Lesser-known tokens gain prominence in the crypto market

While Bitcoin (COIN:BTCUSD) remains stagnant at $42,500, smaller

tokens such as Chiliz (COIN:CHZUSD) and Klaytn (COIN:KLAYUSD) are

gaining attention in the cryptocurrency market. CHZ, used to buy

Fan tokens on Socios.com, rose 40.3% in the last 7 days. KLAY,

supported by the giant Kakao, shows a weekly increase of 12.20%.

Chiliz plans an aggressive strategy of mergers and acquisitions,

while Klaytn proposes a merger with the Finschia Foundation to form

a large Web3 ecosystem in Asia, promising to create a new currency

with additional benefits for token holders. Render (COIN:RNDRUSD)

records a 5% rise at the time of writing, with gains of 8.6% in the

last 7 days, after announcing the integration of its

interoperability protocol between chains to Circle’s cross-chain

transfer protocol. Another highlight was the Chainlink token

(COIN:LINKUSD), which rose 4.9% in the last 24 hours and 17% in the

week, driven by its function as a decentralized oracle that

connects different blockchains.

Ethereum tests Dencun update with proto-danksharding on Goerli

Ethereum’s (COIN:ETHUSD) main developers have implemented the

Dencun update, including proto-danksharding (EIP-4844), on the

Goerli testnet, marking an important step before its mainnet

launch. Despite initial challenges such as a possible “chain

split,” the Goerli fork was successful. This update introduces

ephemeral blobs or proto-danksharding, aimed at reducing

transaction costs on Ethereum, especially for Layer 2 dApps and

rollups. The next steps include activations on other testnets, with

the expectation of a mainnet launch by the end of the first quarter

of 2024.

Comparing the launches of Bitcoin and gold ETFs in the USA

Analyses show that the launch of spot Bitcoin ETFs in the USA

surpassed that of the first gold ETF (AMEX:GLD) in 2004 in terms of

daily volume. On the first day, the Bitcoin ETFs recorded $2.3

billion in volume, compared to $265 million for GLD. Despite larger

volumes for Bitcoin, its price fell 7.4% in the first three days,

contrasting with a 1.3% increase for gold. Initially, the Bitcoin

ETFs quickly reached an AUM of approximately $1.8 billion. In

contrast, GLD, at its 2004 launch, had a slower start. It took 36

days for GLD to accumulate an AUM approaching the $1.8 billion

mark, a deficit of $550 million compared to the initial performance

of the Bitcoin ETFs. Gold and Bitcoin ETFs are now the two main ETF

commodity asset classes in the USA in value. The total volume of

the new ETFs exceeded $9.5 billion in the first three days, showing

robust performance in the cryptocurrency market.

Three main Bitcoin ETFs dominate the market in trading volume

In the first days of trading, three spot Bitcoin ETFs, offered

by Grayscale (AMEX:GBTC), BlackRock (NASDAQ:IBIT), and Fidelity

(AMEX:FBTC), dominated the market, accounting for about 90% of the

total volume. While Grayscale’s ETF faces significant outflows,

BlackRock’s is seen as the likely new leader in liquidity, and

Fidelity’s also recorded substantial inflows.

Grayscale makes large Bitcoin transfers to Coinbase Prime

Arkham Intelligence reported that Grayscale transferred 18,400

BTC to a Coinbase Prime wallet on January 17, totaling

approximately $800 million. This action follows a similar

transaction of $387 million the previous day. These movements,

occurring moments before the opening of the US market, suggest a

market strategy and possible redemptions from Grayscale. These

transfers may be providing liquidity for new investments in Bitcoin

ETFs, with Coinbase Prime acting as a key channel for Bitcoin

purchases by the ETF Trust (AMEX:GBTC).

ARK Invest rebalances ETFs

ARK Invest, led by Cathie Wood, restructured its cryptocurrency

investments by selling 757,664 shares of the ProShares Bitcoin

Strategy ETF (AMEX:BITO) for $15.8 million and buying an equivalent

amount of the Ark 21Shares Spot Bitcoin ETF (AMEX:ARKB). This

change reflects a strategy to obtain more direct exposure to

Bitcoin (COIN:BTCUSD), reducing costs and increasing

competitiveness in the market. The company still holds 3.4 million

shares of BITO, but this realignment suggests a possible future

increase in investments in ARKB, aligned with ARK’s recent request

to the SEC to invest up to 25% in a subsidiary.

ProShares proposes new leveraged and inverse Bitcoin ETFs to the

SEC

ProShares has requested SEC approval for five new Bitcoin ETFs,

including leveraged and inverse options. According to a January 16

filing with the financial regulator, the new ProShares applications

consist of the ProShares Plus Bitcoin ETF, ProShares Ultra Bitcoin

ETF, ProShares UltraShort Bitcoin ETF, ProShares Short Bitcoin ETF,

and ProShares ShortPlus Bitcoin ETF. These funds, which do not

directly invest in Bitcoin, seek to replicate up to twice the daily

performance of the Bloomberg Galaxy Bitcoin Index (AMEX:BITI), both

in upward and downward market movements. The NYSE also proposed

listing options for spot Bitcoin ETFs.

