BTC price experienced a slight fluctuation following an optimistic

US GDP report

Bitcoin (COIN:BTCUSD) dropped by less than 1%, approaching

$39,600, after the US reported a 3.3% growth in fourth-quarter GDP,

surpassing expectations of 2%. While this growth was lower than the

4.9% seen in the previous quarter, it nearly matched December’s

inflation rate of 3.4%. The report attributed the growth to strong

consumption and government spending. On January 26th, $5.82 billion

worth of Bitcoin and Ethereum (COIN:ETHUSD) options are set to

expire, potentially causing volatility in the BTC and ETH markets.

This includes $3.75 billion in BTC options, featuring $360 million

contracts with a $50,000 strike price, and $2.08 billion in ETH

options, including $200 million at $2,400, which may impact market

dynamics post-expiration.

Deutsche Bank research suggests a potential decline in Bitcoin

A survey of 2,000 consumers conducted by Deutsche Bank (NYSE:DB)

revealed pessimism regarding the future of Bitcoin, even after the

introduction of ETFs in the US. Over a third of respondents

predicted that Bitcoin would fall below $20,000 by the year’s end,

with a higher percentage expressing concerns about the

cryptocurrency’s survival compared to those who believe it will

persist. The survey also highlighted a lack of understanding of

cryptocurrencies, with two-thirds of consumers having little or no

knowledge of digital assets.

Tesla keeps Bitcoin stock unchanged in last quarter

Tesla maintained its Bitcoin holdings in the fourth quarter of

2023, with a value of $387 million. The electric car manufacturer,

led by Elon Musk, owns over 9,720 BTC, making it the third-largest

corporate holder of the asset, following MicroStrategy

(NASDAQ:MSTR) and Marathon (NASDAQ:MARA). Tesla initially invested

$1.5 billion in Bitcoin in 2021 but sold 75% of its holdings in

2022 to boost liquidity.

Next big Ethereum update: Final tests announced

The Ethereum (COIN:ETHUSD) developer team is nearing a

significant milestone with the implementation of the Dencun update,

which focuses on efficiency improvements through

“proto-danksharding.” Final testing stages are scheduled for

January 30th and February 7th on the Sepolia and Holesky networks,

following a successful preliminary test on Goerli. If results are

positive, the update is planned for application to the Ethereum

mainnet in late February or early March, promising more accessible

and efficient transactions.

Polygon introduces AggLayer to securely connect blockchains

Polygon Labs (COIN:MATICUSD) has announced AggLayer, an

innovation designed to securely connect blockchains using

zero-knowledge proofs, set to debut in February. This component of

the upcoming Polygon 2.0 aims to facilitate unified liquidity and

consistent security across diverse chains, enhancing

interoperability within the Polygon ecosystem. AggLayer aims to

create a cohesive environment while maintaining the autonomy of

each connected blockchain, marking a significant step towards

integrating Layer 2 networks.

Synthetix launches V3 derivatives on blockchain Base by Coinbase

Synthetix has launched V3 of its perpetual derivatives protocol

on the Ethereum Layer-2 blockchain, Base, powered by Coinbase

(NASDAQ:COIN). This update aims to simplify the launch of new

derivatives products and enhance trading on partner platforms. V3

introduces innovations such as alternative forms of collateral and

improvements to the trading experience.

Interoperability controversies with the LayerZero bridge

LayerZero, an interoperability infrastructure creator, launched

a bridge to staked ETH tokens without waiting for Lido DAO

approval, sparking debate about permission practices on the

blockchain. LayerZero’s marketing approach has drawn criticism,

leading to a community preference for a rival proposition from

Axelar (COIN:AXLUSD) and Wormhole.

Google will open doors to Bitcoin ETF announcements soon

Starting on January 29, 2024, Google (NASDAQ:GOOGL) will begin

running ads related to Bitcoin ETFs, marking a significant change

in its crypto advertising policy. Initially available only in the

United States, these ads have the potential to greatly increase

awareness of Bitcoin ETFs, leveraging Google Ads’ extensive reach.

This new policy aims to provide clear guidelines for promoting

crypto products while ensuring compliance with local

regulations.

