Retail traders drive cryptocurrency surge, says JPMorgan

Analysts at JPMorgan (NYSE:JPM) highlight that the recent surge

in cryptocurrency values is primarily driven by retail traders

acting on impulse, rather than institutional investors or market

fundamentals. According to them, the cryptocurrency market recovery

in February can be attributed to the increasing activity of these

individual traders. The analysis includes observing bitcoin flows,

distinguishing between different wallet sizes, and the necessary

adjustment due to the migration of retail investors to new bitcoin

ETFs. Fernando Pereira, an analyst at Bitget, complements this

observation by warning that the increase in short-term traders’

activity, especially in Bitcoin (COIN:BTCUSD), is a cautionary

sign. “Short-term investors, the famous traders, are entering

BTC again with force. This is a sign to be wary of, as when the

majority of the market is dominated by these players, BTC tends to

fall, as these investors do not usually hold onto their coins in

uncomfortable situations. Today the majority of players are still

long-term, but every day more traders appear,” said

Pereira.

Hedge strategies drive Ether prices above $3,000

The recent surpassing of $3,000 by Ether, the currency of

Ethereum (COIN:ETHUSD), was driven by hedge strategies of traders

in the options market, similar to what happened with Bitcoin in

late 2023. According to Griffin Ardern of BloFin, these hedge

activities, especially around the $3,000 level, contributed to the

price increase by forcing traders to buy Ether to balance their

positions, generating a positive cycle of price hikes.

Vitalik Buterin sees AI potential in Ethereum code audits

Vitalik Buterin, co-founder of Ethereum (COIN:ETHUSD), expressed

enthusiasm for the application of artificial intelligence (AI) in

code audits to enhance security, especially in bug detection,

considered one of Ethereum’s main technical risks. With the recent

increase in interest in AI, driven by innovations from OpenAI and

Nvidia’s (NASDAQ:NVDA) growth, Buterin’s proposal to use AI to

reinforce code audits gains prominence. This approach could

overcome the limitations of traditional auditing tools, offering a

more dynamic adaptation to new contexts and vulnerabilities,

potentially reducing risks associated with hacks and scams in the

Ethereum ecosystem.

Rise of Bitcoin ETFs in 2024 with IBIT and FBTC leading the way

Nate Geraci, of the ETF Store, highlights 2024 as a notable year

for Bitcoin ETFs, particularly for BlackRock (NASDAQ:IBIT) and

Fidelity (AMEX:FBTC), which stood out among the top 8 in terms of

inflows. On February 21, IBIT saw inflows of $5.5 billion, and

FBTC, $3.7 billion. The combined total of investments in Bitcoin

ETFs in the US reached around $41 billion, reflecting confidence in

Bitcoin and the future potential of these funds in the digital

asset market. However, in the last two weeks, there has been a

decrease in inflows, with the top 10 ETFs attracting only about 500

Bitcoins, a notable drop compared to previous weeks.

Valkyrie introduces leveraged Bitcoin ETF to double daily gains

Valkyrie debuted an innovative Bitcoin futures ETF, the

(NASDAQ:BTFX), on Thursday, offering investors the potential to

double the daily return of a Bitcoin futures index. This launch

comes after the SEC’s approval of several companies’ spot bitcoin

ETFs, including Valkyrie’s own. The BTFX, which seeks to replicate

twice the daily performance of the CME Bitcoin futures index, is an

addition to advanced financial products that allow investors to

capitalize on Bitcoin market dynamics.

Coinbase supports Grayscale’s Ethereum Trust conversion to ETF

Coinbase (NASDAQ:COIN), one of the leading US cryptocurrency

exchanges, endorsed Grayscale’s initiative to convert its Ethereum

Trust into a spot Ethereum ETF. With the Ethereum community

optimistic, Coinbase’s General Counsel, Paul Grewal, published an

extensive letter advocating for SEC approval, based on legal,

technical, and economic arguments. Coinbase argues that Ethereum,

backed by the CFTC as a commodity, and its proof-of-stake consensus

system ensure the necessary security and transparency to justify an

ETF.

