Bitcoin rises in response to jobs data

Bitcoin (COIN:BTCUSD) experiences a 4.5% increase on May 3,

driven by US employment data. BTC/USD is trading at $61,751 at the

time of writing. Specifically, non-farm payrolls numbers for April

fell below expectations, indicating weakness in the job market.

This revelation suggests a possible interest rate cut, as hinted by

Federal Reserve Chairman Jerome Powell during a press conference.

Powell indicated a cautious stance on interest rates amid labor

market weakness. This outlook was well received by investors,

leading to an increase in Bitcoin price.

Furthermore, Fernando Pereira, an analyst at Bitget, in his

technical analysis of BTC for May, highlighted that Bitcoin is

currently testing significant support around $60,000. “BTC is

testing very strong support at $60,000, which should hold the price

for a while, but when we look at the long short ratio and see that

75% of the market has open long futures contracts, this is a very

strong indicator that all these contracts must turn into liquidity

for the price to break this support and go after lower targets,

like $54,800 in the short term and $52,000 in the medium

term,” commented Pereira.

Today is the expiration day for cryptocurrency options, with an

expected settlement of $1.39 billion in Bitcoin options and $1

billion in Ethereum options. Approximately 23,367 Bitcoin

contracts, worth $1.39 billion, are set to expire, with a maximum

pain point at $61,000. Meanwhile, about 334,248 Ethereum contracts,

with a notional value of approximately $1 billion, are also

expiring today.

Market leaders and laggards of the week

In the past week, four cryptocurrencies stood out, with Polkadot

(COIN:DOTUSD) and Cosmos (COIN:ATOMUSD), both multi-chain

protocols, rising by 5.83% and 6.90%, respectively. In contrast,

three assets, including NEAR (COIN:NEARUSD), Dogecoin

(COIN:DOGEUSD), and Bitcoin Cash (COIN:BCHUSD), experienced

declines of -5.73%, -7.57%, and -6.24% over the last 7 days,

respectively.

Movement of funds in Bitcoin ETFs on the last day

On May 2, Bitcoin ETFs recorded a total outflow of $34.4

million, with the Grayscale ETF (AMEX:GBTC) being the only one to

incur losses. This outflow contrasts with the previous day, when

all ETFs experienced reductions. Specifically, the GBTC saw an

outflow of $54.9 million, holding 291,248 Bitcoins. Notably,

BlackRock (NASDAQ:IBIT), Fidelity (AMEX:FBTC), and Bitwise

(AMEX:BITB) ETFs saw no inflows or outflows. However, the Ark ETF

(AMEX:ARKB) witnessed a significant inflow of $13.3 million, the

largest since April 23.

BNP Paribas invests in BlackRock’s Bitcoin ETF

BNP Paribas, one of Europe’s largest banks, has started

purchasing shares of BlackRock’s iShares Bitcoin Trust

(NASDAQ:IBIT), marking its entry into the Bitcoin market through an

ETF. According to its recent 13F form, the bank acquired 1,030

shares of IBIT, valued at $41,684, representing a small portion of

its total investments, totaling $113.8 billion.

CleanSpark reports notable increase in Bitcoin mining after halving

CleanSpark (NASDAQ:CLSK), a prominent Bitcoin miner

(COIN:BTCUSD), reported significant production in its first

post-halving monthly update, achieving a hashrate of 17 EH/s and

mining 721 BTC. With the deployment of advanced S21 machines and

expansion of facilities, the company optimized efficiency and

reduced costs. CEO Zach Bradford highlighted an increase in

transaction fees that boosted production, also anticipating a

possible correction in Bitcoin price due to the exit of less

efficient miners.

Stronghold Digital Mining explores sale among other strategies to

maximize shareholder value

Stronghold Digital Mining (NASDAQ:SDIG) announced that it is

evaluating strategies such as selling the company or other

strategic transactions to increase value for shareholders. After

disclosing solid financial and operational results for the first

quarter on May 2, the company, with support from Cohen and Company

Capital Markets and advisory from Vinson & Elkins LLP, is

exploring various options without a defined deadline for

completion. In the first quarter of 2024, Stronghold Digital Mining

reported revenue of $27.5 million, representing a 27% sequential

increase and a 59% year-over-year increase. Of these, $26.7 million

came from cryptographic operations. The company also recorded a

GAAP net profit of $5.8 million and a non-GAAP adjusted EBITDA of

$8.7 million.