Grayscale’s volatile moves in Bitcoin

On January 25, Grayscale (AMEX:GBTC) transferred approximately

12,213 BTC, equivalent to $488 million, to Coinbase (NASDAQ:COIN),

marking a reduction compared to the previous day when 19,236 BTC

were moved. These fluctuations underscore the volatility of Bitcoin

(COIN:BTCUSD) transfers by Grayscale, which has seen outflows of

105,910 BTC ($4.168 billion) to Coinbase Prime since January 12,

according to Arkham Intelligence.

Ark Invest elevates ARKB to top 5 in ARKW portfolio

Ark Invest increased its investment in the Ark 21Shares Spot

Bitcoin ETF (AMEX:ARKB), elevating it to the top 5 of its ARKW

portfolio with the purchase of 267,804 shares valued at $12.3

million. Simultaneously, Ark Invest reduced its position in BITO

(AMEX:BITO) by 282,975 shares, reflecting a capital reallocation

strategy for ARKB, which now occupies the fifth position in ARKW,

surpassing giants like Tesla (NASDAQ:TSLA) and Robinhood

(NASDAQ:HOOD).

Bitwise increases transparency with public Bitcoin ETF address

Bitwise (AMEX:BITB), an asset manager, increased transparency by

making the address of its Bitcoin ETF public, allowing verification

of holdings and aligning with transparency standards in the crypto

industry. After this announcement, the community made donations,

highlighting Bitwise’s innovation in the sector. The company also

addressed concerns about custody and plans to upgrade to Taproot

addresses to enhance security and transparency in operations.

SEC postpones decision on BlackRock’s Ethereum ETF

The SEC has extended the deadline for ruling on BlackRock’s

(NYSE:BLK) Ethereum ETF by an additional 45 days, pending further

public feedback. The regulator seeks more time to evaluate the

proposal and the issues raised after receiving no comments since

the opening for views in December 2023. The decision is now

expected in March and follows similar delays in BlackRock’s

previous ETF applications.

Growing attraction of financial talent to cryptocurrencies

The cryptocurrency industry is increasingly attracting

professionals from the traditional financial sector, driven by

higher salaries and the prestige of an innovative field. A report

from Bitget revealed that one-third of candidates for crypto roles

come from traditional finance backgrounds, seeking positions like

KYC manager and AML analyst. This shift is motivated by the pursuit

of better salaries and the flexibility of remote work, reflecting

the growing maturity and acceptance of cryptocurrencies in the

global financial landscape.

Elwood Technologies obtains UK regulatory clearance

Elwood Technologies has received authorization from the UK FCA

to operate its execution management system on security tokens and

derivatives, marking a significant step forward in offering digital

asset services in a regulated manner. This approval strengthens

Elwood’s position, backed by investors like Goldman Sachs (NYSE:GS)

and Barclays (NYSE:BCS), in the global financial services

market.

Gas Hero by Find Satoshi Lab boosts NFT market

The video game Gas Hero, developed by Find Satoshi Lab, has

achieved an NFT trading volume of around $90 million since its

launch. With six NFT collections, the game stands out in terms of

volume, attracting active users with characters, weapons, and

tradable items on the Polygon PoS network. This success reflects

the growing interest in Web3 games and the strength of the Polygon

(COIN:MATICUSD) ecosystem, indicating the entry of new players into

the Web3 sphere.

Web3Intelligence raises US$4.5 million to launch DOPE token

Web3Intelligence, the creator of the investment app Dopamine,

raised $4.5 million in a private funding round before launching its

DOPE utility token. Investors included DAO MAKER, Shima Capital,

Gate.io, among others. The DOPE token will provide access to a

gamified DeFi investment experience and will be available on

prominent exchanges in the first quarter. DOPE holders will also

gain access to the company’s AML infrastructure, reinforcing

compliance standards.

Sygnum raises US$40 million in financing round

Swiss crypto bank Sygnum has raised $40 million in a new funding

round, reaching a valuation of $900 million. Led by Azimut

Holdings, the round aims to expand Sygnum’s presence in Europe and

Asia, reinforcing its strategy of building trust through strong

regulation and governance. The company, which already manages $4

billion in assets for global clients, plans to develop regulated

solutions for the growing interest in digital assets.

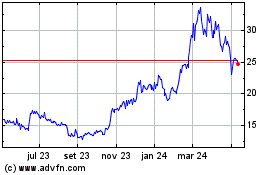

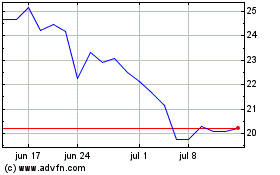

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024