Bitcoin drops to $60,000, lowest level in over a month

The price of Bitcoin (COIN:BTCUSD) continued its decline,

reaching a low of $59,668.41 on Monday. The cryptocurrency is down

4.5% at the time of writing, trading at $60,330.90. This is about

17% below its March record. Cryptocurrency investments have seen

significant outflows in the past two weeks due to pessimism over

rate cuts and macroeconomic influences. Long liquidations and

nervousness ahead of the personal consumption expenditures index on

Friday also pressured the market, impacting other cryptocurrencies

and related stocks.

Additionally, Bitcoin could be heavily impacted and is on the

verge of a correction that may last up to four weeks, pressured by

the imminent Mt. Gox refunds and movements of a German government

wallet. Analysts like Willy Woo and Rekt Capital suggest a period

of stability before any significant upward movement, while nearly

$9.4 billion in payments to Mt. Gox creditors are scheduled to

begin in July.

Mt. Gox to begin bitcoin and bitcoin cash refunds in July 2024

The bankrupt Japanese exchange Mt. Gox will start refunding its

creditors with Bitcoin (COIN:BTCUSD) and Bitcoin Cash (COIN:BCHUSD)

from July 2024. Rehabilitation trustee Nobuaki Kobayashi stated

that the process includes security measures and regulatory

compliance. Creditors have been awaiting these refunds since the

massive 2014 hack that led to the loss of 850,000 Bitcoins. Over

$9.4 billion is owed to approximately 127,000 Mt. Gox

creditors.

Jump Crypto president resigns amid regulatory investigation

Kanav Kariya, president of Jump Crypto, resigned amid a CFTC

investigation into the trading practices of its parent company,

Jump Trading. His resignation follows a series of challenges for

the company, including a $325 million hack and losses in the FTX

collapse. Kariya, expressing optimism for Jump Crypto’s future,

decided to step down to reflect on new opportunities and contribute

to companies in his portfolio while the firm faces regulatory

scrutiny.

Metaplanet raises $6.26 million in bonds for bitcoin purchases

Metaplanet (TSX:3350) announced the issuance of bonds worth 1

billion yen, or about $6.26 million, to finance additional Bitcoin

acquisitions. With board approval, the funds will be used for

long-term purchases. Following the announcement, the company’s

shares rose 12%. Metaplanet follows a strategy similar to

MicroStrategy (NASDAQ:MSTR), using Bitcoin as a strategic treasury

reserve asset amid a challenging economic landscape.

Riot Platforms plans board change at Bitfarms after withdrawing

acquisition proposal

Riot Platforms (NASDAQ:RIOT), after attempting to acquire

Canadian miner Bitfarms (NASDAQ:BITF), announced plans to replace

three board members of the company. Riot, which already owns 14.9%

of Bitfarms, faced a shareholder rights plan preventing it from

acquiring more than 15% of the shares. After withdrawing its

purchase offer, Riot seeks to negotiate with a reconstituted board

to explore a potential beneficial merger between the two

companies.

Bitcoin miners leverage AI investment for infrastructure expansion

Bitcoin mining companies, like Hut 8 (NASDAQ:HUT), are

capitalizing on the growing demand for artificial intelligence (AI)

infrastructure. Hut 8 received a $150 million investment from

Coatue Management to develop its AI infrastructure, reflecting a

trend where AI and high-performance computing (HPC) firms seek

Bitcoin miners for computing power and favorable energy contracts.

This is opening new opportunities for mergers and acquisitions in

the bitcoin mining sector.

Rise in phishing attacks on The Open Network as its popularity

grows

The blockchain platform The Open Network (COIN:TONCOINUSD) is

facing a surge in phishing attacks, as reported by Yu Xian, founder

of the security firm SlowMist. Xian attributes this vulnerability

to the network’s open and free environment, which facilitates the

spread of phishing links and bots, especially via Telegram. This

increase in threats coincides with significant growth in TON, which

recently saw a substantial rise in total value locked and the

number of active wallets.

Light Protocol and Helius Labs introduce “ZK Compression” to scale

Solana

Developers Light Protocol and Helius Labs announced “ZK

Compression,” a technology promising to drastically reduce data

storage costs on the Solana blockchain. This innovation uses state

compression and zero-knowledge proofs to enable significant

savings, allowing more efficient and cheaper data storage. The

technology has faced criticism from some in the Ethereum community

but is defended by Solana (COIN:SOLUSD) co-founder as an effective

layer 2 solution without typical complexities.

Tether ceases USDT issuance on Algorand and EOS in strategic move

Tether (COIN:USDTUSD), issuer of the world’s largest stablecoin

USDT, announced it will stop minting the token on the Algorand

(COIN:ALGOUSD) and EOS (COIN:EOSUSD) blockchains. The decision is

part of a transition to focus on blockchains with greater community

engagement and support. The move aims to balance maintainability

and user interest and will be implemented immediately, though

Tether will continue to redeem USDT on these platforms for another

12 months.

Kraken expands services for institutions through partnership with

Copper’s ClearLoop network

Kraken MTF, the institutional derivatives trading unit of the

cryptocurrency exchange Kraken, integrated with Copper’s ClearLoop

settlement and collateral management network. This collaboration

aims to offer greater security and efficiency in managing

cryptocurrency funds and derivatives for institutional clients,

improving connectivity and reducing risks.

Coinbase leads as most impersonated brand in Web3 phishing scams

Coinbase (NASDAQ:COIN) stands out as the most impersonated brand

in phishing attacks within the cryptocurrency space, according to a

Mailsuite report. Among all U.S. crypto companies, Coinbase was

fraudulently used in 416 phishing attacks over the past four years.

The report analyzed over 1.14 million scams, highlighting

Coinbase’s high visibility and trust as factors attracting

scammers. Among non-crypto brands, Meta Platforms (NASDAQ:META)

leads with at least 10,457 incidents, while Bank of America

(NYSE:BAC) and Mastercard (NYSE:MA) were used in 645 and 1,262

phishing attempts, respectively.

Hong Kong seeks global feedback on cryptocurrency and Web3 policies

Johnny Ng, a Hong Kong legislator, announced that his team is

collecting feedback from the global Web3 industry following the

creation of a cryptocurrency subcommittee in the Legislative

Council. The subcommittee, led by Ng, aims to enhance investor

protection, ensure financial stability, and explore regulations for

cryptocurrency custody and DAOs. Hong Kong has adopted a welcoming

approach for crypto businesses, launching a licensing regime for

trading platforms and exploring new financial products like spot

bitcoin and ether ETFs.

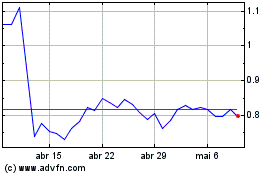

EOS (COIN:EOSUSD)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

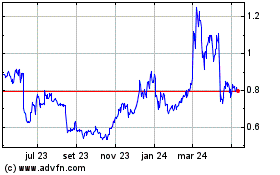

EOS (COIN:EOSUSD)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024