46 | | | $ | 1.40 | | | $ | 2.48 | | | 4 | % | | | | | | (41) | % | | $ | 1.67 | | | $ | 2.48 | | | (33) | % |

| NGLs (per Bbl) | $ | 21.70 | | | $ | 22.86 | | | $ | 23.61 | | | (5) | % | | | | | | (8) | % | | $ | 22.45 | | | $ | 23.40 | | | (4) | % |

| Equivalent (per Boe) | $ | 41.08 | | | $ | 43.92 | | | $ | 45.24 | | | (6) | % | | | | | | (9) | % | | $ | 42.42 | | | $ | 42.47 | | | — | % |

Realized sales price (including the effect of net derivative settlements): (1) |

| Oil (per Bbl) | $ | 74.65 | | | $ | 80.31 | | | $ | 78.77 | | | (7) | % | | | | | | (5) | % | | $ | 77.12 | | | $ | 74.76 | | | 3 | % |

| Gas (per Mcf) | $ | 1.95 | | | $ | 1.95 | | | $ | 2.84 | | | — | % | | | | | | (31) | % | | $ | 2.15 | | | $ | 2.86 | | | (25) | % |

| NGLs (per Bbl) | $ | 21.79 | | | $ | 22.86 | | | $ | 24.21 | | | (5) | % | | | | | | (10) | % | | $ | 22.29 | | | $ | 23.83 | | | (6) | % |

| Equivalent (per Boe) | $ | 42.13 | | | $ | 45.07 | | | $ | 45.22 | | | (7) | % | | | | | | (7) | % | | $ | 43.49 | | | $ | 42.96 | | | 1 | % |

Net production volumes: (2) |

| Oil (MMBbl) | 7.1 | | | 6.6 | | | 6.2 | | | 8 | % | | | | | | 15 | % | | 19.5 | | | 17.7 | | | 10 | % |

| Gas (Bcf) | 34.5 | | | 32.2 | | | 32.9 | | | 7 | % | | | | | | 5 | % | | 97.9 | | | 98.9 | | | (1) | % |

| NGLs (MMBbl) | 2.8 | | | 2.4 | | | 2.5 | | | 13 | % | | | | | | 11 | % | | 7.4 | | | 7.2 | | | 3 | % |

| Equivalent (MMBoe) | 15.6 | | | 14.4 | | | 14.1 | | | 8 | % | | | | | | 11 | % | | 43.3 | | | 41.4 | | | 5 | % |

Average net daily production: (2) |

| Oil (MBbl per day) | 77.4 | | | 72.7 | | | 67.0 | | | 6 | % | | | | | | 15 | % | | 71.3 | | | 64.8 | | | 10 | % |

| Gas (MMcf per day) | 375.4 | | | 354.0 | | | 357.9 | | | 6 | % | | | | | | 5 | % | | 357.3 | | | 362.2 | | | (1) | % |

| NGLs (MBbl per day) | 30.1 | | | 26.8 | | | 27.0 | | | 12 | % | | | | | | 11 | % | | 27.1 | | | 26.3 | | | 3 | % |

| Equivalent (MBoe per day) | 170.0 | | | 158.5 | | | 153.7 | | | 7 | % | | | | | | 11 | % | | 157.9 | | | 151.5 | | | 4 | % |

| Per Boe data: | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Lease operating expense | $ | 4.73 | | | $ | 4.82 | | | $ | 5.08 | | | (2) | % | | | | | | (7) | % | | $ | 5.01 | | | $ | 5.07 | | | (1) | % |

| Transportation costs | $ | 2.13 | | | $ | 1.94 | | | $ | 2.07 | | | 10 | % | | | | | | 3 | % | | $ | 2.05 | | | $ | 2.58 | | | (21) | % |

| Production taxes | $ | 1.87 | | | $ | 1.89 | | | $ | 1.93 | | | (1) | % | | | | | | (3) | % | | $ | 1.89 | | | $ | 1.87 | | | 1 | % |

| Ad valorem tax expense | $ | 0.76 | | | $ | 0.82 | | | $ | 0.70 | | | (7) | % | | | | | | 9 | % | | $ | 0.82 | | | $ | 0.78 | | | 5 | % |

