Bitcoin ETFs in the US See $62 Million in Net Inflows Despite Low

Trading Volume

On August 19, 2024, Bitcoin ETFs in the US recorded $61.98

million in net inflows, while total trading volume dropped to

$779.87 million, the lowest since February. The decline in volume,

significantly below August’s $5.24 billion, is attributed to weak

market sentiment and anticipation of new information from the Fed

meeting.

Spot ether ETFs saw their lowest trading volume since launch,

with $124 million on Monday. Net outflows totaled $13.52 million,

primarily from Grayscale (AMEX:ETHE), which saw $20.30 million in

outflows. Grayscale’s mini trust (AMEX:ETH) had $4.92 million in

net inflows, while Bitwise’s ETF (AMEX:ETHW) saw an increase of

$1.87 million.

In the past 24 hours, Bitcoin (COIN:BTCUSD) slightly fell to

around $59,410 after hitting $61,491 the previous day. Most of the

over $50 million liquidation in the market occurred on OKX and

Binance, with long positions being the most affected.

According to a CryptoQuant survey, Bitcoin needs more demand to

reach new all-time highs. The analysis indicates that whale

accumulation has dropped from 6% in February to just 1% currently,

with demand metrics remaining weak. While whales have reduced their

acquisitions, permanent holders continue to accumulate BTC,

increasing their exposure at a record rate.

Ethereum (COIN:ETHUSD) fell 1.4% in the last 24 hours to $2,602,

while Solana (COIN:SOLUSD) declined by -0.2%, priced at $144. On

the other hand, BNB (COIN:BNBUSD), Dogecoin (COIN:DOGEUSD), and

Ripple (COIN:XRPUSD) managed to maintain recent gains.

FLOKI token and Valhalla game to gain visibility in Premier League

The FLOKI token (COIN:FLOKIUSD) and the Valhalla game will be

promoted on English Premier League properties as part of a one-year

contract, aiming to increase the visibility of the $1.3 billion

token. FLOKI will be the cryptocurrency partner of Nottingham

Forest and will have advertisements at Sunderland AFC. After the

announcement, FLOKI rose 7.7% to $0.000126. Floki expects these

partnerships to enhance brand recognition and boost its

ecosystem.

State Street launches digital asset platform for institutions

State Street (NYSE:STT), with $4.3 trillion in assets under

management, announced on August 20 a new digital asset platform for

institutional clients. In partnership with Taurus, the platform

will offer tokenization, custody, and node management services. The

collaboration aims to streamline the issuance and maintenance of

digital assets such as bonds and funds. Institutional interest in

digital assets is growing, with Bitcoin and Ether ETFs attracting

more investment, while State Street strengthens its position in the

digital assets market.

Chainlink faces bearish challenges due to lack of activity and

negative indicators

Chainlink is facing difficulties due to the lack of network

activity and bearish signals. The NVT ratio reached its highest

level in nearly five years, suggesting that the network’s value may

be excessive relative to transaction volume. Additionally, the

Relative Strength Index (RSI) is negative, indicating weak

momentum. The price of LINK (COIN:LINKUSD) is at $10.21, struggling

to surpass $11.00, and has accumulated -27% losses for the

month.

Binance avoids $2.4 billion in fraud losses in 2024

Binance, the largest cryptocurrency exchange by volume,

prevented potential losses of over $2.4 billion in the first seven

months of 2024. Of these, $1.1 billion (45%) were related to

suspicious fraud withdrawals. Recently, Binance recovered $73

million stolen and strengthened its global compliance

practices.

Coinbase’s Base hits record active addresses, boosts “Onchain

Summer” campaign

Coinbase’s layer 2 solution, Base, reached a record high of 4

million active addresses last week. This milestone comes during the

“Onchain Summer” campaign, which encourages building on the

network. In 2023, the event brought 700,000 NFTs and $242 million

in transactions. In 2024, Base allocated 600 Ether ($2 million) to

reward developers and collaborated with AtariX to bring classic

games to the blockchain, despite questions about true onchain

integration.

Clearpool launches Ozean blockchain in the Optimism ecosystem

Clearpool is developing Ozean, a layer 2 blockchain integrated

into the Optimism (COIN:OPUSD) ecosystem and powered by Caldera.

Utilizing the OP Stack, Ozean aims to connect real-world assets to

DeFi, offering native yield through staking with the CPOOL token

(COIN:CPOOLUSD). Clearpool, which also launched the stablecoins

USDX and ozUSD, seeks to attract institutional investors, expanding

its presence in DeFi.

