Bitcoin boosts the crypto market with a $40 billion surge

Following recent statements by Jerome Powell, the chairman of

the Federal Reserve, financial markets reacted with expectations of

seven interest rate cuts in 2024, with the federal funds rate

potentially reaching between 3.50% and 3.75%. This prediction

boosted several indices, with the Dow Jones surpassing 37,000 and

the S&P 500 approaching its record, rising by 1.4%. Bitcoin

(COIN:BTCUSD) experienced a significant increase in its market

capitalization, rising more than $40 billion in 24 hours,

surpassing $43,000. Fernando Pereira, an analyst at Bitget,

commented on the market optimism regarding the Federal Reserve’s

future monetary policies and their positive impact on Bitcoin’s

value: “The decision to keep interest rates was expected, the

surprise came in the expectation of future Fed cuts. We can expect

3 cuts in 2024, and this has excited investors. This news should

keep BTC above $40k for a few good days.” At the time of

publication, Bitcoin was at $42,416.

JPMorgan predicts Ethereum’s supremacy and a cautious outlook for

cryptocurrencies in 2024

In 2024, JPMorgan Chase (NYSE:JPM) anticipates that Ethereum

(COIN:ETHUSD) will surpass Bitcoin (COIN:BTCUSD) and other

cryptocurrencies, despite a generally cautious approach to the

crypto market. This prediction is based on the EIP-4844 upgrade, or

Protodanksharding, which promises to significantly enhance the

Ethereum network. This upgrade will be particularly beneficial for

Layer 2 networks, improving efficiency without altering Ethereum’s

block size. Meanwhile, JPMorgan analysts highlight Bitcoin’s price

stagnation, attributing it to the inclusion of future events like

the halving in prices. They also point out the slow progress of

tokenization and limited integration of decentralized finance into

the traditional financial system, noting challenges such as

fragmentation and lack of regulation. In terms of venture capital

funding in the crypto sector, there are signs of improvement, but

the situation is still considered uncertain.

Buterin introduces ZK-EVM to optimize Ethereum

Vitalik Buterin, co-founder of Ethereum (COIN:ETHUSD), has

proposed ZK-EVM, an innovative approach to improve Ethereum’s main

chain. This architecture aims to incorporate cryptographic

techniques into the main chain to enhance transaction security and

efficiency, especially for Layer 2 applications. ZK-EVM,

functioning as an integral part of the Ethereum protocol, aims to

reduce reliance on external systems, improving transaction speed

and security while maintaining compatibility with Ethereum’s

multiclient philosophy.

Cronos Labs launches a new Layer 2 test network

Cronos Labs (COIN:CROUSD), responsible for the Cronos

blockchain, has announced the launch of a new Layer 2 network, the

“Cronos zkEVM chain,” initially in a testing phase. Using Matter

Labs’ tools, the network adds a new layer to the Cronos ecosystem,

which already includes the Cronos EVM blockchain and the Cronos PoS

chain. This is the first public test network to use Matter Labs’ ZK

Stack, with plans for full operation in the second quarter of

2024.

BONK surges due to listing on Coinbase

The meme coin BONK (COIN:BONKUST), built on the Solana

blockchain, witnessed an increase of over 45% following the

announcement of its listing on Coinbase (NASDAQ:COIN). This

inclusion elevates BONK to the status of the third-largest meme

coin on the platform, behind Dogecoin (COIN:DOGEUSD) and Shiba Inu

(COIN:SHIBUSD). Coinbase plans to roll out BONK-USD trading in

phases. The announcement reversed BONK’s recent losses,

highlighting Coinbase’s influence on traders’ perception of

legitimacy and interest in listed tokens. BONK is currently trading

at $0.000015, marking a 15.4% growth in the last 24 hours and a

118.66% increase in the last 7 days.

