Avalanche Shows Signs Of Recovery As Key Indicator Flashes A Buy Signal – Details

13 Fevereiro 2025 - 8:00PM

NEWSBTC

Avalanche (AVAX) has faced relentless selling pressure since

mid-December, with its price plummeting over 60% and erasing all

the gains from its impressive November 2024 rally. This sharp

decline has left investors on edge, fueling fear and uncertainty as

Avalanche mirrors the bearish trends seen across the broader crypto

market. Doubts about AVAX’s potential to recover and generate

significant gains have started to dominate market sentiment,

leaving many questioning whether a rebound is possible in the near

term. Related Reading: Cardano Could Move Up To $0.83 If Momentum

Holds – Can ADA Sustain A Breakout? However, amidst this

uncertainty, there are signs that Avalanche may be preparing for a

turnaround. According to key metrics shared by top analyst Ali

Martinez, Avalanche is showing promising signs of a potential

rebound. Martinez highlights that a key technical indicator has

flashed a buy signal on the weekly chart, offering a glimmer of

hope for a recovery rally. This signal suggests that AVAX might be

nearing a bottom, and if market conditions align, it could mark the

beginning of a new bullish phase. As the market remains volatile,

all eyes are on Avalanche to see if this buy signal can translate

into sustained upward momentum. Investors are cautiously

optimistic, hoping that AVAX can overcome current challenges and

reclaim its bullish potential. Avalanche Indicator Signals A

Potential Trend Reversal Avalanche (AVAX) has been stuck in a state

of indecision as bulls fail to reclaim the $27 mark, while bears

struggle to push the price further down. This tug-of-war reflects

the broader uncertainty in the crypto market, leaving Avalanche at

a critical juncture. Analysts are divided on the next move for

AVAX, with some predicting a massive recovery rally while others

anticipate a continuation of the bearish trend that has gripped the

market since mid-December. Top analyst Ali Martinez has added to

the discussion by sharing a technical analysis on X that reveals

promising signs for Avalanche. Martinez highlights that the TD

Sequential indicator, a widely used tool for identifying trend

exhaustion and potential price reversals, has flashed a buy signal

on the weekly chart. This is significant, as weekly signals carry

more weight and often suggest the possibility of long-term

reversals. If bulls capitalize on this signal and push the price

above the $27 resistance level, it could trigger a broader recovery

phase. On the flip side, failure to hold current levels may lead to

further consolidation or downside movement as bears attempt to

regain control. Related Reading: Ethereum Whales Have Bought Over

600,000 ETH In The Past Week – Time For A Price Upswing? The coming

days and weeks will be crucial for Avalanche, as the price action

will either validate the bullish signal or reinforce the prevailing

bearish sentiment. Investors are closely monitoring the $27 level

and the implications of the TD Sequential signal, as it could mark

the beginning of a long-awaited recovery rally for AVAX. AVAX Price

Consolidates Between Key Levels Avalanche (AVAX) is trading at

$25.6 after several days of indecision and consolidation within a

narrow range, stuck below the $27 resistance level and above the

$23 support zone. This tight range reflects the ongoing uncertainty

in the broader market as bulls and bears battle for control. Bulls

face a crucial test at current levels. They need to hold the $25

support zone and build momentum to push AVAX above the key $28.7

resistance level. Breaking and reclaiming this mark as support

would confirm a trend reversal, signaling the start of a potential

recovery rally. A successful breakout above $28.7 could attract

more buyers and lead to a move into higher price levels. However,

selling pressure remains a significant risk for AVAX. If the price

loses the $23 support level, the bearish trend that has dominated

since mid-December could continue. A breakdown below this range

would likely take AVAX into lower demand zones, with $20 being the

next critical support level. Related Reading: Litecoin Approaches

Daily Range Peak – Can LTC Break Multi-Year Highs? The coming days

will be pivotal for Avalanche, as the price must either reclaim

higher levels to change the bearish narrative or risk further

declines as the market grapples with ongoing fear and uncertainty.

Featured image from Dall-E, chart from TradingView

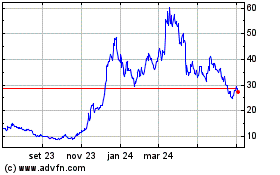

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

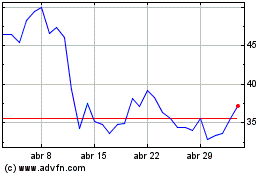

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025