Solar Alliance Second Quarter Revenue Grows 51% Year Over Year as Gross Profit Margin Improves to 35%

24 Agosto 2023 - 9:00AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and utility solar sectors,

announces it has filed its unaudited financial results for the

three- and six-month period ended June 30, 2023. The Company’s

Financial Statements and related Management’s Discussion and

Analysis are available under the Company’s profile at

www.sedarplus.ca.

“Solar Alliance delivered 51% year-over-year

quarterly revenue growth during the second quarter of 2023,” said

CEO Myke Clark. “The combination of revenue to date, the contracted

backlog of projects that is expected to be built before the end of

the year and significant work-in-process support another strong

year of growth.”

“Just as importantly, the gross margin of 35%

reflects the process improvements and disciplined approach we are

taking to project execution. The stronger gross margin contributed

to the first positive comprehensive income result in the Company’s

commercial solar history. Solar Alliance has been clear in our

signal to the market that a key focus was targeting profitability

and we are pleased to see significant progress made towards this

goal.”

Financial highlights

- Revenue for the three months ended

June 30, 2023, was $1,454,213 an increase of 51% from $964,548 in

the same period in 2022 as the Company continued to increase both

the number and the size of projects in its construction

pipeline.

- Cost of sales of $951,052 (Q2 2022:

$891,789) resulting in a gross profit of $503,161 (Q2, 2022:

$72,759) and a gross profit margin of 35% (Q2 2022: 8%).

- Total expenses for the period were

$754,339, a 16% reduction from $897,825 in the comparable period in

2022, as the Company continues to identify and implement overhead

efficiencies to support its profitability target, while

experiencing continued revenue growth.

- The Company reported $197,311 in

positive comprehensive income (Q2 2022: comprehensive loss of

$440,918).

- Net loss for the quarter of

$240,522, compared to a net loss of $208,304 in the comparable

prior year period.

- Cash balance of $285,745 as of June

30, 2023.

- Contracted project backlog of

approximately $7,200,000 as of June 30, 2023, supports continued

revenue growth into 2024.

Business highlights

$1.47 million contract signed for

project in Tennessee. On May 31, 2023, the Company

announced it signed a contract for the design, engineering, and

construction of a 565-kW commercial solar project for a

manufacturing company in Tennessee. The project, with a $1.47

million capital cost, is scheduled to begin construction in Q3 2023

with completion targeted by the end of 2023.

Letter of Intent to acquire Canadian

solar company. On May 18, 2023, the Company announced it

entered into an arm's length Letter of Intent dated May 16, 2023,

to acquire a growing, profitable Canadian solar company in what is

expected to be a predominantly share-based transaction.

Sold 67% interest in New York community

solar project. On June 21, 2023, the Company announced it

sold a 67% interest in the Company's two operating solar projects

in the state of New York for consideration of USD $973,360.72.

Solar Alliance will maintain a 33% interest in the two projects,

enabling the Company to continue to benefit from the economics of

the project.

“This impressive level of growth sets stage for

a strong finish to 2023 as we execute on our pipeline of contracted

projects. Critically, revenue growth is occurring as we reduce

costs and improve gross margins on projects. We continue to build a

stable, growing company that is well positioned to take advantage

of the current global shift to renewable energy,” concluded

Clark.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO1.604.359.5178mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)

Solar Alliance is an energy solutions provider

focused on the commercial, utility and community solar sectors. Our

experienced team of solar professionals reduces or eliminates

customers' vulnerability to rising energy costs, offers an

environmentally friendly source of electricity generation, and

provides affordable, turnkey clean energy solutions. Solar

Alliance’s strategy is to build, own and operate our own solar

assets while also generating stable revenue through the sale and

installation of solar projects to commercial and utility customers.

The Company currently owns two operating solar projects in New York

and actively pursuing opportunities to grow its ownership pipeline.

The technical and operational synergies from this combined business

model supports sustained growth across the solar project value

chain from design, engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to: the

ability to complete the Company’s projects on schedule or at all;

the continued benefit of the economics of the New York solar

projects, satisfactory due diligence, the ability to settle the

definitive agreement, obtain the approval of the TSX Venture

Exchange and complete the proposed transaction to acquire the

Canadian solar company on the terms as announced or at all;

uncertainties related to the ability to raise sufficient capital;

changes in economic conditions or financial markets; litigation,

legislative or other judicial, regulatory, legislative and

political competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the 872 KW

Tennessee solar project; the targeting of larger customers; the

ability to predict and counteract the effects of COVID-19 on the

business of the Company, including but not limited to the effects

of COVID-19 on the construction sector, capital market conditions,

restriction on labour and international travel and supply chains;

potential corporate growth opportunities and the ability to execute

on the key objectives in 2023. Consequently, actual results may

vary materially from those described in the forward-looking

statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

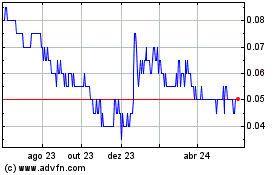

Solar Alliance Energy (TSXV:SOLR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

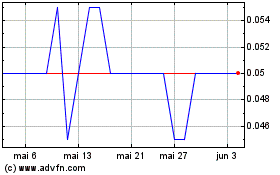

Solar Alliance Energy (TSXV:SOLR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024