Possible approval of a Bitcoin ETF could lead to a ‘news-driven

sell-off,’ according to a report

A report from CryptoQuant suggests that the approval of a spot

Bitcoin ETF could trigger a “news-driven sell-off.” With Bitcoin

recovering above $40,000, many holders are sitting on unrealized

profits, historically a precursor to price corrections. Miners are

also profiting, increasing selling pressure. The price of Bitcoin

is expected to drop to around $32,000 in a “news-driven sell-off,”

despite the high probability of the ETF being approved by the SEC

in early 2024.

Cathie Wood repositions ARK Next Generation Internet ETF’s Bitcoin

portfolio

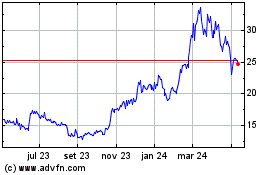

Cathie Wood’s ARK Next Generation Internet ETF (AMEX:ARKW) has

sold all 2.25 million shares in Grayscale Bitcoin Trust

(USOTC:GBTC) due to doubts about the trust’s conversion into an

ETF. Simultaneously, the fund acquired 4.32 million shares in the

ProShares Bitcoin Strategy ETF (AMEX:BITO), which invests in

Bitcoin futures (COIN:BTCUSD). The strategy reflects ARK’s caution

amid regulatory uncertainty from the SEC regarding the approval of

spot Bitcoin ETFs.

Bitcoin mining stocks outperform Bitcoin’s own growth

In 2023, Bitcoin mining stocks posted an impressive performance,

outpacing Bitcoin’s 160% increase (COIN:BTCUSD), with Hive Digital

Technologies (NASDAQ:HIVE) and Marathon Digital Holdings

(NASDAQ:MARA) growing by 251% and 781%, respectively. Notably,

these stocks have high short interest, according to Fintel data and

Mortensen Bach analysis, and this short interest has contributed to

the rising stock prices. The Valkyrie Bitcoin Miners proxy

(NASDAQ:WGMI) grew by 132% in three months, compared to Bitcoin’s

53% growth. The increasing interaction between high short interest

and rising stock prices indicates a potential short squeeze

scenario, potentially driving prices even higher.

Court approves Celsius’ Chapter 11 restructuring

The US Bankruptcy Court in the Southern District of New York has

approved Celsius’ restructuring, allowing the formation of a new

Bitcoin mining company. This decision, part of the Chapter 11

bankruptcy process, involves a $225 million capitalization and the

transfer of specific mining assets, excluding some key assets.

Contractual amendments were approved, along with a detailed budget

for the settlement. The SEC retains its authority over crypto

tokens, setting a new course for Celsius and revised guidelines for

creditors.

Bitcoin options volume hits a historic record

According to The Block’s Data Panel, Bitcoin options trading

volume (COIN:BTCUSD) reached a historic high, surpassing $38

billion on major derivatives exchanges before the end-of-month,

quarter, and year expiration date. Deribit led with $26.7 billion,

followed by increases on OKX and Binance. Around $7.7 billion in

Bitcoin options are set to expire on Deribit, marking the

exchange’s largest expiration. The intense activity signals growing

interest among traders in hedging and rolling strategies.

Additionally, options volume on the CME also reached a historic

high, indicating increased interest from sophisticated market

participants.

SEI reaches an all-time high with rapid price rise

The price of the SEI cryptocurrency (COIN:SEIUSD) has made a

remarkable recovery since November, reaching a new all-time high of

$0.537. This surge was preceded by a significant increase since

December 19, marked by a series of strong daily gains. The token

experienced a slight drop after the peak, currently at $0.4782, but

it marks a 151% increase year-to-date in 2023.

CAKE rises with PancakeSwap’s supply reduction proposal

PancakeSwap’s CAKE token (COIN:CAKEUSD) saw a price increase

after the proposal to reduce the maximum token supply from 750

million to 450 million. This change aims to transition PancakeSwap

from a high-inflation model to an “Ultrasound CAKE” scenario.

Reducing the maximum supply would increase the circulating supply

to 59%, potentially increasing scarcity and token value in the

market. At the time of writing, CAKE has recorded a weekly increase

of 22.5%, with a positive 8.5% gain year-to-date in 2023.

Bitcoin SV shines in the last week of the year

Bitcoin SV (COIN:BSVUSD) stood out as one of the biggest gainers

of the week, with an impressive increase of over 70%, reaching a

yearly high of 101%. This increase was largely driven by South

Korean traders, representing 76% of the total trading volume.

Despite the recent growth, BSV is still about 80% below its

all-time high.

Vitalik Buterin proposes a change to Ethereum’s PoS model

Vitalik Buterin, the founder of Ethereum (COIN:ETHUSD), has

proposed a significant change to the Proof of Stake (PoS) model

after the Shanghai upgrade. The current system, with around 895,000

validator objects, faces technical challenges such as processing a

high number of signatures, currently 28,000, with a projected 1.79

million. Buterin proposes reducing it to 8,192 signatures per slot,

simplifying the operation, improving security, and addressing

quantum resistance. This change is crucial for balancing Ethereum’s

security, decentralization, and usability. He criticized

committee-based security on other blockchains and suggests

maintaining high penalties for attackers. Buterin explored three

approaches, including decentralized stake pools, two-layer staking,

and rotating participation, emphasizing “security through

simplicity” in response to concerns about state-level attacks.

zkSync surpasses Ethereum in monthly transactions

n the past month, zkSync, a Layer 2 scaling solution for

Ethereum, exceeded Ethereum’s mainnet (COIN:ETHUSD) in transaction

volume, processing 34.7 million transactions compared to Ethereum’s

34.2 million. This milestone, primarily driven by the introduction

of rollups—a concept similar to Bitcoin’s ordinals—in EVM networks,

including Layer 2, highlighted zkSync as the leader in transaction

activity, surpassing even Arbitrum (COIN:ARBUSD) with 31.4 million

transactions. zkSync, which operates as a Layer 2 network, bundles

multiple transactions into a single cryptographic proof, offering

faster and more cost-effective processing. Since mid-December,

registration transactions have been a key factor in the increase in

zkSync’s activity.

