Upbeat Earnings News May Lead To Strength On Wall Street

22 Janeiro 2025 - 1:11PM

IH Market News

The major U.S. index futures are currently

pointing to a higher open on Wednesday, with stocks likely to add

to the gains posted in the previous session.

Early buying interest is likely to be generated in reaction to

upbeat earnings news from big name companies such as Netflix

(NASDAQ:NFLX), Procter & Gamble (NYSE:PG) and Travelers (NYSE

TRV).

Shares of Netflix are surging by 14.6 percent in pre-market

trading after the streaming giant reported fourth quarter results

that exceeded analyst estimates on both the top and bottom lines.

The company also said it is raising prices after a jump in

subscribers during the quarter.

Consumer goods giant Procter & Gamble is also seeing notable

pre-market strength after reporting better than expected fiscal

second quarter results.

Shares of Travelers are also jumping by 5.8 percent in

pre-market trading after the insurance giant reported fourth

quarter results well above analyst estimates.

On the other hand, shares of Johnson & Johnson (NYSE JNJ)

may move to the downside after the drug giant reported better than

expected fourth quarter results but provided disappointing sales

guidance for 2025.

After a positive start, U.S. stocks largely kept moving higher

on Tuesday, and the major averages all ended the day’s session on a

firm note. A drop in bond yields and optimism about a few interest

rate cuts this year contributed to the positive sentiment in the

market.

The Dow closed up 537.98 points or 1.2 percent,

at 44,025.81. The S&P 500 ended higher by 52.58 points or 0.9

percent, at 6,049.24, while the Nasdaq settled at 19,756.78,

gaining 126.58 points or 0.6 percent.

Investors picked up stocks as worries about tariffs eased a bit

as Donald Trump, who signed a slew of executive orders on Monday

soon after being sworn in as the 47th President of United States,

refrained from signaling trade barriers against China. He

threatened to impose tariffs of up to 25 percent on Mexico and

Canada but did not enact a policy.

Oracle surged nearly 7.5 percent, buoyed by reports that Trump

will announce private sector investment of up to $500 billion to

fund artificial intelligence infrastructure.

Charles Schwab climbed nearly 6 percent on strong earnings news.

3M moved up sharply, buoyed by stronger than expected quarterly

earnings.

General Motors, Moderna, Dollar General, Micron Technology,

Southwest Airlines, Alaska Air, Delta Airlines, Caterpillar, Nike,

Starbucks and United Airlines Holdings gained 3 to 5 percent.

Nvidia, Boeing, Amazon, Target, Eli Lilly, US Bancorp, American

Express and Netflix were among the other notable gainers in the

session.

Walgreens Boots Alliance tanked nearly 10 percent, weighed down

by the Department of Justice’s lawsuit against the company. The

company, which made a multibillion-dollar settlement over opioid

prescriptions two years ago, now faces a suit that alleges it

dispensed “millions of unlawful prescriptions.”

Apple Inc. shares declined sharply following a series of

downgrades due to weak iPhone sales and somewhat disappointing

performance in hardware and services segments.

Chevron, Merck, Lennar and Booking Holdings were some of the

other notable losers.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

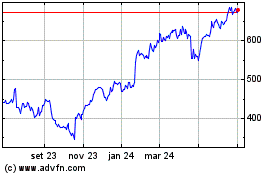

Netflix (NASDAQ:NFLX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

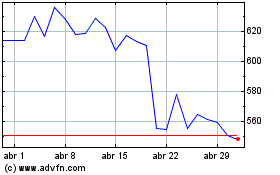

Netflix (NASDAQ:NFLX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025