Widespread fall in the cryptocurrency market: Bitcoin drops to the

level of US$40,000

The cryptocurrency market faced a sharp drop, with bitcoin

(COIN:BTCUSD) falling below US$41,000. At the time of writing,

Bitcoin was trading down 1.6% at $40,608. Ether (COIN:ETHUSD) also

followed the downward trend, declining by 1.3% to US$2,434. This

devaluation affected the entire market, including shares of

companies linked to cryptocurrencies. Moreover, this Friday,

Bitcoin options worth $890 million and Ethereum options worth $520

million will expire.

Julio Moreno of CryptoQuant attributes the drop to the

post-launch correction of the ETF and sales by large bitcoin

holders. Bitget analyst Fernando Pereira also analyzed the bitcoin

situation, predicting an imminent test of the $40,000 support, a

point of high trading volume, especially from short-term traders.

He believes that the weekend could close above this mark, but

anticipates a drop below it in the following week, indicating a

scenario of uncertainty and volatility in the cryptocurrency

market. “BTC is about to test the $40,000 support. This should

be a region with a lot of trading volume, especially from

short-term traders, who should open long positions aiming for a

slight increase. I believe that we will spend the weekend above

this region, but that we will work below it the following

week,” said Pereira.

Uma token price soars with MEV protection plan for lending

protocols

The price of the Uma token (COIN:UMAUSD), native to the Uma

protocol, jumped 112%, from US$2 to US$ 5.78, after announcing an

MEV solution aimed at securing lending protocols. Uma’s market

capitalization reached nearly $370 million, the highest since

mid-2022. The solution, named Oval, will focus on protecting

against significant annual losses from lending protocols due to

MEV. The launch is scheduled for next week.

Aave proposes Chainlink CCIP integration to improve GHO

DeFi platform Aave has proposed integrating Chainlink’s

Cross-Chain Interoperability Protocol (CCIP) to enhance secure

transfers of its stablecoin GHO (COIN:GHOUSD) between different

blockchains. This change aims to overcome the current limitations

of GHO, which is primarily accessible through Ethereum or secondary

markets. The CCIP integration aims to transform GHO into a

multichain asset, increasing its liquidity and accessibility, and

strengthening Aave’s total locked value.

Ethereum sees 24% of supply staked

Ethereum (COIN:ETHUSD) has reached a notable milestone, with 24%

of its total supply now being staked. This trend indicates ETH

holders’ preference for generating passive income through staking,

rather than seeking immediate profits from selling. The Shapella

upgrade, which introduced withdrawal of staked ETH, strengthened

this trust, resulting in a substantial increase in the market value

of Ethereum staking to $72.75 billion.

Blackrock raises Bitcoin holdings in iShares ETF

Blackrock has increased its Bitcoin holdings in the iShares ETF

(NASDAQ:IBIT), now holding 28,622 Bitcoins, after adding

approximately 3,555 BTCs recently. The latest acquisition on Jan.

16 added 8,705 BTC, making this the smallest addition since the

fund’s launch. The fund, which was the first to exceed US$1 billion

in assets, continues to expand and now has a notional value of

US$1.2 billion. The Fidelity ETF (AMEX:FBTC) also surpassed the $1

billion mark in inflows in the first five days of trading.

Grayscale CEO defends high Bitcoin ETF fees and predicts market

downturn

After the launch of spot ETFs, Bitcoin (COIN:BTCUSD) fell more

than 13%, with billions leaving GBTC Grayscale. Some of that

capital came from investors switching to ETFs with lower fees,

while others took profits. Investors who purchased GBTC (AMEX:GBTC)

at lower prices are exiting the Bitcoin space altogether, opting

not to switch to cheaper ETFs. JPMorgan (NYSE:JPM) sees continued

outflows and downward pressure on GBTC fees, while other ETFs

attract significant capital inflows. However, Michael Sonnenshein,

CEO of Grayscale Investments, defended the Grayscale Bitcoin Trust

ETF’s 1.5% fees in an interview with CNBC, highlighting its track

record of success and diverse investor base. He predicts that many

of the recently approved bitcoin ETFs with lower fees will not

survive in the market, as most charge between 0.2% and 0.4%.

Sonnenshein highlights the lack of track record of these products

and suggests that only a few will reach critical asset management

mass.

ARK Invest transfers investments from BITO to its own Bitcoin ETF

ARK Invest is redirecting its investments from the ProShares

Bitcoin Strategy ETF (AMEX:BITO) to ARKB (AMEX:ARKB), its own

recently launched bitcoin ETF. According to recent disclosures, the

ARK Next Generation Internet ETF (AMEX:ARKW) sold 758,915 shares of

BITO, totaling approximately US$15 million, and acquired an

equivalent value in ARKB shares. This move follows ARK’s strategy

of focusing on spot bitcoin ETFs following US approval.

Impacts of Bitcoin ETFs on the market and the next halving

Following the introduction of spot bitcoin ETFs in the US, there

has been an increase in outflows from European bitcoin

exchange-traded products (ETPs), according to Luke Nolan of

CoinShares. The trend indicates a redirection of US institutional

traders’ investment strategies towards new domestic ETFs.

Previously, many US institutions used European ETPs for almost

risk-free trading, but now find greater convenience and

profitability in domestic ETFs. Nolan notes that this change has

also affected Canadian bitcoin ETPs, with American investors

preferring the new US funds. The focus now turns to Bitcoin’s next

big event: the halving, scheduled to take place in less than 100

days. Historically, halvings have correlated with rises in Bitcoin

prices, but the introduction of spot bitcoin ETFs could influence

price predictions this round. The halving, an event scheduled to

occur approximately every four years, cuts miners’ rewards in half,

creating scarcity and potentially affecting the value of Bitcoin.

