Bitcoin rises boosted by Bitcoin Conference 2024 and economic

expectations

On July 26, Bitcoin hit three-day highs driven by anticipation

for the Bitcoin Conference 2024. In June, the US Personal

Consumption Expenditures (PCE) price index rose 0.2% from May and

2.6% year-over-year. Strong consumer spending suggests progress in

curbing inflation without harming the economy, potentially

influencing future Fed interest rate decisions.

Bitcoin’s price (COIN:BTCUSD) surged to an intraday high of

$67,999.99 on Friday, up 2.45% in the past 24 hours to $67,400.

Weekend volatility may increase with Donald Trump’s speech at the

conference in Nashville. Traders are optimistic, predicting prices

between $68,900 and $85,000. The expiration of $3.9 billion in

futures options on Deribit sets a “maximum pain point” that could

heighten selling pressure, but volatility doesn’t guarantee Bitcoin

will hit this level, with current support around $65,000.

Ether’s (COIN:ETHUSD) price fluctuated about 2.61% in the last

24 hours, currently at $3,256.

Bitcoin 2024 in Nashville: high-profile talks and large turnout

The Bitcoin 2024 conference in Nashville continues with a packed

agenda of talks on Bitcoin’s future. With over 35,000 attendees,

the event explores Bitcoin’s financial, political, and social

impact.

At the conference, Jan van Eck, CEO of VanEck, announced that

over 30% of his portfolio is in Bitcoin (COIN:BTCUSD), likening it

to “digital gold” and highlighting its potential as a store of

value. Van Eck predicts Bitcoin could reach $2.9 million by 2050.

He also praised blockchain solutions with more predictable

transaction fees and emphasized considering Bitcoin ecosystem

support when choosing ETFs.

Independent presidential candidate Robert F. Kennedy Jr.

declared himself a strong Bitcoin supporter, revealing that most of

his wealth is invested in BTC during his speech.

Other notable speakers today include Michael Saylor, Cathie

Wood, and Edward Snowden. Republican candidate Donald Trump is set

to speak on Saturday.

Bitcoin ETFs see modest growth, while Ethereum ETFs face outflows

On July 25, 2024, Bitcoin ETFs saw inflows totaling $31.1

million, driven by $70.7 million into BlackRock’s ETF

(NASDAQ:IBIT), offsetting $39.6 million outflows from Grayscale’s

ETF (AMEX:GBTC), according to Farside Investors data.

In contrast, Ethereum ETFs faced net outflows totaling $152.4

million. Grayscale’s ETF (AMEX:ETHE) lost $346.2 million despite

some inflows into other funds. BlackRock’s ETF (NASDAQ:ETHA)

recorded the highest inflows at $70.9 million.

At the New York Stock Exchange, Bitwise Asset Management

(AMEX:ETHW) showcased a banner for its new Ethereum ETF, ETHW. The

ETF saw net inflows of $16.3 million on Thursday, with total

investments of $249.9 million since its launch on Tuesday.

Cryptocurrency emojis disappear from X after unannounced change

The X app (formerly Twitter), now under Elon Musk’s management,

automatically removed emojis from cryptocurrency-related hashtags

like #bitcoin and #bnbchain. The change was not publicly announced

and was noticed by users on Friday. Emojis associated with hashtags

like #bitcoin were introduced in 2020 to popularize cryptocurrency

symbols but have now disappeared. Previously, X charged companies

up to $1 million to add emojis or brand symbols to their

hashtags.

Jersey City plans to invest in Bitcoin with ETFs

In the US, a municipal pension plan in Jersey City, New Jersey,

will invest in Bitcoin through ETFs, as announced by Mayor Steven

Fulop. Although the exact amount was not specified, the investment

will be similar to the 2% made by the Wisconsin pension fund. The

investment, pending SEC approval, represents a significant step for

cryptocurrency acceptance in pension funds.

Coinbase adds new executives to board

Coinbase Global (NASDAQ:COIN) expanded its board of directors

with Chris Lehane, former political strategist and vice president

at OpenAI; Christa Davies, former CFO at Aon; and Paul Clement,

former US Solicitor General. Lehane, known for legalizing Airbnb,

will offer strategic advice, while Davies and Clement will focus on

audit, compliance, and litigation, especially in its SEC battle.

All share a vision of promoting financial inclusion through

cryptocurrencies.

In other news, Coinbase added support for the BLOCKLORDS (LRDS)

token, a native asset of a blockchain strategy game, with an

Experimental label. The LRDS is new to the platform and has low

trading volume. BLOCKLORDS is a free-to-play medieval-themed MMO

available on Epic Games and set for future release on Steam. The

LRDS token, recently launched, currently trades at $1.75.

