Tether restructures to expand presence in the digital assets market

Tether (COIN:USDTUSD), the developer of the world’s largest

stablecoin by market value, is expanding into broader areas of

digital assets. The company has created four new divisions to

diversify its operations: “Tether Finance” to manage the USDT

stablecoin, “Tether Power” focused on bitcoin mining investments,

“Tether Data” to handle technology investments, including

artificial intelligence, and “Tether Edu”, dedicated to educational

initiatives. The strategy indicates a significant shift in the

company’s approach, aiming for sustainable solutions and the

promotion of a financial and technological ecosystem for the

future.

Aptos Labs partners with Microsoft and others to boost

institutional DeFi

Aptos Labs (COIN:APTUSD), the developer of the Aptos blockchain,

is collaborating with Microsoft (NASDAQ:MSFT), Brevan Howard, and

SK Telecom (KOSPI:017670) to promote institutional access to

decentralized finance. The partnership will introduce Aptos Ascend,

a comprehensive package of institutional solutions, including

regulatory support, transaction privacy, and KYC checks, aiming for

a secure and scalable gateway to DeFi.

Outlook and challenges for Bitcoin approaching the next halving

As Bitcoin (COIN:BTCUSD) approaches the fourth halving, there is

increasing stability and confidence in the market, anticipating a

new era of sustainable growth. Public interest is intensifying,

demonstrated by the increase in transaction volume and price

appreciation, currently quoted at $63,632 at the time of writing.

Analyst Fernando Pereira from Bitget highlights the importance of

observing the 20-week moving average: “a very important average

to observe in the market at this moment is the 20-week period,

which is currently at $53k. As the weeks go by, this average will

rise, and when it and the price intersect, it will be higher than

that. It is possible that they will meet near $56k, but we will

observe week after week. There is a good long-term buying

point.“

Despite this stability, rumors of price increases from China

were not enough to boost Bitcoin recently. Analysts from Goldman

Sachs (NYSE:GS) and JPMorgan (NYSE:JPM) warn of the possibility of

price declines post-halving, suggesting that the increase may

already be priced in. Additionally, tighter monetary policies and

lack of venture capital investment in the crypto sector, along with

the launch of Bitcoin ETFs, could affect future demand and prices

following the halving.

Bitcoin ETF outflows on April 17th

On April 17th, Bitcoin ETFs recorded significant financial

movements. According to Farside data, there was a withdrawal of

$165 million, the highest since the beginning of the month. Notable

withdrawals include Grayscale’s ETF (AMEX:GBTC) with $133.1 million

and Ark’s (AMEX:ARKB) with $42.7 million withdrawn. Bitwise

(AMEX:BITB) also saw its first withdrawal of $7.3 million. In

contrast, BlackRock (NASDAQ:IBIT) continued to receive investments,

albeit at a reduced pace.

Nym Technologies enhances Bitcoin privacy with Liquid Network

partnership

Nym Technologies, focused on privacy for Web3 infrastructure,

has joined the Liquid Federation, improving support for Bitcoin’s

layer 2 ecosystem (COIN:BTCUSD). This group, which includes

exchanges and developers, operates Bitcoin’s main sidechain, the

Liquid Network. Nym now plays a central role, managing transactions

and essential infrastructure, and works to integrate its privacy

solutions into Liquid, enhancing the confidentiality of Bitcoin

transactions.

Blockchain secondary markets may expand reach of tokenized assets,

says Moody’s

A report from Moody’s Investors Service (NYSE:MCO) highlights

that blockchain-based secondary markets could enhance the reach of

tokenized assets, such as real estate and private equity, divided

into multiple tokens. This innovation could increase liquidity and

accessibility, facilitating instant transactions and reducing

operational costs. However, the report also warns of technological

and regulatory challenges, including risks associated with smart

contracts and other security issues.

Ondo Finance expands tokenized bond offerings to the Cosmos

ecosystem

Ondo Finance announced its partnership with the Noble chain to

introduce its tokenized US Treasury bond offerings to the Cosmos

ecosystem (COIN:ATOMUSD). The first asset to be issued, USDY, is a

tokenized note with an annual yield of 5.2%. This expansion will

allow the integration of Ondo’s offerings into more than 90

blockchains in Cosmos, increasing the adoption of its secure and

profitable financial products.