Blockchain Blast attracts $1.1 billion in deposits before launch

The Layer 2 blockchain Blast, developed by the NFT Blur team,

has accumulated over $1.1 billion in deposits ahead of its

scheduled activation in February. The promise of an airdrop in May

encouraged $1 billion in deposits in Staked Ether (COIN:STETHUSD)

and $103 million in Dai Stablecoin (COIN:DAIUSD). Depositors earn

approximately 5% yield and “Blast Points” for the airdrop launch.

Despite the initial success, the project faces criticism and

comparisons to pyramid schemes, especially for allowing deposits

before the platform’s activation.

Swell doubles locked value in staking to $245 million

Swell, a liquid staking protocol, has seen its total locked

value double to 108,000 Ether, approximately $245 million. This

significant increase followed the introduction of “Pearl” rewards

and the expansion of EigenLayer support to include liquid staking

tokens like swETH (COIN:SWETHUSD). Swell now positions itself as

one of the leading liquid staking protocols, attracting growing

interest within the Ethereum ecosystem.

Ripple Labs transfers 310 million XRP from the escrow wallet

In December, Ripple Labs (COIN:XRPUSD) transferred 310 million

XRP, approximately $198 million, from its escrow wallet. This

leaves about 26.34 million XRP in the wallet, worth $16.7 million.

With less than 40 billion XRP tokens in escrow, Ripple plans

gradual releases until 2027. Ripple faces challenges, including SEC

allegations, but also opportunities in instant payments and

partnerships, such as with the National Bank of Georgia.

$2.4 million in Ether moved by wallet linked to Donald Trump

A wallet associated with Donald Trump transferred over $2.4

million in Ether (COIN:ETHUSD) to Coinbase (NASDAQ:COIN), possibly

selling accumulated cryptocurrencies. These Ether were generated as

royalties from a collection of Trump NFTs on OpenSea. Arkham

Intelligence, which monitors the wallet, reported that after months

of accumulation, the wallet began sending ETH to Coinbase. Despite

Trump’s skepticism about cryptocurrencies, recent documents suggest

he profited between $500,000 and $1 million from the sales of his

NFT collection.

Artificial intelligence dominates crypto narratives in 2023

A CoinGecko survey revealed that artificial intelligence (AI)

was the dominant crypto narrative in 2023, capturing 11.3% of total

interest. Driven by the launch of chatbots like ChatGPT, this trend

increased focus on AI-related cryptocurrencies, with Akash Network

(COIN:AKTUSD) and Render (COIN:RNDUSD) showing significant price

gains. Akash Network increased by 1,055% in the last year, while

Render rose by 1,003%. Besides AI, GameFi and meme coins were also

popular. The sector is paying attention to the legal implications

of recent developments, such as the New York Times’ lawsuit

(NYSE:NYT) against OpenAI and Microsoft (NASDAQ:MSFT), and

innovations like LG’s robotic assistant.

Worldcoin launches identity verification services in Singapore

Worldcoin (COIN:WLDUSD) is expanding its global presence by

introducing its innovative identity verification system, Orb, in

Singapore. Additionally, Worldcoin has been expanding to other

cities worldwide, including several in Spain and Germany, marking a

significant step forward in its global identity verification

initiative.

Argentina proposes regularization of crypto-assets with tax

incentives

Argentina, under newly elected President Javier Milei, proposes

a controversial bill to legalize and tax cryptocurrencies, both

domestic and foreign. As part of a broader economic reform, the

bill encourages voluntary declaration of crypto assets with reduced

tax rates, starting at 5% until March and increasing to 15% by

November. The measure aims to regularize assets held abroad and

faces strong opposition shortly after its introduction. Argentina’s

long history of high inflation and monetary instability motivates

this initiative.

Bitzlato suspends withdrawals after asset seizure by France

Bitzlato, a Russian cryptocurrency exchange, announced the

temporary suspension of “special balance withdrawals” due to legal

issues related to the seizure of its assets by French authorities

in January. The company, which had its infrastructure and assets

seized by other international authorities as well, is facing money

laundering and other charges. Its founder pleaded guilty in the

United States, agreeing to surrender $23 million.

Levana protocol loses $1.1 million in exploitation on the Osmosis

blockchain

The Levana perpetual swap protocol on the Osmosis blockchain

suffered an exploitation that resulted in the loss of over $1.1

million from its liquidity pools. The attack lasted 13 days, from

December 13 to 26, exploiting network congestion and a bug in

Osmosis’s fee market code (COIN:OSMOUSD). This allowed attackers to

manipulate prices and drain the pools. Levana is working on a fix

and plans to compensate affected users through an airdrop and

protocol fee distribution.

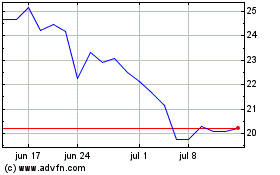

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024