General and administrative (3) | $ | 2.25 | | | $ | 2.16 | | | $ | 2.07 | | | 4 | % | | | | | | 9 | % | | $ | 2.23 | | | $ | 2.04 | | | 9 | % |

| Net derivative settlement gain (loss) | $ | 1.05 | | | $ | 1.15 | | | $ | (0.02) | | | (9) | % | | | | | | 5,350 | % | | $ | 1.07 | | | $ | 0.49 | | | 118 | % |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | $ | 12.98 | | | $ | 12.46 | | | $ | 13.39 | | | 4 | % | | | | | | (3) | % | | $ | 12.68 | | | $ | 12.12 | | | 5 | % |

| | | | | | | | | | | | | | | | | | | |

(1) Indicates a non-GAAP measure or metric. Please refer above to the section “Definitions of non-GAAP Measures and Metrics as Calculated by the Company” for additional information. |

(2) Amounts and percentage changes may not calculate due to rounding. |

(3) Includes non-cash stock-based compensation expense per Boe of $0.34, $0.32, and $0.34 for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively, and $0.32 and $0.28 for the nine months ended September 30, 2024, and 2023, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

| | |

Adjusted EBITDAX Reconciliation (1) | | | | | | | | | |

| (in thousands) | | | | | | | | | |

| | | | | | | | | |

Reconciliation of net income (GAAP) and net cash provided by operating activities (GAAP) to Adjusted EBITDAX (non-GAAP): | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, | | For the Trailing Twelve Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 | | 2024 |

| Net income (GAAP) | $ | 240,523 | | | $ | 222,343 | | | $ | 582,015 | | | $ | 570,769 | | | $ | 829,126 | |

| Interest expense | 50,682 | | | 23,106 | | | 94,362 | | | 67,713 | | | 118,279 | |

| Interest income | (18,017) | | | (4,106) | | | (31,120) | | | (13,802) | | | (37,172) | |

| Income tax expense (benefit) | 57,127 | | | (45,979) | | | 142,786 | | | 51,619 | | | 187,489 | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 202,942 | | | 189,353 | | | 548,781 | | | 501,374 | | | 737,888 | |

Exploration (2) | 10,759 | | | 9,071 | | | 44,121 | | | 40,612 | | | 58,842 | |

| | | | | | | | | |

| Stock-based compensation expense | 6,587 | | | 6,038 | | | 17,393 | | | 14,519 | | | 23,124 | |

| Net derivative (gain) loss | (86,283) | | | 75,355 | | | (70,256) | | | 12,352 | | | (150,762) | |

| Net derivative settlement gain (loss) | 16,491 | | | (314) | | | 46,288 | | | 20,398 | | | 52,811 | |

| | | | | | | | | |

| Other, net | 706 | | | 698 | | | 2,126 | | | 1,625 | | | 1,998 | |

| Adjusted EBITDAX (non-GAAP) | $ | 481,517 | | | $ | 475,565 | | | $ | 1,376,496 | | | $ | 1,267,179 | | | $ | 1,821,623 | |

| Interest expense | (50,682) | | | (23,106) | | | (94,362) | | | (67,713) | | | (118,279) | |

| Interest income | 18,017 | | | 4,106 | | | 31,120 | | | 13,802 | | | 37,172 | |

| Income tax (expense) benefit | (57,127) | | | 45,979 | | | (142,786) | | | (51,619) | | | (187,489) | |

Exploration (2)(3) | (10,456) | | | (8,912) | | | (34,892) | | | (31,566) | | | (49,793) | |

| Amortization of deferred financing costs | 2,182 | | | 1,371 | | | 4,925 | | | 4,114 | | | 6,297 | |

| Deferred income taxes | 45,615 | | | (51,075) | | | 116,522 | | | 43,171 | | | 161,607 | |

| Other, net | (8,843) | | | (8,041) | | | (36,945) | | | (22,160) | | | (27,323) | |

| Net change in working capital | 32,040 | | | (52,893) | | | (15,433) | | | (57,329) | | | 37,345 | |

| Net cash provided by operating activities (GAAP) | $ | 452,263 | | | $ | 382,994 | | | $ | 1,204,645 | | | $ | 1,097,879 | | | $ | 1,681,160 | |

| | | | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) Stock-based compensation expense is a component of the exploration expense and general and administrative expense line items on the unaudited condensed consolidated statements of operations. Therefore, the exploration line items shown in the reconciliation above will vary from the amount shown on the unaudited condensed consolidated statements of operations for the component of stock-based compensation expense recorded to exploration expense. |

(3) For the periods presented, amounts exclude certain capital expenditures related to unsuccessful exploration activities. |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

|

Reconciliation of Net Income to Adjusted Net Income (1) | | | | |

| (in thousands, except per share data) | | | | | | | |

| | | | | | | |

| For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (GAAP) | $ | 240,523 | | | $ | 222,343 | | | $ | 582,015 | | | $ | 570,769 | |

| Net derivative (gain) loss | (86,283) | | | 75,355 | | | (70,256) | | | 12,352 | |

| Net derivative settlement gain (loss) | 16,491 | | | (314) | | | 46,288 | | | 20,398 | |

| | | | | | | |

| | | | | | | |

| Other, net | 706 | | | 698 | | | 2,126 | | | 1,625 | |

Tax effect of adjustments (2) | 14,992 | | | (16,435) | | | 4,740 | | | (7,459) | |