The cryptocurrency community closely monitors these events,

considering their impact on the overall Bitcoin supply and market

dynamics.

JPMorgan sees 50% chance of Ether ETF approval by May

The market is optimistic about the possible approval of an ETF

for Ethereum (COIN:ETHUSD) by May 23, but JPMorgan (NYSE:JPM)

evaluates this probability at just 50%. The expectation follows the

trend of last year’s Bitcoin ETF, with Ether being seen as the next

candidate. Although some see positive signs, such as the SEC not

mentioning ETH in lawsuits against exchanges, JPMorgan remains

skeptical, especially in the wake of Ethereum’s transition to PoS,

and the current regulatory challenges facing staking exchanges.

South Korea reassesses position on cryptocurrency ETFs and reflects

Asian divergences

The Office of the President of South Korea has urged the

Financial Services Commission (FSC) to re-evaluate its stance on

spot cryptocurrency Exchange Traded Funds (ETFs). Tae-yoon Sung,

head of presidential policy, highlighted the need for a flexible

approach, considering whether foreign ETFs are suitable for the

domestic market. This follows a warning from the FSC against the

intermediation of foreign ETFs by domestic companies. The South

Korean position reflects the division in Asia; while Singapore and

Thailand are cautious, and Hong Kong indicates openness to spot

Bitcoin ETFs.

Taiwan election victory boosts cryptocurrency regulation

The re-election of Lai Ching-te in Taiwan, an advocate of AI and

blockchain, signals a breakthrough in cryptocurrency regulation.

His party has already prepared a bill establishing minimum

standards for exchanges and reinforcing consumer protection. While

no rival is against blockchain, growing intolerance of crypto

crimes highlights the need for strict regulation, especially amid

concerns about fraud and the use of cryptocurrencies in election

campaigns.

China establishes working group to standardize the metaverse

China has created a working group led by the Ministry of

Industry and Information Technology to promote standardization in

the emerging metaverse sector. With representatives from the

government, academia and large technology companies, such as Huawei

and Tencent, the objective is to establish industrial standards and

unify consensus. This aims to reduce redundant costs and boost

industrial development, facing speculation and disagreement over

the definition of the metaverse.

Forbes introduces Connect Wallet platform

Forbes launched Connect Wallet, an innovative platform that

offers free access to premium content and active engagement in web3

coverage. Functioning as a cryptographic storage solution and

portal for an exclusive club, the platform allows users to

co-create content and access expert advice and investment signals.

The partnership with Magic, a web3 infrastructure provider, ensures

efficient and reliable integration, representing a breakthrough in

web3 adoption.

Coinbase heads for legal victory against SEC with 70% chance

A Bloomberg Intelligence analyst, Elliot Stein, rates Coinbase’s

(NASDAQ:COIN) chances of winning the legal battle at 70% against

the US SEC. After a recent hearing, Stein realized that Coinbase

could achieve an outright dismissal of the case. Judge Katherine

Polk Failla questioned the SEC on its definition of “investment

contract,” favoring Coinbase’s interpretation. Furthermore,

Ripple’s (COIN:XRPUSD) victory in a similar case and Coinbase’s

effective refutation of brokerage allegations strengthens its

position. Stein suggests that a move to the Supreme Court could

refine the application of the Howey Test, narrowing its scope in

relation to digital assets.

HTX and HTX DAO resume services after DDoS attack

Cryptocurrency exchange HTX and HTX DAO quickly recovered from a

DDoS attack on Friday, restoring services after a 15-minute outage.

Justin Sun, HTX’s consultant, confirmed the restoration of

services. This type of attack overwhelms the system with excessive

requests, aiming to take it offline. HTX had previously suffered an

attack in November, resulting in the theft of approximately $97

million.

Manta Network suffers DDoS attack during token issuance

Manta Network, a blockchain startup, encountered a distributed

denial of service (DDoS) attack during the issuance of its MANTA

token. This resulted in extended withdrawal times and network

sluggishness. The Manta team confirmed the accumulation of pending

transactions and is working to resolve issues related to

transaction delays and increased gas fees. This attack occurred

during the initial token launch period of MANTA.

Copyright challenges and solutions in the age of AI: The role of

blockchain

With the rise of AI technologies like ChatGPT and Midjourney,

copyright issues become critical. Recently, The New York Times

(NYSE: NYT) sued OpenAI and Microsoft (NASDAQ: MSFT), alleging the

unauthorized use of its articles for AI training. OpenAI responded

that it is impossible to develop advanced models without protected

material. Michael Sonnenshein, CEO of Grayscale, proposes

blockchain as a solution, arguing that it can ensure fair

compensation and ownership while addressing authenticity and

intellectual property issues. This technology could transform how

AI and copyrights coexist, benefiting creators with transparency

and fair compensation.

Donald Trump launches a new NFT collection on the Bitcoin

blockchain

Former U.S. President, Donald Trump, is launching a new NFT

collection on the Bitcoin blockchain, aiming to revitalize his

campaign with fresh funds. The collection, named “Trump MugShot,”

will include 200 cards minted on the blockchain and will be

available for sale on Magic Eden. Buyers of the first 100 NFTs will

receive an exclusive certificate and VIP tickets to an event at

Mar-a-Lago. The collection represents a new foray by Trump into the

world of NFTs and digital collectibles.

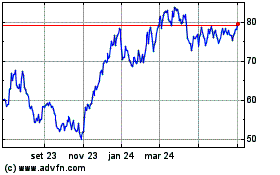

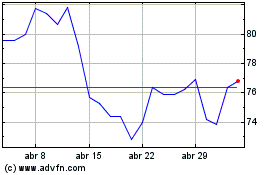

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ARK Next Generation Inte... (AMEX:ARKW)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024