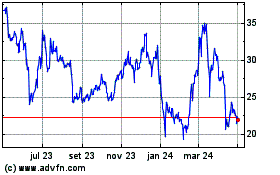

ZCash appreciates with Grayscale’s privacy ETF plan

ZCash (COIN:ZECUSD), a privacy-focused cryptocurrency, saw a 15%

increase in its value after news that Grayscale Investments

submitted an application to the SEC for an ETF dedicated to

privacy. This move propelled the price of ZEC to nearly $30, before

stabilizing around $27.48. Grayscale, already known for its Bitcoin

ETF, is now directing its attention to assets that promote privacy,

despite the regulatory challenges faced by such coins.

ECB criticizes Bitcoin value after SEC ETF approval

The European Central Bank expressed strong skepticism about the

value of Bitcoin (COIN:BTCUSD), reacting to the recent approval of

Bitcoin ETFs by the SEC. In a blog post, Ulrich Bindseil and Jürgen

Schaaf of the ECB argued that Bitcoin is inherently worthless,

despite the recent wave of investor enthusiasm triggered by the

SEC’s decision. They highlighted concerns about volatility, price

manipulation, excessive energy consumption, and use in illicit

activities, emphasizing the potential risks to investors and

society.

Euler Finance launches advanced DeFi lending platform after

recovery

After overcoming a cyberattack resulting in a loss of $200

million, Euler Finance revealed Euler v2, a flexible upgrade of its

DeFi lending platform. The new version allows users to lend and

borrow in a decentralized manner, with innovations such as the

Euler Vault Kit and the Ethereum Vault Connector for creating

custom lending vaults. Despite the setback suffered in 2023, Euler

bets on enhanced security and expanded functionalities to redefine

DeFi lending.

LastPass breach results in $6.2 million crypto asset theft

Hackers stole over $6.2 million in crypto assets from 22

LastPass users between February 19 and 20. The breach involved 41

wallets, including Bitcoin and Ethereum. Researchers tracked the

stolen funds and advised victims to report the incident and change

their keys. This attack follows a breach in October, where over $4

million was stolen, highlighting the importance of digital

security.

Gauntlet terminates partnership with Aave due to operational

challenges

Gauntlet, a company focused on risk management for decentralized

finance (DeFi), announced the termination of its collaboration with

the lending platform Aave. John Morrow, co-founder of Gauntlet,

expressed on the Aave forum that the organization faced

difficulties with the variable and informal expectations of key

stakeholders, making the project’s continuity unsustainable.

Gauntlet, which played a crucial role in Aave’s security since

2020, is now seeking to facilitate the transition and identify a

new risk manager for the platform.

Ondo Finance expands USDY token reach with Aptos integration

Ondo Finance expanded the accessibility of its USDY token,

backed by US Treasury assets, by integrating it into the Layer-1

Aptos blockchain. This collaboration with Aptos, created by former

Meta employees, brings USDY, available on other networks like

Ethereum and Solana, to a new audience. The partnership aims to

combine digital and traditional asset yields on Aptos, promising

innovations in staking and capital efficiency for tokenized

assets.

PSG innovates by becoming blockchain network validator for its fan

tokens

Paris Saint-Germain, a powerhouse in French football, announced

its entry into the blockchain world as a validator on the Chiliz

Chain, where its fan tokens reside. The club will use profits to

repurchase these tokens, a novel strategy among sports clubs that

typically launch tokens to offer memorabilia and unique experiences

to fans. This initiative not only reinforces PSG’s role in the

digital economy of fan tokens, valued at $28 million, but also

promises to strengthen the Chiliz network, generating more value

and revenue for all involved.