Yearn.Finance seeks profit return after $1.4 million error

The DeFi protocol Yearn.Finance (COIN:YFIUSD) faced a $1.4

million loss due to a script error and is now appealing to

arbitrage traders to return excessive profits generated by the

incident. During a token conversion, a multi-signature error

resulted in the unwanted exchange of 3,794,894 lp-yCRVv2 tokens,

causing significant slippage in the liquidity pool. Yearn.Finance

confirmed that no user funds were affected and is implementing

measures to prevent future errors, including dedicated management

contracts and stricter price impact limits.

SEC postpones decision on Invesco Galaxy’s Ethereum ETF

The SEC has extended the deadline to decide on Invesco Galaxy’s

Ethereum ETF, moving the initial decision date from December 23,

2023, to February 6, 2024. This extension aims to provide the

Commission with more time to evaluate the proposal and related

issues. The SEC’s decision on this ETF, which seeks to reflect the

spot price of Ether, is eagerly awaited, especially considering the

growing interest of financial institutions like BlackRock

(NYSE:BLK) and Fidelity in cryptocurrency ETFs. Meanwhile, the SEC

is engaging with Bitcoin ETF issuers, indicating a potential

breakthrough in regulatory approvals for crypto assets.

ARK Invest sells Coinbase shares despite a market surge

ARK Invest, led by Cathie Wood, sold a significant portion of

Coinbase (NASDAQ:COIN) shares on Wednesday, totaling approximately

$42.59 million, while the cryptocurrency exchange’s shares reached

their highest value in 20 months. The sales occurred in the ARK

Innovation (AMEX:ARKK) and ARK Next Generation Internet (AMEX:ARKW)

ETFs, totaling over $150 million in sales since December 5. Despite

this, Coinbase still represents more than 10% of ARK’s portfolio.

In parallel, the company also reduced its holdings in the Grayscale

Bitcoin Trust (USOTC:GBTC), while Coinbase shares, with a 325%

increase this year, significantly outperform other major tech

companies.

Coinbase focuses on Brazil for global expansion

Coinbase (NASDAQ:COIN), one of the leading cryptocurrency

exchanges, is redirecting its global growth strategy toward Brazil,

identifying the country as a key market. The decision is influenced

by Brazil’s regulatory evolution and high cryptocurrency adoption

rate. With the goal of reaching 1 billion users globally, Coinbase

sees engagement with the Brazilian government and collaboration

with local regulators and companies as a key opportunity. Brazil,

highlighted for its young population and ranking among the top ten

in crypto adoption according to Chainalysis, becomes a strategic

focus for the company’s expansion.

Latin American investors show high confidence in cryptocurrencies

for 2024

A recent survey by Bitget, one of the world’s largest

cryptocurrency exchanges, revealed surprising optimism among Latin

American investors regarding cryptocurrencies in 2024.

Approximately 96% are confident in the market, and 89% plan to

increase their investments. The majority, 63.5%, believe that

Bitcoin will surpass $45,000. Significantly, 60.1% of respondents

view cryptocurrencies as their sole form of investment. The survey

included 3,810 users from countries such as Brazil, Mexico, and

Argentina. In Brazil, there is a high market maturity, with 17.9%

of crypto investors having been involved for more than five years,

and 81.8% diversifying beyond Bitcoin (COIN:BTCUSD) and Ethereum

(COIN:ETHUSD). Compared to 2022, Bitget recorded a 348% user growth

in Brazil from January to November of this year, with a 180%

increase in trading volume, while Argentina saw a 202% growth in

volume, and Mexico, 217%.

Blockchain.com expands

Blockchain.com plans to increase its team by 25% and expand into

Europe and emerging markets in 2024. After downsizing its workforce

previously, the company is now focusing on Nigeria and Turkey.

Curtis Ting, formerly of Kraken, will lead the new European hub in

Paris. CEO Peter Smith sees the current phase as an opportunity for

growth and market capture, bolstered by recent funding rounds and

innovations in payment solutions.

