False news of approval of Bitcoin ETF by SEC account on X shakes

market

On January 9th, a compromise of the SEC account on X (formerly

Twitter) led to the dissemination of false information about the

approval of a Bitcoin ETF, causing significant market volatility.

The investigation identified that the phone number linked to the

SEC account was accessed by an unauthorized third party. Security

experts and the crypto community highlighted the irony of the

situation, as the SEC itself did not follow the security practices

it recommends. US lawmakers demand explanations and transparency

from the SEC, emphasizing the seriousness of the security breach

and its potential impact on the markets, and calling for a

comprehensive investigation into the security practices of

regulatory bodies.

Bitcoin (COIN:BTCUSD) quickly rose to nearly $48,000 before

falling to $44,900, resulting in massive liquidation of both short

and long positions. The market turmoil prompted short-term holders,

with less than 155 days of ownership, to transfer $1.3 billion in

profits to exchanges, one of the largest profit transfers in two

years. In total, about $2 billion in Bitcoin was sent to exchanges,

with $750 million representing losses, highlighting the significant

impact of this false news on the cryptocurrency market. At the time

of writing, the price of Bitcoin was at $45,440.

Ethereum (COIN:ETHUSD) and platform-based Ethereum tokens

recorded an increase in the last 24 hours, driven by the

expectation of a future Ether ETF, following the likely approval of

the Bitcoin ETF in the US. Native tokens of Lido (COIN:LDOUSD) and

RocketPool (COIN:RPLUSD) experienced significant increases, while

layer 2 network tokens such as Mantle (GATE:MNTUSDT) and Optimism

(COIN:OPUSD) also rose. Despite the rally, the approval of the

Ether ETF is still considered a probability, not a certainty.

Intense competition reduces fees for spot Bitcoin ETFs

Anticipating SEC approval on Wednesday, spot Bitcoin ETF

applicants have cut fees to compete better.

- BlackRock: Reduced the fee from 0.3% to 0.25%. Offered a

temporary discount from 0.2% to 0.12% for the first $5 billion in

assets in the first 12 months.

- Ark Invest/21Shares: Reduced fees from 0.25% to 0.21%. Offers

zero fees for the first six months or up to $1 billion in

assets.

- Fidelity: Reduced the permanent fee from 0.39% to 0.25%.

- Valkyrie: Reduced the fee from 0.8% to 0.49%.

- Invesco Galaxy: Reduced the fee from 0.59% to 0.39%.

- WisdomTree: Reduced the fee from 0.5% to 0.3%.

- Bitwise: Maintains the position as the potential cheapest

issuer, reducing the permanent fee from 0.24% to 0.2%.

- Grayscale: Filed an amended S-3 form to convert its existing

GBTC product into an ETF, reducing the fee from 2% to 1.5%.

While these fees are higher compared to traditional stock and

bond ETFs, they are competitive in the commodities segment. The

SEC’s decision will influence the launch of these ETFs.

Notable increase in assets of BITO ETF, according to K33 Research

Vetle Lunde from K33 Research highlights the significant growth

in assets under management (AUM) of the Proshares Bitcoin Strategy

ETF (AMEX:BITO). Recently, BITO had a notable increase, with the

fourth-largest daily inflow of 4,555 Bitcoins on January 9th. This

growth is comparable to the peaks observed at its launch in October

2021 and in July of the same year. Currently, BITO holds the

equivalent of 46,930 Bitcoins. Lunde also notes a 2% increase in

open contracts on the CME and an 8% growth in exposure to the CME

ETF, indicating a growing preference for regulated markets and

Bitcoin ETFs.

Richard Heart confronts SEC accusations with a robust legal defense

Richard Heart, the founder of HEX (COIN:HEXUSD), faces SEC

accusations with a strong legal defense. Represented by renowned

lawyers, Heart has refuted securities fraud charges. His legal team

has requested a preliminary conference in a letter sent to Judge

Carol Bagley Amon, emphasizing his dedication to blockchain

technology since 2011. Heart’s defense challenges the SEC’s

jurisdiction and the validity of the charges, arguing that software

programs operate on a decentralized and independent network.

