GBTC, IBIT, and FBTC have a strong debut

After years of anticipation, the Bitcoin ETFs were finally

approved in the USA and started trading on Thursday. BitMex

Research ranked the 11 newly launched funds by trading volume on

the first day, with the ETFs from Grayscale (AMEX:GBTC), BlackRock

(NASDAQ:IBIT), and Fidelity (AMEX:FBTC) leading in volume.

In comparison, the futures-based Bitcoin ETF from ProShares

(AMEX:BITO) generated $1 billion in volume on its first day in

October 2021, while the record for the launch of an individual ETF

is $2.1 billion. The 11 ETFs reached $2.3 billion in trading

volumes at the time of writing.

Other ETFs like those from Ark 21Shares (AMEX:ARKB), Bitwise

(AMEX:BITB), Invesco (AMEX:BTCO), VanEck (AMEX:HODL), and Franklin

(AMEX:EZBC) also recorded upward movements, with volumes ranging

between $10 million and $100 million.

Bitcoin (COIN:BTCUSD), meanwhile, reached a high of $49,102 this

morning and fell to $45,932 at the time of writing, in the early

afternoon. Fernando Pereira, an analyst at Bitget, commented on the

movement of Bitcoin prices: ‘Finally, the requests for ETFs

were approved, but Bitcoin barely moved with this news. This,

combined with the divergence that the price has been showing (more

negative days than positive even with the price rising) shows that

the demand is already at the end. Very difficult to pass $50,000 in

the short term. The party is ending.’

Bitwise allocates Bitcoin ETF profits to community development

Bitwise Asset Management announced that 10% of the profits from

its Bitcoin ETF (AMEX:BITB) will be donated to organizations that

support open-source Bitcoin development. CEO Hunter Horsley

expressed enthusiasm in funding developers, especially the pioneers

of the Bitcoin community. Following the recent SEC approval of 11

Bitcoin ETFs, Bitwise seeks to contribute to the industry’s

expansion, with no plans for reimbursement of the donations. The

beneficiaries were selected for their track record in supporting

Bitcoin development, emphasizing the importance of sustainable

support for Bitcoin Core Development.

SEC’s split decision in approving spot Bitcoin ETFs

SEC Chairman Gary Gensler was one of three members of the

commission who voted in favor of creating the first spot Bitcoin

ETF. Gensler, along with Hester Peirce and Mark Uyeda, approved the

registrations, while Caroline Crenshaw and Jaime Lizárraga opposed

them. Despite Peirce’s support for cryptocurrency, Gensler

maintained a critical stance, emphasizing risks and customer

protection. According to Crenshaw, the controversial decision could

compromise investor protection, marking a significant moment in the

regulation of the cryptocurrency market. In related news about the

security breach of the SEC’s account on X, the FBI is collaborating

in the investigation. The infraction, which occurred on January 9,

involved the publication of a false announcement about the approval

of spot Bitcoin ETFs, which was quickly debunked by the SEC and its

Chairman Gary Gensler. The SEC clarified that the false

announcement was not prepared by the agency, dispelling rumors of a

premature launch.

Challenges on the way to SEC’s Ether ETF

The Chairman of the US SEC, Gary Gensler, expressed caution

about approving an ETF for Ethereum (COIN:ETHUSD), following the

launch of the Bitcoin ETF. Despite the rise in ether prices, there

are doubts about its classification as a commodity or security, a

critical factor in the SEC’s decision. Gensler reiterated that many

cryptographic assets are considered investment contracts. Experts

are divided on the likelihood of an ether ETF being approved soon,

with some optimistic and others skeptical, depending on the SEC’s

regulatory approach.

Circle Internet Financial moves towards IPO

Circle Internet Financial, issuer of the stablecoin USDC

(COIN:USDCUSD) with a market value above $25 billion, took a

significant step towards becoming a public company. The company

confidentially submitted a Form S-1 to the US Securities and

Exchange Commission, a standard procedure for IPOs. Details such as

the number and price of shares are still uncertain, depending on

the SEC’s review and market conditions. This initiative follows

earlier discussions about an IPO and a failed attempt to go public

in 2022, valuing the company at $9 billion.

Aave votes to add PayPal’s stablecoin PYUSD

The DeFi protocol Aave is holding a vote to integrate the PYUSD

stablecoin (COIN:PYUSDUSD), issued by PayPal and Paxos Trust

Company, into its Ethereum pool. The proposal, with 99.98% of votes

in favor, aims to strengthen the synergies between PYUSD and Aave’s

stablecoin GHO (COIN:GHOUSD). Trident Digital, which supports

PYUSD/USDC liquidity on Curve, plans to contribute up to $10

million in liquidity for PYUSD on Aave. The strategy aims to

generate organic loan demand for PYUSD, boosting the Aave

ecosystem.

JPMorgan highlights the market and mining impact following the

approval of the first spot Bitcoin ETFs

According to JPMorgan Chase (NYSE:JPM), the buying pressure on

bitcoin and mining stocks has increased in recent months. JPMorgan

analysts Smith and Pearce indicate uncertainty about the future

impact of this novelty on bitcoin and mining stocks. They observed

that mining stocks have risen 131% in the past three months,

outperforming the 71% increase in bitcoin value. However, while

they warn of possible sales in the sector, they see buying

opportunities, highlighting that the ETF does not directly affect

the mining economy. ‘Our feeling is that mining stocks need a

break, but we expect the stock performance to follow bitcoin prices

in the coming weeks.’ JPMorgan maintains an optimistic view

for the year in bitcoin mining, highlighting Iris Energy

(NASDAQ:IREN) as a promising choice.