Coinbase registers robust profit in first quarter and analyzes

Bitcoin pullback in global market context

In the first quarter, Coinbase Global (NASDAQ:COIN) performed

exceptionally well, benefiting from favorable market conditions and

diversification of its business. The cryptocurrency trading company

reported a net profit of $1.2 billion and earnings per share of

$4.40, including a $650 million mark-to-market gain on

cryptographic assets. Analysts such as Canaccord Genuity and KBW

adjusted their price forecasts to reflect the growing international

opportunity and the introduction of new products such as the

Coinbase Prime wallet and the Layer 2 blockchain, Base.

In a recent report, Coinbase highlighted that the decline in

Bitcoin price (COIN:BTCUSD) in April, which saw the cryptocurrency

depreciate by 16%, reflects a broader trend not limited to the

cryptocurrency sector. According to the analysis, this movement

mirrors declines also observed in stocks and gold amid a

strengthening dollar. Analysts David Han and David Duong emphasize

that Bitcoin’s maximum drawdown of 23% since the peak is below

historical declines, suggesting a reduction in price fluctuations

and a sign of greater stability and legitimization of Bitcoin as a

global macroeconomic asset.

Block initiates monthly Bitcoin purchase program to increase

reserves

Payment company Block (NYSE:SQ), under the leadership of Jack

Dorsey, has launched a program to allocate 10% of its monthly gross

profit from bitcoin operations to the purchase of more bitcoins.

The initiative began in April and is scheduled to continue until

the end of 2024. With a bitcoin gross profit of bitcoin of $80

million in the first quarter, Block can add approximately $24

million in bitcoin to its balance annually. The company already

holds a significant amount of bitcoin (COIN:BTCUSD), valued at

around $4.7 billion.

Michael Saylor defends bitcoin as the best corporate hedge against

inflation and predicts Ethereum’s classification as a security by

the SEC

During the MicroStrategy World: Bitcoin for Corporations event,

Michael Saylor, CEO of MicroStrategy (NASDAQ:MSTR), highlighted

bitcoin’s superiority in strengthening corporate balance sheets in

an inflationary environment. He argued that bitcoin (COIN:BTCUSD)

is the only asset that outperforms the cost of capital, considering

all other assets as dilutive. Saylor also discussed the inadequacy

of investments such as gold, silver, and government bonds in

keeping up with the cost of capital, highlighting the performance

of the S&P 500 as a reflection of monetary expansion and

inflation.

Additionally, Saylor predicts that the SEC will classify

Ethereum (COIN:ETHUSD) and other major cryptocurrencies as

securities, denying spot ETF requests from managers like BlackRock

(NYSE:BLK). During his presentation at the conference, he expressed

that unlike other cryptocurrencies such as BNB (COIN:BNBUSD),

Solana (COIN:SOLUSD), Ripple (COIN:XRPUSD), and Cardano

(COIN:ADAUSD), only Bitcoin has complete institutional acceptance,

described by him as the only universally institutional-grade

cryptographic asset.

Increase in venture capital investments in cryptocurrency startups

in 1Q24

After three consecutive quarters of decline, the cryptocurrency

and blockchain sector saw a notable increase in venture capital

investment in early 2024. A report by Galaxy Research revealed that

$2.49 billion was invested in 603 transactions in the first

quarter, a 29% growth in funding volume and a 68% increase in the

number of deals compared to the previous quarter. This improvement

may indicate a recovery, but continuous increases in the coming

quarters will be needed to confirm a sustained upward trend.

Various factors, such as new innovations in blockchain technologies

and macroeconomic conditions, influenced this dynamic.

Nevertheless, total investment remains below levels seen at

previous Bitcoin peaks.

Loss of $70.5 million in Bitcoin due to address poisoning scam

Cyvers Alert, a blockchain security company, reported the loss

of 1,155 Wrapped Bitcoin (COIN:WBTCUSD), equivalent to $70.5

million, by a cryptocurrency trader due to an address poisoning

attack. According to Meir Dolev, founder and CTO of Cyvers, this

incident is one of the largest values ever lost in such a scheme.

Address poisoning occurs when criminals create fake addresses

similar to legitimate ones to deceive victims, leading them to

transfer cryptocurrencies to fraudulent addresses.