Furthermore, the market reaction has been positive, with increases

in HEX prices and associated tokens following Heart’s legal

response, demonstrating the crypto community’s interest in the

case’s outcome.

Arthur Hayes, former co-founder of BitMEX, becomes a consultant at

the decentralized AI platform Ritual

Arthur Hayes, former co-founder of BitMEX, now joins the team at

Ritual, a decentralized platform focused on artificial

intelligence, as a consultant. Ritual, which recently raised $25

million in funding, offers fine-tuning of AI models and APIs to

facilitate access to these models. Hayes, who also runs the

Maelstrom family office and pioneered perpetual swaps at BitMEX,

joins a notable advisory board at Ritual, including experts from

NEAR, EigenLayer, and Gauntlet. He expressed enthusiasm for AI

decentralization and the creation of more robust

censorship-resistant technologies, aiming to drive collaboration

and independence in the emerging AI economy.

Libre: The new tokenization platform backed by investment giants

Prominent institutional investors in cryptocurrencies, such as

Nomura’s Laser Digital, Brevan Howard’s WebN Group, and Hamilton

Lane, have announced a partnership in the new tokenization

platform, Libre. Developed under the leadership of Avtar Sehra and

built on the Polygon CDK, Libre focuses on complete

decentralization from the outset. The platform will allow issuers

and distributors to interact directly on the blockchain,

integrating compliance, such as KYC and AML, in a more

sophisticated manner. Products such as hedge funds and private

credit are planned for launch in the first quarter, with the goal

of reducing operational costs and generating revenue through web

services.

BitGo obtains regulatory approval in Singapore for cryptocurrency

services expansion

BitGo, a major cryptocurrency custody service provider, has

received preliminary approval from the Monetary Authority of

Singapore to operate as a significant payment institution. This

authorization allows BitGo to exceed previously established

transaction limits, strengthening its role in the Asian market.

With full licensing, BitGo will expand its secure buying and

selling of digital asset operations. Founded in 2013, the company

already has licensing in Germany and is involved in a Bitcoin ETF

in the US.

Binance and other cryptocurrency exchanges removed from the App

Store in India

Binance has confirmed the removal of its app, along with other

foreign exchange apps, from Apple’s App Store (NASDAQ:AAPL) in

India. The company, aware of Apple’s new restrictions, has stated

its commitment to complying with local regulations. Current app

users will not be affected, and Binance is seeking to resolve the

issue with regulators. Other exchanges removed include Kraken, MEXC

Global, HTX, and Gate.io. The removal follows Apple’s strict stance

on cryptocurrency, as previously seen with Coinbase Wallet and

Trust Wallet.

Turkey nears finalization of cryptocurrency regulation

Turkey’s Minister of Finance, Mehmet Şimşek, announced that the

country is in the final stage of technical studies to establish

cryptocurrency regulations, according to Coindesk. This move is

part of a broader effort to remove Turkey from the Financial Action

Task Force (FATF) gray list, which highlights countries with

deficiencies in anti-money laundering measures. The proposed

legislation will define crypto assets as “intangible assets” and

place cryptocurrency exchanges under the supervision of the

country’s Capital Markets Board, subject to operational

requirements similar to financial institutions. Şimşek expects the

proposals to be ready before FATF’s next assessment in

February.

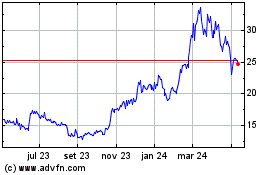

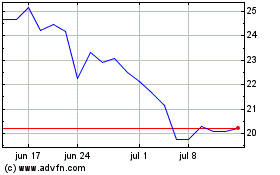

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024