Ledger innovates with self-custody products

Ledger, a company specializing in cryptocurrency and digital

asset security, launched the “Ledger Flex,” a crypto wallet with a

touchscreen to facilitate self-custody. Alongside the Stax wallet,

released in May, the Flex aims to redefine user experience.

Additionally, Ledger introduced the Security Key app, which uses

cryptographic login instead of traditional passwords, simplifying

access recovery with seed phrases, highlighting the importance of

self-custody after exchange collapses in 2022.

Federal Reserve drops actions against Silvergate after bank closure

On July 26, 2024, the Federal Reserve dropped all enforcement

actions against Silvergate Bank and Silvergate Capital Corporation

after the bank closed its operations and reimbursed clients. The

bank, once a major player in providing services to the

cryptocurrency and blockchain industry, collapsed in March 2023 due

to financial troubles and the FTX crisis, and still faces

litigation and investigations, including SEC actions.

Franklin Templeton considers expanding tokenized securities to new

blockchains

Franklin Templeton is considering expanding its tokenized

securities, such as the Franklin OnChain U.S. Government Money Fund

(FOBXX), to new blockchains, including Ethereum. Launched in 2021

on the Stellar blockchain, FOBXX has surpassed $400 million in

assets and now seeks to enhance scalability and transparency while

exploring the potential of user-managed wallets and multichain

environments.

Scammers use fake software to steal crypto assets

Yu Xian of SlowMist warned about a new scam using fake video

conferencing software to conduct address poisoning attacks and

steal cryptocurrencies. Xian recommended caution with unknown

software. In one case, a scammer posed as from xLabs and used fake

meeting software to deceive a victim. After installing the

malicious app, the victim managed to transfer assets and avoid

theft. The same method was used in an attack on MonoSwap.

Orbit Chain expansion by Arbitrum DAO

The Arbitrum DAO is reviewing a proposal to expand the Orbit

Chain, originally based on Ethereum, to other blockchains like

Bitcoin, Binance Smart Chain, and Cosmos. In January, the Arbitrum

Foundation (COIN:ARBUSD) launched the Arbitrum Expansion program,

allowing its codebase to adapt to other chains. With 99.8%

community approval, the expansion could increase revenue and the

dominance of Arbitrum technologies.

StarkWare integrates IBC protocol

StarkWare, developer of Ethereum Layer 2 Starknet, is

collaborating with Informal Systems to integrate the

Inter-Blockchain Communication (IBC) protocol from the Cosmos

ecosystem (COIN:ATOMUSD). This integration will enable Starknet to

connect with IBC-compatible chains, promoting greater

interoperability and decentralization. The IBC uses light clients

to validate transactions between blockchains, facilitating

efficient communication between distinct networks.

BitfFlyer buys FTX Japan and plans crypto ETFs

BitfFlyer Holdings acquired FTX Japan, making it a wholly-owned

subsidiary. The new unit will focus on crypto custody for

institutional investors and launching cryptocurrency ETFs in Japan.

Yuzo Kano, CEO of BitfFlyer, predicts that Japanese crypto ETFs are

imminent, driven by the growing adoption of Bitcoin ETFs and

institutional demand.

Terrorist financing predominantly in cash, says report

The Singapore Department of Homeland Security’s 2024 report

revealed that terrorist organizations continue to use cash

transfers predominantly for fundraising, with cryptocurrency

adoption remaining low. While crypto use is growing, groups like

ISIS still prefer traditional methods such as cash couriers and

informal value transfer systems.

FINMA warns of banking risks from stablecoins in Switzerland

FINMA warned that stablecoin issuers in Switzerland might create

risks for partner banks, as they can bypass the need for a banking

license by using registered bank default guarantees. This could

expose banks to reputational and legal damage if the issuer

encounters problems. The guidance updates requirements to ensure

adequate customer protection and full deposit coverage.

Elizabeth Warren warns about crypto mining risks

US Senator Elizabeth Warren continued her criticism of

cryptocurrencies, claiming that foreign crypto mining operations

pose risks to national security and the environment. In a Senate

hearing, she argued that these operations could compromise the

power grid and facilitate money laundering. Warren also highlighted

the need for stricter regulations. Her anti-crypto stance faces

growing opposition, with some bill supporters withdrawing

support.

Crypto PAC investment stirs primaries in Washington and Michigan

The PAC Protect Progress focuses on supporting candidates

favoring favorable cryptocurrency regulation or adoption. Less than

two weeks before the Democratic primaries in Washington, candidate

Emily Randall received a financial boost from Protect Progress,

which invested $1.5 million in media to promote her. The PAC also

supported a candidate in Michigan, raising concerns about the

influence of large donations in the electoral process.

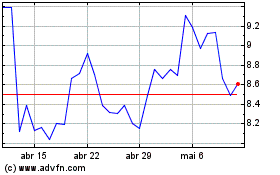

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025