Tether boosts liquidity with $1 billion USDT issuance on TRON

Tether, the largest stablecoin issuer, minted $1 billion in USDT

(COIN:USDTUSD) on the TRON blockchain, potentially raising its

market cap to $117 billion. The tokens were minted on August 20 and

directed to Tether’s treasury address. Although the circulating

amount on TRON seems unchanged, this could strengthen TRON’s

position as a leader in USDT, surpassing Ethereum and other

networks. Tether’s CEO confirmed that the market capitalization is

now $117 billion.

MangoDAO approves SEC settlement to resolve securities violations

MangoDAO, of the Solana-based DeFi protocol, approved a proposal

to resolve a securities violation case with the SEC. On August 19,

the DAO agreed to pay $223,228, destroy MNGO tokens, and halt

trading of these tokens in the US. The proposal received over 110

million favorable votes but neither admits nor denies wrongdoing.

Mango Markets, which was exploited in 2022, faces ongoing

challenges and regulatory investigations.

BitFuFu reports strong revenue growth but faces high mining costs

BitFuFu (NASDAQ:FUFU) reported a 69.7% increase in revenue in Q2

2024, reaching $129.4 million, with significant growth in cloud

mining solutions and self-mining of Bitcoin. However, net income

fell to $1.3 million, impacted by an unrealized loss of $16.4

million in Bitcoin. The cost to mine one Bitcoin rose to $51,887,

compared to $19,344 in 2023, reflecting higher operational expenses

and the Bitcoin halving. Mining capacity expanded 62.5%, reaching

24.7 EH/s.

US-listed Bitcoin miners have financial edge over international

competitors

According to a Bernstein report, US-listed Bitcoin miners have a

competitive advantage over their unlisted counterparts due to

better access to financing. This allows them to raise capital more

easily, which is crucial in a capital-intensive industry. Recently,

companies like Marathon Digital (NASDAQ:MARA) and Riot Platforms

(NASDAQ:RIOT) announced large capital offerings, highlighting this

advantage. Bernstein believes these listed miners are

well-positioned to lead industry consolidation and predicts BTC

prices could reach $200,000 by 2025.

Metaplanet expands Bitcoin investments with $3.4 million purchase

Metaplanet (TSX:3350) purchased 57,273 BTC for approximately

$3.4 million (¥ 500 million), increasing its total to 360,368 BTC,

valued at over $23 million. The acquisition, funded by a loan from

MMXX Ventures, completes its ¥ 1 billion investment plan. The

company aims to raise $70 million for future acquisitions, with

$58.76 million earmarked for more Bitcoin.

Nigeria SEC plans to license crypto exchanges to enhance regulation

The Nigerian Securities and Exchange Commission (SEC) plans to

issue licenses for cryptocurrency exchanges to improve the

regulatory environment. In June, the SEC amended its rules for

digital assets and trading platforms. Director-General Emomotimi

Agama expects changes to happen swiftly, highlighting the fintech

sector’s potential in the country. Nigeria, one of the

fastest-growing cryptocurrency economies, is adjusting after the

lifting of banking restrictions and facing recent regulatory

challenges.

Binance returns to India facing regulatory and tax challenges

Binance returned to India, coinciding with the 78th Independence

Day of the country, seeking to revitalize its presence in the

cryptocurrency market. However, the exchange faces a tax demand of

$86 million, in addition to penalties for violating anti-money

laundering regulations. Binance has taken steps to align with local

requirements, including paying fines and committing to strict tax

reporting. Despite uncertainties, experts see potential for

innovation and increased competition in the Indian market.

Ledn secures $50 million Bitcoin-backed loan from Sygnum

Ledn, a cryptocurrency lending platform, secured a $50 million

syndicated loan, backed by Bitcoin, from Swiss bank Sygnum. This

financing will strengthen Ledn’s retail lending operations,

offering greater access to capital and solidifying Bitcoin’s

legitimacy as an asset. With notable growth in its retail lending,

Ledn plans to use this liquidity to expand its financial offerings,

promoting transparency and security.

YeagerAI raises $7.5 million for GenLayer

YeagerAI, the developer of the decentralized AI network

GenLayer, raised $7.5 million in an initial round led by North

Island Ventures, with participation from various investors,

including Node Capital and Arrington Capital. GenLayer uses smart

contracts and language models to create dynamic solutions that

respond to external data, innovating in subjective decision

consensus and delegated proof of stake.

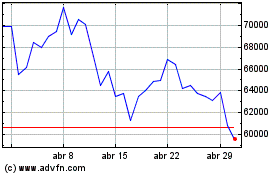

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Jul 2024 até Ago 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Ago 2023 até Ago 2024