Net R&D tax credit carryover (3) | — | | | (76,686) | | | — | | | (76,686) | |

| Adjusted net income (non-GAAP) | $ | 186,429 | | | $ | 204,961 | | | $ | 564,913 | | | $ | 520,999 | |

| | | | | | | |

| Diluted net income per common share (GAAP) | $ | 2.09 | | | $ | 1.88 | | | $ | 5.03 | | | $ | 4.75 | |

| Net derivative (gain) loss | (0.75) | | | 0.64 | | | (0.61) | | | 0.10 | |

| Net derivative settlement gain (loss) | 0.14 | | | — | | | 0.40 | | | 0.17 | |

| | | | | | | |

| | | | | | | |

| Other, net | 0.01 | | | — | | | 0.02 | | | 0.02 | |

Tax effect of adjustments (2) | 0.13 | | | (0.14) | | | 0.04 | | | (0.06) | |

| Net R&D tax credit carryover | — | | | (0.65) | | | — | | | (0.64) | |

| Adjusted net income per diluted common share (non-GAAP) | $ | 1.62 | | | $ | 1.73 | | | $ | 4.88 | | | $ | 4.34 | |

| | | | | | | |

| Basic weighted-average common shares outstanding | 114,405 | | | 117,823 | | | 114,870 | | | 119,589 | |

| Diluted weighted-average common shares outstanding | 114,993 | | | 118,328 | | | 115,701 | | | 120,165 | |

| | | | | | | |

| Note: Amounts may not calculate due to rounding. | | | | | | | |

| | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) The tax effect of adjustments for each of the three and nine months ended September 30, 2024, and 2023, was calculated using a tax rate of 21.7%. This rate approximates the Company's statutory tax rate for the respective periods, as adjusted for ordinary permanent differences. |

(3) Adjusted net income removes the benefit of the research and development tax credit carryover related to tax years prior to 2023. |

| | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| September 30, 2024 |

| | |

Reconciliation of Total Principal Amount of Debt to Net Debt (1) | | | |

| (in thousands) | | | |

| As of September 30, 2024 | | As of October 1, 2024 |

| | | |

Principal amount of Senior Notes (2) | $ | 2,736,026 | | | $ | 2,736,026 | |

Revolving credit facility (2) | — | | | 190,000 | |

| Total principal amount of debt (GAAP) | 2,736,026 | | | 2,926,026 | |

| Less: Cash and cash equivalents | 1,735,313 | | | 21,808 | |

| Net Debt (non-GAAP) | $ | 1,000,713 | | | $ | 2,904,218 | |

| | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) Amounts as of September 30, 2024, are from Note 5 - Long-Term Debt in Part I, Item 1 of the Company's Form 10-Q. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

| | |

| | |

Adjusted Free Cash Flow (1) | | | | | | | | | | |

| (in thousands) | | | | | | | | | | |

| | For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| Net cash provided by operating activities (GAAP) | | $ | 452,263 | | | $ | 382,994 | | | $ | 1,204,645 | | | $ | 1,097,879 | | | |

| Net change in working capital | | (32,040) | | | 52,893 | | | 15,433 | | | 57,329 | | | |

| Cash flow from operations before net change in working capital (non-GAAP) | | 420,223 | | | 435,887 | | | 1,220,078 | | | 1,155,208 | | | |

| | | | | | | | | | |

| Capital expenditures (GAAP) | | 302,107 | | | 216,710 | | | 957,156 | | | 766,756 | | | |

| Changes in capital expenditure accruals | | (11,696) | | | 11,463 | | | (33,187) | | | 35,683 | | | |

| Capital expenditures before changes in accruals (non-GAAP) | | 290,411 | | | 228,173 | | | 923,969 | | | 802,439 | | | |

| | | | | | | | | | |

| Adjusted free cash flow (non-GAAP) | | $ | 129,812 | | | $ | 207,714 | | | $ | 296,109 | | | $ | 352,769 | | | |

| | | | | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

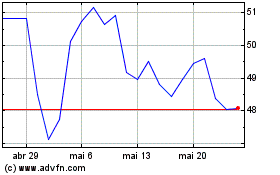

SM Energy (NYSE:SM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

SM Energy (NYSE:SM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024