Polkadot (DOT) Defies Market Volatility, Holds Strong Above $4.8 Support Level

14 Fevereiro 2025 - 9:30AM

NEWSBTC

In a market often characterized by sharp swings and unpredictable

trends, Polkadot (DOT) has emerged as a beacon of stability,

defying broader volatility to hold above the critical $4.8 support

level. While other altcoins experience uncertainty, DOT has managed

to maintain stability, signaling strong buying interest at this key

price zone. This steady performance comes as bulls attempt to build

momentum, aiming for a potential breakout. However, with broader

market volatility still in play, traders are closely watching

whether DOT can sustain its strength and push higher, or if selling

pressure will test its resolve. Will Polkadot’s stability pave the

way for an upside move, or is a retest of lower levels inevitable?

DOT’s Price Action: Can Bulls Build On This Stability? Despite

market fluctuations, DOT is currently showing impressive

resilience, holding firm above the $4.8 support level. This

stability suggests that buyers are actively defending this key zone

in order to prevent a deeper decline. Related Reading: Polkadot

(DOT) Breakout Looms With $17 Target In Sight – Details Although

the cryptocurrency is currently trading below the 100-day Simple

Moving Average (SMA), it is making an effort to regain momentum by

pushing toward the $6.2 resistance level. Its upward attempt

indicates that bullish sentiment is still present, with buyers

aiming to reclaim control despite lingering downside pressure.

Additionally, the Relative Strength Index (RSI) line is trending

toward the 50% threshold, indicating a shift in momentum. This

movement shows that buying and selling pressures are nearing

equilibrium, making the next price move critical in determining the

short-term trend. If the RSI successfully rebounds and moves above

50%, it might signal a bullish resurgence, with increased buying

pressure driving the price higher. Conversely, if the RSI fails to

hold and dips further, it may indicate growing bearish pressure,

raising the risk of a downward continuation. What’s Next For

Polkadot? Potential Scenarios Above And Below $4.8 Should buyers

gain momentum, a breakout above $6.2 could open the door for more

upside. The next key resistance levels to watch are $7.7 and $9.8,

capable of fueling a bullish rally amid trading volume increases. A

sustained move above these levels may set the stage for Polkadot to

retest the $11.9 region, further strengthening positive sentiment.

Related Reading: Polkadot Holds Key Demand Level – DOT Could Hit

$11 In Coming Weeks On the other hand, if selling pressure

intensifies and DOT loses the $4.8 support, the price could retreat

toward $3.5 or even $1.9 in a bearish scenario. A deeper correction

is likely to trigger additional downside risks, forcing bulls to

step in and defend lower support zones. For now, market sentiment

and key technical indicators will determine the next major move.

Whether Polkadot builds on its stability or faces a pullback,

traders should remain cautious and watch for volume shifts, RSI

trends, and overall market conditions to confirm the next

direction. Featured image from Medium, chart from Tradingview.com

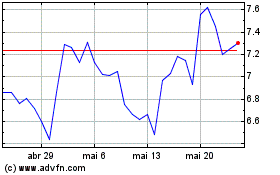

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025