New benchmark for cryptocurrencies: CoinDesk launches CoinDesk 20

Index

The CoinDesk 20 Index is the new cryptocurrency benchmark,

similar to the Dow Jones Industrial Average, offering an overview

of the market. Launched by CoinDesk Indices, this index includes 20

of the largest and most liquid cryptocurrencies, such as bitcoin

(COIN:BTCUSD) and ether (COIN:ETHUSD). Bullish, a CoinDesk

exchange, already offers perpetual futures tied to this index,

which surpassed $1 million in trading volume soon after launch.

With maximum weights of 30% and 20% for bitcoin and other members,

respectively, the CoinDesk 20 seeks to be a diversified and

reliable barometer for the cryptocurrency market.

US temporarily relaxes cryptocurrency tax reporting rules

The US Treasury Department and the IRS announced a temporary

revision in the tax reporting rule for cryptocurrency transactions.

Initially, transactions over $10,000 required extensive reporting,

but now companies are exempt from these requirements until the

introduction of formal cryptocurrency regulations. The government

plans to implement detailed rules for reporting the receipt of

digital assets and will open up for public feedback. The temporary

change comes amid efforts to standardize cryptocurrency reporting

and ensure tax compliance.

Cantor Fitzgerald CEO confirms Tether reserves

Howard Lutnick, CEO of Cantor Fitzgerald, confirmed that Tether

(COIN:USDTUSD) has the billions necessary to support USDT at a

1-to-1 ratio. During an interview at the World Economic Forum on

Bloomberg, Lutnick assured that Tether has the assets to back its

stablecoin, the largest in market capitalization. This statement

comes in response to persistent doubts about Tether’s reserves,

which claims to have assets of about $86 billion to support USDT.

Cantor Fitzgerald, as custodian of Tether’s assets, plays a crucial

role in managing these reserves.

Jamie Dimon, CEO of JPMorgan, expresses disdain for Bitcoin in

Davos

In Davos, Switzerland, Jamie Dimon, CEO of JPMorgan (NYSE:JPM),

criticized bitcoin (COIN:BTCUSD) during an interview on CNBC. He

expressed disinterest in the $830 billion digital asset, asking

journalists to stop discussing the topic. While acknowledging the

use of blockchain and differentiating useful cryptocurrencies from

others with no value, such as bitcoin, Dimon showed openness for

others to invest as they prefer. His previous negative statements

about bitcoin coincided with greater adoption by his company,

raising suspicions of deceptive strategies. Even with the approval

of Bitcoin ETFs and growing interest from JPMorgan clients, the

price of bitcoin fell, and analysts at the bank doubt the impact of

these funds on the asset’s value.

AltLayer launches ALT token on Binance with rewards and airdrops

AltLayer, specializing in decentralized rollups, announced the

launch of its ALT token on the Binance Launchpool. Starting Friday,

Binance users can use Binance Coin (COIN:BNBUSD) and FDUSD

(COIN:FDUSDUST) to obtain ALT tokens, which will be listed on

January 25 with multiple trading pairs. The initial allocation of

500 million ALT represents 5% of the total 10 billion. There will

be an airdrop for early supporters and campaign participants,

excluding US residents. The ALT token, in addition to its economic

utility and governance, is part of a strategy to strengthen the

security and decentralization of the AltLayer network.

Socket and Bungee resume after $3.3 million exploitation

Following a pause due to a $3.3 million exploitation, the

interoperability service Socket and its bridge platform Bungee have

resumed operations. The attack focused on wallets with infinite

approvals for Socket contracts. The Socket team quickly halted

activities to contain the spread of the attack and stated that the

issue was resolved. These incidents highlight the risks associated

with cross-chain bridges, a common target of attacks in the

cryptocurrency sector.

Parents of Sam Bankman-Fried seek dismissal of FTX lawsuit

Joseph Bankman and Barbara Fried, parents of FTX founder Sam

Bankman-Fried, are contesting the lawsuit filed by the exchange,

denying involvement in fraudulent transfers or breaches of

fiduciary duties. They claim that their familial relationship with

their son does not constitute a legal basis for the charges. FTX’s

lawsuit, which seeks compensation for alleged financial damages,

accuses the parents of enriching themselves through the company.

The parents refute the allegations, including the misuse of Blue

Water property in the Bahamas and pressure for political and

charity donations.

Core Scientific approves recovery plan and prepares to exit

bankruptcy

Bitcoin miner Core Scientific (USOTC:CORZQ) has received

judicial approval for its reorganization plan and expects to exit

Chapter 11 bankruptcy later this month. CEO Adam Sullivan

highlights this development as a crucial step in strengthening the

company, which plans to capitalize on the growing demand for

Bitcoin (COIN:BTCUSD) and high-value computing. The plan involves

the issuance of common shares and warrants, representing 60% of the

new capital, and will reduce the company’s debt by approximately

one billion dollars. Listing on Nasdaq is scheduled for January 24,

2024. Core Scientific, which filed for bankruptcy in December 2022,

secured a loan from BlackRock (NYSE:BLK) and expanded its

partnership with Bitmain during the process.

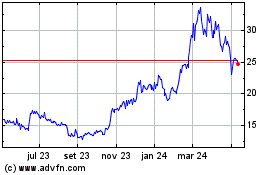

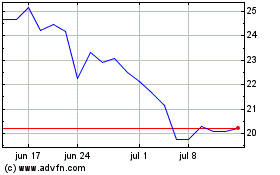

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ProShares Bitcoin ETF (AMEX:BITO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024