AVAX Price Continues To Consolidate Around $35 — Here Are The Levels To Watch

01 Fevereiro 2025 - 12:30PM

NEWSBTC

The AVAX price has been mostly quiet since the start of 2025,

mirroring the climate of the altcoin market so far in the new year.

After reaching a local high of $55 in early December 2024, the

Avalanche token has been in a steady decline, reaching as low as

$32.2 on Wednesday, January 29. Investors, Watch Out For These

Price Levels In a new post on the X platform, popular crypto

analyst Ali Martinez revealed the key on-chain levels that could

prove pivotal to the future trajectory of AVAX price. This on-chain

observation focuses on the average cost basis of several Avalanche

investors. In cost-basis analysis, a zone’s capacity to serve as

support or resistance depends on the total amount of tokens last

purchased by investors at the level. As shown in the chart below,

the size of the dot represents and is directly proportional to the

number of AVAX tokens acquired within each corresponding price

range. Related Reading: Chainlink Could Target $30 Once It Breaks

Bullish Pattern – Top Analyst According to data from IntoTheBlock,

around 302,100 addresses purchased approximately 14.26 million AVAX

tokens within the price range of $34.01 and $35.15. As highlighted

by Martinez, this has led to the formation of a crucial support

cushion within this price region. The $34.5 region is able to act

as a crucial support level due to the number of investors with

their cost basis in and around it. The rationale is that when the

AVAX price returns to $34.5, investors with their cost basis around

this zone are likely to double down and defend their position by

acquiring more tokens, allowing prices to quickly recover.

Furthermore, IntoTheBlock data shows that the $39.49 – $40.54 price

bracket is currently thick with investors. According to data from

IntoTheBlock, more than 233,000 addresses bought over 12.33 million

AVAX between the price range. Martinez noted that this $39.49 –

$40.54 price region is a major resistance zone because investors

are always likely to make a move when an asset returns to their

cost basis. In this scenario, investors who were in the red before

may want to quickly sell their holdings as soon as they enter

profit, which could place downward pressure on the AVAX price. The

price action of the AVAX around two regions could make or mar its

performance over the next few weeks. Hence, investors might want to

pay extra attention to the altcoin whenever it approaches these

support and resistance zones. AVAX Price At A Glance As of this

writing, the price of AVAX stands at around $34.8, reflecting a

mere 1% increase in the past 24 hours. The premier cryptocurrency’s

performance is even more sluggish on larger timeframes. According

to data from CoinGecko, the Avalanche is down by nearly 3% in the

past seven days. Related Reading: Bitcoin Price Enters Ascending

Phase After Cup And Handle Formation At $105,000, Here’s The Next

Target Featured image from IQ.wiki, chart from TradingView

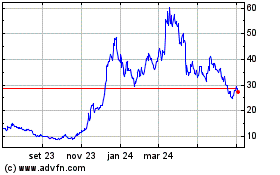

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

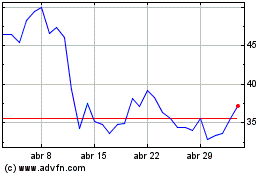

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025