Genius Group Announces Preliminary First Half 2024 Financial Results: 130% Pro Forma Revenue Growth

20 Novembro 2024 - 10:00AM

Genius Group Limited (NYSE American: GNS) (“Genius Group” or the

“Company”), a leading AI-powered, Bitcoin-first education and

acceleration group, today provided preliminary unaudited financial

and operational results for the six months ended June 30, 2024.

“Whilst our auditors complete their review of

our first half financial results of 2024 in the coming weeks, we

are pleased to provide preliminary results on our revenue and

adjusted EBITDA. We believe our 130% pro forma revenue growth

continues our track record of exceeding the Edtech industry growth

rate as a whole, and our reduction in EBITDA loss is a direct

result of our strategy of becoming a self-sustaining, cash positive

business.” said Roger Hamilton, CEO of Genius Group.

“We look forward to the coming month, in which

we will be providing detailed first half financial results

following the completion of our auditors’ review, together with

guidance for the full year including our Bitcoin Treasury Plan. We

believe our AI education and acceleration model, including our

Genius Cities platform and latest AI avatars, provides a powerful

value add layer to our Bitcoin-first strategy, and we believe in

the coming year we will solidify our leadership position in

delivering AI powered training and tools for the future of

work.”

Preliminary Financial Highlights for the First Half of

2024

- First half revenue of $13.2

million, compared to $11.8 million in 2023. First half revenue in

2024 excludes revenue from FatBrain AI prior to the asset purchase

transaction that closed in March, and first half revenue in 2023

includes revenue from Entrepreneur Resorts Ltd, which was

subsequently spun off from the Company in 2023.

- First half adjusted EBITDA net loss

of ($5.9) million, compared to ($7.3) million first half adjusted

EBITDA net loss in 2023, with adjusted EBITDA in 2024 excluding

adjusted EBITDA from FatBrain prior to the transaction closed in

March, and first half adjusted EBITDA in 2023 including adjusted

EBITDA from Entrepreneur Resorts Ltd.

Preliminary Pro Forma Financial Highlights for the First

Half of 2024

- First half pro forma revenue of $20.7 million, compared to $9.0

million in first half of 2023, representing a 130% increase.

- First half 2024 pro forma adjusted EBITDA net loss of ($4.6)

million, compared to ($7.3) million first half pro forma adjusted

EBITDA net loss of ($7.3) million in 2023, representing a 37%

reduction.

Financial results include the Fatbrain AI (LZGI)

transaction following the signing of a settlement commitment where

all parties have committed to reach an amicable settlement that

includes proceeding with the LZGI transaction and effectively

addressing and rectifying the various issues related to the

transaction.

About Genius Group

Genius Group (NYSE: GNS) is a leading provider

of AI powered, digital-first education and acceleration solutions

for the future of work. Genius Group serves 5.4 million users in

over 100 countries through its Genius City model and online digital

marketplace of AI training, AI tools and AI talent. It provides

personalized, entrepreneurial AI pathways combining human talent

with AI skills and AI solutions at the individual, enterprise and

government level.

For more information, please visit

https://www.geniusgroup.net/

Pro Forma Financial Results

Genius Group pro forma financial results take

into account the Group Companies including FatBrain AI – with the

transaction completed in March 2024.

The Pro Forma Financial Results should be viewed

as the current group’s financial performance, of which the audited

financial results represent a subset of this group. The historical

results do not necessarily indicate our expected results for any

future periods.

Non-IFRS Financial Measure

We have included Adjusted EBITDA because it is a

key measure used by our management and board of directors to

understand and evaluate our core operating performance and trends,

to prepare and approve our annual budget and to develop short- and

long-term operational plans. In particular, the exclusion of

certain expenses in calculating Adjusted EBITDA can provide a

useful measure for period-to-period comparisons of our core

business.

We calculate Adjusted EBITDA as net profit /

loss for the period plus income taxes and social contribution plus

/ minus finance revenue /expense result plus depreciation and

amortization plus impairments plus revaluation adjustment of

contingent liabilities plus share-based compensation expenses plus

bad debt provision.

Forward-Looking Statements

Statements made in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements can be

identified by the use of words such as “may,” “will”, “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties, many

of which the Company cannot predict with accuracy and some of which

the Company might not even anticipate and involve factors that may

cause actual results to differ materially from those projected or

suggested. Readers are cautioned not to place undue reliance on

these forward-looking statements and are advised to consider the

factors listed above together with the additional factors under the

heading “Risk Factors” in the Company's Annual Reports on Form

20-F, as may be supplemented or amended by the Company's Reports of

a Foreign Private Issuer on Form 6-K. The Company assumes no

obligation to update or supplement forward-looking statements that

become untrue because of subsequent events, new information or

otherwise.

ContactsMZ Group - MZ North America(949)

259-4987GNS@mzgroup.uswww.mzgroup.us

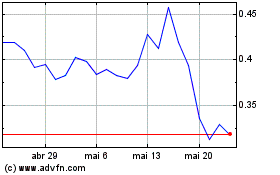

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Genius (AMEX:GNS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024