Gemini Earn users may recover only 61% of crypto assets

Gemini has updated Earn users on the reorganization plan of the

bankrupt cryptocurrency lender Genesis, indicating that they may

recover between 61% and 100% of the value of their cryptocurrencies

on January 19, 2023. The response to the proposal has been mostly

negative, with criticism of the plan’s complexity and concerns

about the actual return of assets. Users are expected to vote on

the plan by January 10, 2024. If approved, there will be an initial

distribution of Genesis assets, but in case of rejection,

alternatives may further delay distributions.

CoinList pays $1.2 million fine for sanctions violations

Cryptocurrency exchange CoinList has agreed to pay $1.2 million

to resolve allegations from the US Office of Foreign Assets Control

(OFAC) of violating sanctions by allowing users in Crimea to use

its platform. OFAC identified that CoinList opened 89 accounts for

customers in Crimea, despite sanctions in place due to Russian

occupation since 2014. The fine was reduced due to CoinList’s

cooperation and the limited volume of transactions involved. The

company expressed its commitment to compliance, planning to invest

$300,000 in compliance controls.

FASB’s new accounting rules for Bitcoin drive corporate adoption

The Financial Accounting Standards Board (FASB), responsible for

setting accounting and financial reporting standards for businesses

and nonprofit organizations in the United States, has adopted new

accounting rules for Bitcoin (COIN:BTCUSD), marking a significant

advancement in integrating digital assets into corporate

accounting. Starting with fiscal years beginning after December 15,

2024, Bitcoin will be accounted for at fair value, aligning it with

other financial assets. Industry leaders like Michael Saylor of

MicroStrategy (NASDAQ:MSTR) and Fred Thiel of Marathon Digital

(NASDAQ:MARA) have praised this move on X, seeing it as a catalyst

for corporate adoption of Bitcoin, anticipating a positive impact

on corporate management and financial reporting.

SEC Chairman avoids discussion of Bitcoin ETFs

During an interview focused on the US Treasury market, SEC

Chairman Gary Gensler avoided commenting on applications for spot

Bitcoin ETFs. Gensler emphasized the relevance of the $26 trillion

US Treasury market and downplayed the significance of crypto

securities, citing investor risk due to the lack of regulatory

compliance.

IMF Director discusses risks and regulation of cryptocurrencies

Kristalina Georgieva, Managing Director of the IMF, highlighted

the need to regulate cryptocurrencies to preserve financial

stability. Speaking at a conference in Seoul, she emphasized the

importance of clear rules and robust infrastructure, warning about

the risks of cryptocurrencies to macrofinancial stability and

fiscal sustainability. The conference, focused on digital money,

included discussions on regulatory frameworks and CBDCs. Georgieva

acknowledged the benefits of digital money and the relevance of

experiences in emerging markets like India, while Seoul’s Finance

Minister, Choo Kyung-ho, underscored the inevitability of

transitioning to digital money.

Rulematch launches institutional cryptocurrency exchange in

Switzerland

Switzerland has welcomed Rulematch, a cryptocurrency exchange

aimed at banks, with participation from major entities like Spain’s

Banco Bilbao Vizcaya Argentaria (BBVA). Integrating Nasdaq

technology and Metaco’s crypto custody, Rulematch offers Bitcoin

(COIN:BTCUSD) and Ether (COIN:ETHUSD) trading in dollars to

selected institutions. This initiative reflects the growing demand

for institutional-level cryptocurrency trading solutions, combining

strict compliance and advanced features to meet the high standards

of the financial industry.

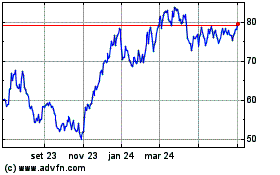

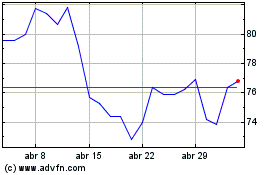

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024