Shares of Coinbase and Robinhood react downwards

Shares of Coinbase Global (NASDAQ:COIN) and Robinhood Markets

(NASDAQ:HOOD) suffered declines on Thursday after the approval of

Bitcoin ETFs by the US SEC, generating uncertainties about the

impact on cryptocurrency trading platforms. Both companies, which

had a positive start in the session, fell more than 4% and 2%,

respectively, at the time of writing. The approval of the ETFs is

seen as a milestone in the cryptographic space, but raises concerns

about competitive pressure for these companies. Despite being the

custodian of many of these ETFs, analysts at JPMorgan (NYSE:JPM)

see a mixed scenario for the company, with potential direct

competition to its services. Vlad Tenev, CEO of Robinhood,

announced that the investment platform will add spot Bitcoin ETFs

as soon as possible. Meanwhile, both Coinbase and Robinhood had an

exceptional performance in the previous year, with significant

increases in their shares.

Polymarket registers record volume

Polymarket, a decentralized betting platform, recorded an

impressive volume of $5.7 million after the US SEC approved Bitcoin

ETFs, exceeding its daily average of $300,000 and even the volume

of OpenSea. According to analyses by Richard Chen from

1confirmation, Polymarket stood out after the SEC’s decision, with

a specific contract on the approval of the Bitcoin ETF attracting

more than $12 million in bets. The platform also saw a significant

increase in the number of active users, reaching the highest level

since April 2022.

South Korea maintains restrictions on cryptocurrency ETFs

The Financial Services Commission of South Korea confirmed that

it will continue to restrict the launch of cryptocurrency ETFs by

financial institutions. Despite the approval of Bitcoin ETFs in the

USA, the South Korean regulator does not plan to review or suspend

its ban, citing investor protection and the stability of financial

markets. Since 2017, South Korea has not considered

cryptocurrencies as financial assets and prohibits institutional

investments in them. The nation is working on a two-part

cryptocurrency regulation, with the first phase scheduled for July

2024.

Restructuring and growth at NEAR Protocol

The Near Foundation, responsible for the NEAR Protocol

(COIN:NEARUSD), announced a 40% reduction in its staff, despite

significant development in the past year. This decision, influenced

by the NFC, mainly affects the marketing and business development

departments, maintaining the engineering team. CEO Illia Polosukhin

explained that the change aims to focus on higher-impact activities

and promote decentralization. Parallelly, NEAR’s decentralized

financial ecosystem showed strong performance, with the total value

locked surpassing $100 million and the NEAR token growing 17.25%

the previous day.

Vitalik Buterin supports increasing Ethereum’s gas limit

Vitalik Buterin, co-founder of Ethereum (COIN:ETHUSD), advocated

for a 33.3% increase in the Ethereum block gas limit, from 30 to 40

million units. This change would allow more transactions per block,

improving network efficiency. Buterin notes that the current limit

has remained stable for almost three years, while Martin Köppelmann

from Gnosis recognizes that such an increase would require more

operational resources from nodes. Jesse Pollak from Coinbase also

supports the idea, highlighting the potential benefits. Unlike

other changes, this adjustment can be made directly by validators

adjusting their node settings.

Mantle (MNT) reaches new record

Mantle (COIN:MNTLLUSD) achieved a new all-time high, continuing

its upward trend since October 2023. The digital asset broke the

previous barrier of $0.53 in December and, after a consolidation

phase, initiated another wave of growth, surpassing the $0.80 mark

at the time of writing. Analysts like Defi Maestro and KashKysh are

optimistic, highlighting the daily transaction volume and the

potential of Ethereum ecosystems and layer 2 solutions. Technical

analysis suggests a parabolic trajectory for MNT, pointing to a

possible rise of 17%, potentially reaching $0.93.

Costly purchasing error in meme coin

A trader, possibly by mistake, spent nearly $9 million in three

large transactions to acquire the Solana meme coin WIF. These

purchases triggered a temporary price increase to $3 due to low

liquidity, followed by a drop to 15 cents. The result was a

substantial loss of over $5.7 million for the trader. This event

highlights the risks of trading in low liquidity pools and sparked

speculation of being a marketing stunt to draw attention to WIF,

which had previously been a big success in the Solana

ecosystem.

Cookie3 and Chainwire form strategic partnership for Web3 analysis

Cookie3, an analytics platform for Web3 users, announced a

collaboration with the press release distribution service

Chainwire. This partnership, revealed on January 10th, allows

companies to monitor the impact of their press releases on the

blockchain. Cookie3 is offering a 10% discount for Chainwire users,

which can be accessed with the code ‘campaigns’. The announcement

highlights that Cookie3’s clients will have easier access to

Chainwire’s PR services and vice versa, with Chainwire providing

enhanced user analytics.

CoinGecko faces hacker attack on platform X and issues security

alert

CoinGecko, known for tracking cryptocurrency prices, had its

account on platform X compromised, resulting in the fraudulent

disclosure of a new cryptocurrency, GCKO. Hackers promoted a fake

token airdrop through a suspicious link. CoinGecko alerted its

users not to interact with the malicious content. The attack

occurred due to an accidental click on a fraudulent link by a team

member, despite security measures like two-factor authentication.

CoinGecko has since regained control of their accounts and

apologized for the incident.

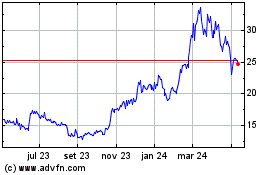

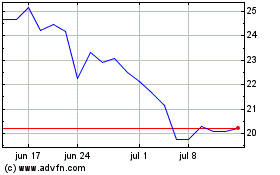

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024