Arbitrum supports groundbreaking film on digital art and NFTs

The Arbitrum Foundation (COIN:ARBUSD), which promotes the

Ethereum Layer 2 Arbitrum network, will finance “New Here,” an

innovative cinematic project by Dpop Studios aiming to explore the

universe of digital art through the experience of a newcomer

entering the intriguing world of NFTs and blockchain. The film,

featuring the production of Oscar-winning Shane Boris, seeks not

only to highlight the work of NFT artists but also to incorporate

new forms of creation and audience engagement through emerging

technologies like blockchain and artificial intelligence.

Oasys joins forces with Kakao’s Metabora SG for growth in Japan

The blockchain platform for games Oasys, based in Japan, has

partnered with Metabora SG, the Web3 games division of South

Korea’s giant Kakao, to boost the game publisher’s presence in the

Japanese market. The collaboration aims to combine Metabora SG’s

expertise in creating engaging games with Oasys’ sustainable

technology, aiming to capture the interest of Japanese gamers. This

initiative is part of Oasys’ “Dragon Update,” a key strategy for

2024, focused on expanding interoperability and connections in the

blockchain gaming ecosystem.

Ping Exchange revolutionizes security in crypto asset trading

Ping Exchange is introducing a new era in crypto asset trading

security, offering a hybrid platform that combines advanced

security protocols with user-focused asset control. Standing out

for its hybrid cold storage and the use of the innovative CorePass

ID app for authentication, Ping Exchange ensures secure and

decentralized transactions, putting power directly in the hands of

users. This pioneering approach promises a significant change in

how crypto exchanges protect assets and user identity, challenging

conventions and establishing new standards of security and access

control in the cryptocurrency space.

FalconX advances in Hong Kong in response to growing institutional

demand

FalconX, a prominent broker in the digital asset sector,

announces its expansion into Hong Kong, aiming to meet the

increasing institutional interest in cryptocurrencies in the

region. The company intends to provide advanced brokerage services,

including over-the-counter trading and derivatives, to a

professional investor audience. This move highlights Hong Kong as

an innovative hub in virtual assets and Web 3.0, differentiating

itself by its progressive regulatory approach compared to the

restrictive policies of mainland China.

Sam Bankman-Fried changes legal team ahead of sentencing

Sam Bankman-Fried, founder of the defunct FTX exchange, replaced

his legal defense team in preparation for the final phase of his

trial. The change occurred during a court hearing on February 21,

indicating a new strategy as his sentencing approaches in March for

multiple charges of fraud and conspiracy. Observers noted a drastic

change in Bankman-Fried’s presentation, who swapped his casual

attire for a prison uniform, reflecting the seriousness of his

current situation.

DMG Blockchain Solutions announces growth in first quarter of

fiscal 2024

DMG Blockchain Solutions Inc. (TSXV:DMGI), a leading blockchain

technology and data center company, released its financial results

for the first quarter of fiscal 2024, highlighting revenue of $9.7

million and a net profit of $7.0 million. The company, which

significantly expanded its mining operations, mined 196 bitcoins,

marking a 35% increase from the previous quarter. With the

acquisition of 4,550 bitcoin miners, DMG is preparing to double its

hash capacity. CEO Sheldon Bennett emphasized continued investments

in infrastructure and software, aiming to further strengthen the

company’s position in the cryptocurrency market.

Eigen Labs raises $100 million from a16z to innovate on Ethereum

Eigen Labs, creator of the innovative EigenLayer project

promising to revolutionize the decentralized finance (DeFi) sector

by enabling the reuse of Ethereum tokens, raised $100 million from

venture capital firm a16z crypto. Still in pre-operational phase,

EigenLayer is already generating great anticipation, with its total

value locked (TVL) reaching nearly $8 billion, highlighting the

growing interest in restake solutions on the blockchain.

Helius raises $9.5 million to advance in the Solana ecosystem

Helius, a development platform focused on Solana, secured a $9.5

million Series A funding, led by Foundation Capital, with

participation from notable investors, including Solana co-founders.

With a focus on enhancing tools for developers, such as web hooks

and remote procedure controls (RPCs), Helius plans to expand its

team and technology to integrate more developers and institutions

into Solana.

Zcash (COIN:ZECUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Zcash (COIN:ZECUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025