Significant expansion of the Polkadot ecosystem in the Q1

According to a report by Messari, the Polkadot ecosystem

(COIN:DOTUSD) saw a significant increase in its key metrics in the

first quarter of the year. The market capitalization of the native

DOT token rose from $8.4 billion at the end of 2023 to $12.7

billion, accompanied by a 270% jump in the price of DOT, reaching a

peak of $11.3. The number of daily active addresses reached a

record of 514,000, a 48% increase from the previous quarter.

Moonbeam (COIN:GLMRUSD) remains the largest parachain, while Manta

Network saw the largest growth in active addresses, driving Total

Value Locked (TVL) to over $440 million. The network also

experienced significant advances in the utilization of its

Cross-Chain Message (XCM) format, demonstrating the ecosystem’s

continued dynamism.

MoonPay adds PayPal support for cryptocurrency purchases in the US

MoonPay (COIN:GLMRUSD), a cryptocurrency payment platform,

announced that it now allows users in the United States to buy and

sell over 110 types of cryptocurrencies using PayPal (NASDAQ:PYPL).

The integration, recently revealed, facilitates transactions for

MoonPay users who are already familiar with PayPal for online

purchases. This partnership also enhances transaction security, as

PayPal does not share complete financial details during the

process.

Paolo Ardoino proposes development of “Pear Phone” focusing on

privacy

Paolo Ardoino, CEO of Tether and co-founder of Holepunch,

revealed plans for a possible “Pear Phone.” This device, based on

the Android Open Source Project (AOSP), would come equipped with

Holepunch apps, such as Keet for encrypted messaging, along with

other apps built on the Pear Runtime P2P protocol and the Bitkit

Bitcoin wallet. Ardoino suggests that the phone will not have

Google apps and will feature a peer-to-peer app store, aligning

with Holepunch’s mission to promote P2P apps that ensure user

privacy and reduce reliance on major tech companies.

ZTX introduces native token payment for beauty and regenerative

treatments

The ZTX metaverse platform, in partnership with Frontier, a

leading Japanese regenerative medicine company, announced that its

native token ZTX (COIN:ZTXUST) will be accepted as a form of

payment for cosmetics and treatments with stem cells and exosomes.

Frontier offers exosome therapy in various clinics throughout

Japan, covering everything from disease treatments to aesthetic

procedures. The partnership allows patients to pay for treatments

with ZTX tokens, including discounts for early payments.

EigenLayer increases token distribution after community feedback

The Ethereum reset protocol, EigenLayer, announced additional

distribution of about 28 million of its EIGEN tokens to over

280,000 wallets. This decision follows criticisms of restrictions

in the initial airdrop program. The Eigen Foundation stated that it

will include in the distribution users who interacted with the

protocol before April 29, also encompassing early participants. The

distribution of EIGEN tokens, which are not yet on the market but

are traded in futures contracts at $10 each, represents an

estimated value of around $280 million. The official token delivery

is scheduled to begin on May 10.

Former FTX co-CEO relinquishes Bahamas mansion

The ongoing fallout from the FTX collapse now involves a

luxurious mansion in the Bahamas and a legal agreement. Ryan

Salame, former co-CEO of FTX Digital Markets, a part of the now

defunct exchange, has agreed to surrender his luxury residence on

the island as part of a settlement in a criminal case. This

agreement comes in a context where only he has suffered significant

exits, contrasting with the company’s bankruptcy, which at its peak

was valued at $32 billion. The scandal highlighted serious

management failures and misuse of client funds, triggering a crisis

of confidence in the cryptocurrency market.

Nigeria hosts roundtable for consensus on cryptocurrency regulation

The Nigerian Blockchain Industry Coordinating Committee (BICCoN)

is organizing a meeting on May 6, involving the new

director-general of the Nigerian Securities and Exchange Commission

(SEC) and several cryptocurrency exchanges. BICCoN president Lucky

Uwakwe announced that the virtual conference aims to align all

stakeholders, from exchange operators to blockchain associations,

to discuss and shape future cryptocurrency regulations in the

country.

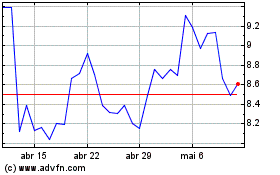

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Cosmos Atom (COIN:ATOMUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025