Union Labs plans integration with AggLayer to enhance blockchain

interoperability

Union Labs, a project dedicated to blockchain interoperability,

announced plans to integrate with AggLayer, a decentralized service

developed by Polygon Labs (COIN:MATICUSD). This collaboration aims

to facilitate liquidity sharing between networks using AggLayer and

those operating under the Cosmos Inter-Blockchain Communication

(IBC) Protocol (COIN:ATOMUSD). The partnership could strengthen

connections between Polygon’s Ethereum network and the vast Cosmos

blockchain ecosystem, promoting greater efficiency and low latency

in cross-chain transactions.

New Zealand considers future of digital currency

The Reserve Bank of New Zealand has opened a consultation on the

implementation of digital currency. Citizens are invited to comment

on various aspects, including the design of digital currency, the

possibility of interest payments, and retention limits, with the

central bank considering a $2,000 limit. The consultation closes on

July 26th. The NZD-denominated CBDC would be distributed by the

private sector, prioritizing financial inclusion and supporting

smart contracts. The development process will extend until

2030.

Trial of cryptocurrency trader for fraud in Mango Markets

Cryptocurrency trader Avi Eisenberg is facing trial in New York

for alleged fraud in trades on Mango Markets, resulting in gains of

$110 million. While prosecutors accuse Eisenberg of market

manipulation, his defense claims a legitimate trading strategy.

Expert witnesses have been heard, but the focus remains on the

jury’s decision. Eisenberg could face up to 20 years in prison if

convicted on the three charges, highlighting the legal complexities

in the world of cryptocurrencies.

Binance launches ‘Megadrop’ platform, plans return to Indian

market, and receives full license in Dubai

Binance has launched the ‘Megadrop’ today, an innovative

platform for token launches that offers clear rewards to

participants. Combining elements of Binance Launchpool with Web3,

Megadrop allows users to access new tokens before they are listed,

promoting an enriching experience and greater engagement with the

expanding crypto ecosystem. Additionally, Binance, previously

excluded from the Indian market, is planning to re-enter the

country by paying a fine of $2 million, according to the Economic

Times. Earlier this year, Binance and other exchanges were removed

from the Apple Store in India after receiving compliance notices

from the country’s Financial Intelligence Unit. Furthermore,

Binance has obtained a full license as a virtual asset service

provider in Dubai. The grant came with a condition: co-founder and

former CEO Changpeng “CZ” Zhao must relinquish voting control in

the local unit. CZ, currently in the US awaiting sentencing,

negotiated settlements with the Department of Justice in November.

His sentencing is scheduled for April 30th.

Gradual recovery of funding in Web3 after stagnation period

After a period of retraction, the Web3 sector, focused on

blockchain technologies and cryptocurrencies, recorded a slight

increase in funding in the first quarter of 2024, the first rise

since late 2021. This sector raised nearly $1.9 billion in 346

transactions, a 58% increase from the previous quarter, although

still lower than the same period last year, which had $2.3 billion

in 670 transactions. The sector, which faced significant challenges

such as fraud and credibility crises, is beginning to show signs of

recovery, with the creation of new unicorns and an increase in the

price of major cryptocurrencies. Nevertheless, large investment

rounds are rare, suggesting a cautious path ahead for the full

recovery of investment in Web3.

Thruster Finance raises $7.5 million for expansion on Ethereum

Layer 2

Thruster Finance, a decentralized exchange platform on the

Ethereum Layer 2 Blast network, raised $7.5 million in seed

funding. Led by Pantera Capital, the round also had participation

from OKX Ventures and other significant investors in the crypto

space. Thruster’s valuation rose to $70 million after the quick

close of the round, positioning it as a promising DeFi platform

with growing locked value and user base.

Magic Eden challenges Blur’s supremacy in the NFT market

Blur maintained its position as the leading non-fungible token

(NFT) marketplace in the first quarter, with $1.5 billion in

trading volume. However, Magic Eden emerged in March, surpassing

Blur’s total NFT trading volume, driven by reward programs and its

Ethereum-based marketplace.

The successful fusion of nostalgia and blockchain by BitBoy

One

BitBoy One, a release from Ordz Games, sold out 1,000 units in

just two minutes. Inspired by the 1989 Game Boy, the product

combines the nostalgia of classic games with blockchain innovation,

allowing Web3 interactions and Bitcoin earnings during gameplay, in

addition to including an exclusive NFT. Its versatility as a

Bitcoin hardware wallet strengthens its position as a bridge

between gaming and digital finance.

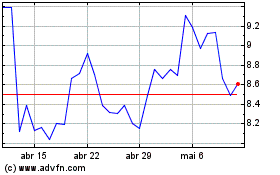

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025